Choosing the right vendor is just the beginning. The real challenge, and where the most significant value is found, lies in managing that relationship for long-term success. A simple cost analysis is no longer sufficient for navigating complex supply chains. To gain a competitive edge, businesses must systematically track quality, reliability, innovation, and strategic alignment. This is where a vendor performance scorecard becomes indispensable.

A well-designed scorecard is a strategic tool, moving your team from reactive problem-solving to proactive partnership management. It provides a clear, data-driven framework for evaluating suppliers, fostering communication, and driving continuous improvement. But what does a truly effective scorecard look like in practice? How do you move from a basic checklist to a dynamic performance instrument?

This guide moves beyond theory to dissect seven powerful vendor performance scorecard examples. We will analyze distinct models, from balanced and risk-based scorecards to those focused on sustainability and strategic relationships. For each example, you will find:

- Strategic Breakdown: Why this scorecard model works and in which business contexts it excels.

- Key Metrics: The specific KPIs that power the evaluation process.

- Actionable Takeaways: Replicable strategies you can immediately apply to your own procurement and vendor management processes.

Our goal is to equip you with practical frameworks to not only measure performance but to actively enhance it, ensuring every vendor relationship contributes tangible, strategic value to your bottom line.

1. The Balanced Scorecard for Vendor Performance: A 360-Degree View

Kicking off our list of vendor performance scorecard examples is not a single template, but a powerful strategic framework: the Balanced Scorecard (BSC). Originally developed by Drs. Robert Kaplan and David Norton as a corporate performance management tool, its principles are perfectly adapted for creating a holistic, 360-degree view of your suppliers. This approach moves beyond purely transactional metrics like cost and delivery times to assess a vendor's total value contribution.

The BSC framework evaluates vendors across four distinct but interconnected perspectives, ensuring their performance is directly aligned with your company's strategic goals. This method transforms the supplier relationship from a simple cost center into a strategic partnership focused on mutual growth and value creation.

Breaking Down the Four Perspectives

Implementing a Balanced Scorecard for a vendor involves defining specific Key Performance Indicators (KPIs) within each of the four quadrants.

- Financial Perspective: This is the most traditional area, but with a strategic lens. Instead of just price, you evaluate the vendor's overall financial impact.

- Metrics: Total Cost of Ownership (TCO), cost savings initiatives, payment term compliance, and contribution to revenue (e.g., through innovation).

- Customer Perspective: This quadrant measures how the vendor's performance directly affects your end customers.

- Metrics: Impact on product quality, contribution to customer satisfaction scores (CSAT), and adherence to brand or quality standards.

- Internal Process Perspective: This focuses on the efficiency and effectiveness of the vendor's operational integration with your own business processes.

- Metrics: On-Time In-Full (OTIF) delivery rates, order accuracy, lead time, and process compliance (e.g., invoicing procedures).

- Learning & Growth Perspective: This forward-looking quadrant assesses the vendor's capacity for innovation and continuous improvement. It’s about building a resilient and adaptive supply chain.

- Metrics: Proactive risk mitigation, investment in new technology, staff training and expertise, and collaboration on new product development.

Strategic Insight: The power of the BSC is its balance. A vendor might excel financially (low cost) but score poorly in the Customer perspective (low quality), revealing a hidden risk to your brand. This framework makes those trade-offs visible and quantifiable.

When to Use This Approach

The Balanced Scorecard is ideal for your most critical, high-spend, or strategic-tier suppliers where the relationship is more of a partnership than a simple transaction. It is particularly effective for long-term contracts where collaboration, innovation, and continuous improvement are paramount to success. While it may be too complex for minor, non-critical suppliers, it is an essential tool for managing vendors who have a significant impact on your competitive advantage. By using this comprehensive vendor performance scorecard example as a foundation, you can ensure your key suppliers are true partners in achieving your strategic objectives.

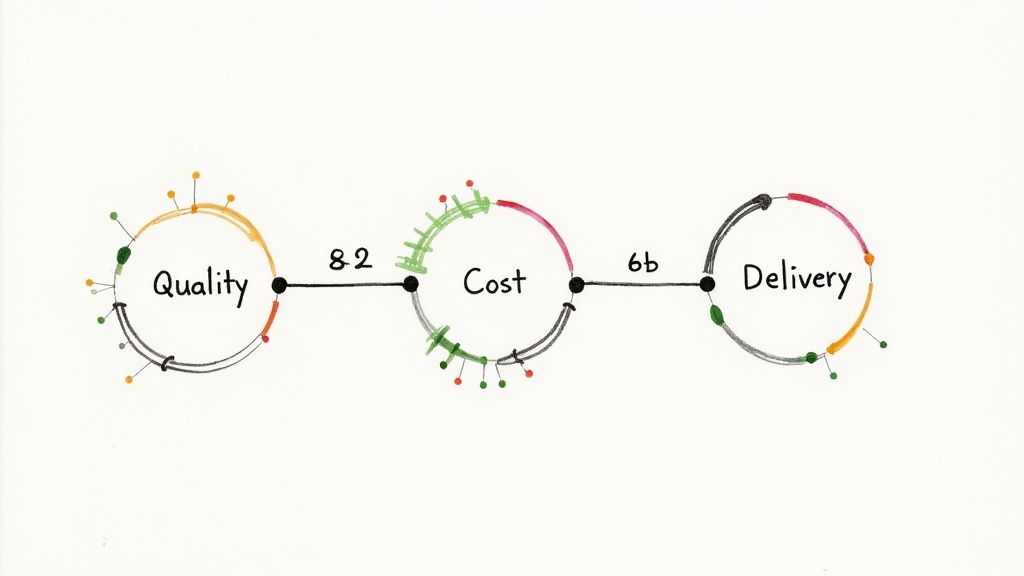

2. The Quality-Cost-Delivery (QCD) Scorecard: The Foundational Pillar

Next in our review of vendor performance scorecard examples is the classic Quality-Cost-Delivery (QCD) model. Born from the principles of lean manufacturing and popularized by industry giants like Toyota, this framework provides a straightforward yet powerful method for evaluating suppliers. It concentrates on the three most fundamental pillars of vendor performance, offering a clear and universally understood assessment that is easy to implement.

The QCD scorecard’s strength lies in its simplicity and directness. It avoids complexity by focusing on the operational outcomes that matter most: Was the product good? Was the price right? Did it arrive on time? This approach creates a transparent and objective foundation for performance conversations, making it a go-to tool for manufacturing, automotive, and electronics industries where these three factors are paramount.

Breaking Down the Three Pillars

A successful QCD scorecard relies on well-defined KPIs for each of its core components. These metrics should be quantitative and easily measurable to ensure objective evaluation.

- Quality: This pillar measures the vendor's ability to meet your specified standards and deliver defect-free products or services.

- Metrics: Defect rate (parts per million or PPM), warranty claim rates, number of non-conformance reports (NCRs), and compliance with quality certifications (e.g., ISO 9001).

- Cost: This goes beyond the initial price tag to assess the vendor’s overall cost-effectiveness and financial value.

- Metrics: Unit price variance against budget, Total Cost of Ownership (TCO), cost reduction proposals, and invoice accuracy.

- Delivery: This pillar evaluates the reliability and punctuality of the vendor's logistics and fulfillment processes. It measures how well they adhere to agreed-upon schedules.

- Metrics: On-Time In-Full (OTIF) percentage, lead time accuracy (quoted vs. actual), and shipping and packaging compliance.

Strategic Insight: While the QCD model is fundamentally operational, its data provides crucial strategic insights. A consistent decline in a supplier's delivery score, for example, could be a leading indicator of deeper financial or production issues, allowing you to proactively mitigate a potential supply chain disruption.

When to Use This Approach

The Quality-Cost-Delivery scorecard is the workhorse of vendor management, especially for direct material suppliers in manufacturing and production environments. It is exceptionally effective for evaluating vendors where the goods or services are standardized and the primary performance criteria are operational. It is the perfect tool for procurement teams that need a clear, data-driven, and easy-to-communicate system for routine supplier performance reviews. While it may not capture softer metrics like innovation, its focused approach ensures that the absolute essentials of the supply chain are rigorously maintained.

3. The Risk-Based Vendor Performance Scorecard: A Proactive Defense

Next in our list of vendor performance scorecard examples is an approach that places risk management at the very core of the evaluation process. The Risk-Based Vendor Performance Scorecard is a framework designed to proactively identify, assess, and mitigate potential threats posed by third-party suppliers. This method moves beyond standard performance metrics to create a comprehensive risk profile for each vendor, ensuring business continuity and regulatory compliance.

This approach is crucial in today's interconnected business environment where a supplier's failure can have cascading effects on your operations, finances, and reputation. It works by integrating risk assessment directly into the performance review cycle, focusing on a vendor's stability, security posture, and adherence to legal and industry standards. This creates a dynamic, forward-looking view of supplier health.

Breaking Down the Four Perspectives

Implementing a risk-based scorecard involves evaluating vendors through a lens of potential vulnerabilities. The metrics are specifically chosen to act as early warning indicators of trouble.

- Financial Viability: This perspective gauges a vendor's financial health to assess the risk of service interruption or sudden failure.

- Metrics: Credit scores (e.g., Dun & Bradstreet PAYDEX), debt-to-equity ratio, cash flow trends, and reliance on your business for their total revenue.

- Operational & Business Continuity Risk: This quadrant measures the vendor’s operational resilience and their ability to withstand disruptions.

- Metrics: Documented business continuity and disaster recovery plans, employee turnover rates, and dependencies on fourth-party subcontractors.

- Compliance & Regulatory Risk: This focuses on the vendor's adherence to laws, regulations, and industry-specific standards that also apply to your organization.

- Metrics: Adherence to GDPR, HIPAA, or PCI DSS; status of required licenses and certifications; and history of regulatory fines or sanctions.

- Cybersecurity & Data Privacy Risk: This modern and critical perspective assesses the strength of a vendor's information security controls to protect sensitive data.

- Metrics: Third-party security ratings (e.g., SecurityScorecard), evidence of security audits (SOC 2 reports), and incident response plan testing results.

Strategic Insight: The risk-based model shifts the focus from "What did the vendor do for us?" to "What potential harm could this vendor cause us?" It’s a defensive strategy that protects your organization from unforeseen third-party failures, making it a critical tool for resilience.

When to Use This Approach

This scorecard is indispensable for industries with high regulatory burdens, such as financial services, healthcare, and government contracting. It is also essential for any business that shares sensitive customer data (PII), relies on vendors for critical operational functions, or operates in a volatile market. While it can be applied to all vendors, its intensity should be scaled; high-risk vendors handling critical data require deep, frequent assessments, whereas low-risk suppliers of office goods need only a light touch. This targeted approach makes it one of the most efficient and powerful vendor performance scorecard examples for building a secure and resilient supply chain.

4. The KPI-Driven Performance Dashboard: Real-Time Data for Agile Decisions

Next on our list of vendor performance scorecard examples is the KPI-Driven Performance Dashboard. This approach leverages business intelligence (BI) tools to provide a real-time, data-centric view of supplier performance. Unlike static, periodic reviews, this model offers a dynamic and constantly updated snapshot, enabling procurement teams to make swift, informed decisions based on the latest information.

The core principle of this model is its direct alignment of vendor KPIs with overarching business objectives. It transforms performance management from a reactive exercise into a proactive, continuous process. By visualizing data through interactive charts and graphs, these dashboards make complex performance metrics easily digestible, highlighting trends, identifying outliers, and flagging potential issues before they escalate. Giants like Amazon and Microsoft have popularized this approach, using sophisticated internal dashboards to manage their vast networks of vendors and partners with precision.

Breaking Down the Core Components

A successful KPI-driven dashboard is built on a foundation of carefully selected metrics that directly reflect business priorities. The key is customization and real-time data integration.

- Operational Excellence: This is the engine room of the dashboard, tracking the fundamental aspects of the vendor's day-to-day execution.

- Metrics: On-Time In-Full (OTIF) delivery, lead time variance, order fill rate, order accuracy, and inventory turnover.

- Quality & Compliance: This component measures the vendor’s adherence to agreed-upon standards, ensuring the integrity of your products and services.

- Metrics: Defect rate (parts per million), return rate, compliance with industry regulations (e.g., ISO standards), and audit pass rates.

- Commercial & Financial Health: This area focuses on the financial efficiency and value generated by the supplier relationship.

- Metrics: Cost variance against budget, total cost of ownership (TCO), invoice accuracy, and implemented cost-saving initiatives.

- Partnership & Innovation: A forward-looking component that tracks the vendor's engagement and contribution beyond basic transactions.

- Metrics: Responsiveness to inquiries, participation in joint business planning, new technology adoption, and contribution to product development.

Strategic Insight: The primary advantage of a KPI dashboard is its immediacy. While a Balanced Scorecard offers strategic depth, a real-time dashboard provides tactical agility. It allows managers to instantly spot a dip in a vendor’s delivery performance and address it the same day, rather than waiting for a quarterly review.

When to Use This Approach

The KPI-Driven Performance Dashboard is essential for industries where supply chain velocity and operational efficiency are critical differentiators, such as e-commerce, manufacturing, and technology. It is particularly powerful for managing a large number of vendors where manual tracking is impractical. This approach is ideal for businesses that have invested in data infrastructure (like an ERP or procurement software) and want to leverage that data for a competitive advantage. By providing select vendors with access to their own dashboard, you can foster a culture of transparency and self-improvement, turning performance data into a collaborative tool for continuous optimization.

5. The Sustainability and ESG Vendor Scorecard: Aligning Procurement with Purpose

Moving beyond traditional operational metrics, the Sustainability and ESG Vendor Scorecard represents a modern, purpose-driven evolution in supplier evaluation. This framework integrates Environmental, Social, and Governance (ESG) criteria directly into the vendor performance assessment process. It's designed to ensure your supply chain not only performs efficiently but also aligns with your company's core values, ethical standards, and long-term sustainability goals.

This approach evaluates vendors on their environmental footprint, commitment to social responsibility, and the integrity of their corporate governance. By doing so, it helps mitigate reputational risk, build a resilient supply chain, and meet the growing demands from consumers and investors for corporate accountability. Companies like Patagonia and IKEA have pioneered this model, demonstrating that responsible sourcing is a powerful competitive advantage.

Breaking Down the Three Pillars

Implementing an ESG scorecard involves selecting relevant KPIs across its three core dimensions, which are then weighted alongside traditional metrics like cost and quality.

- Environmental: This pillar assesses the vendor's impact on the planet and their efforts to promote environmental stewardship.

- Metrics: Carbon emissions (Scope 1, 2, and 3), waste reduction and recycling rates, water usage efficiency, use of renewable energy, and adherence to sustainable material sourcing policies.

- Social: This pillar focuses on how a vendor manages relationships with its employees, the community, and other stakeholders, ensuring ethical and fair practices.

- Metrics: Fair labor practices (audited against standards like SA8000), health and safety incident rates, diversity and inclusion policies, and community engagement initiatives.

- Governance: This pillar examines the vendor's internal controls, policies, and procedures to ensure transparency, compliance, and ethical behavior.

- Metrics: Anti-corruption and bribery policies, data privacy and security protocols (GDPR/CCPA compliance), supply chain transparency, and board diversity.

Strategic Insight: An ESG scorecard transforms procurement from a cost-cutting function into a value-creation engine. It identifies suppliers who are not just low-cost but also low-risk and innovation-oriented, making your supply chain more resilient to regulatory changes, consumer backlash, and environmental disruptions.

When to Use This Approach

The ESG scorecard is essential for any business where brand reputation, corporate values, and sustainability are key pillars of the overall strategy. It is particularly critical for consumer-facing brands, B-Corp certified companies, and organizations operating in highly regulated industries. While collecting and verifying ESG data requires a significant commitment, starting with your most strategic or highest-risk suppliers is a practical first step. By integrating ESG criteria into your vendor performance scorecard examples, you build a supply chain that is not only profitable but also principled and prepared for the future.

6. The Relationship-Based Vendor Scorecard: Fostering Strategic Alliances

Moving beyond purely quantitative data, our sixth vendor performance scorecard example centers on the qualitative aspects that forge true strategic partnerships. The Relationship-Based Vendor Scorecard evaluates suppliers not just on what they deliver, but how they collaborate, communicate, and innovate with your team. This approach is founded on the principle that a strong, transparent, and mutually beneficial relationship is a powerful driver of long-term value, risk reduction, and competitive advantage.

This framework integrates traditional performance metrics with qualitative assessments of partnership health. It acknowledges that a supplier who actively collaborates on solving problems, communicates proactively about potential issues, and aligns with your company's culture can be far more valuable than a low-cost vendor who operates in a transactional silo. Companies like Apple and Procter & Gamble have famously built empires on the back of deeply integrated, relationship-focused supplier networks.

Breaking Down the Key Components

Implementing a Relationship-Based Scorecard means measuring the "soft skills" of the partnership alongside hard data. This requires defining KPIs that capture the quality of the interaction and strategic alignment.

- Communication & Responsiveness: This measures the ease and effectiveness of interactions. A good partner is accessible and transparent.

- Metrics: Response time to queries, clarity and quality of communication, frequency of proactive updates, and accessibility of key contacts.

- Collaboration & Proactivity: This assesses the vendor's willingness to work as a unified team to solve challenges and identify opportunities.

- Metrics: Willingness to participate in joint planning sessions, contribution to process improvement initiatives, and proactive risk identification and mitigation.

- Strategic Alignment: This evaluates how well the vendor understands and supports your company's broader strategic objectives, from sustainability goals to market expansion.

- Metrics: Alignment with corporate values and ethics, contribution to innovation and R&D, and commitment to shared long-term goals.

- Cultural Fit & Trust: This is the foundational element, measuring the level of trust and mutual respect that underpins the relationship.

- Metrics: Executive-level engagement, willingness to share sensitive information for mutual benefit, and feedback from internal stakeholders on the ease of doing business.

Strategic Insight: The Relationship-Based Scorecard turns supplier management from a "check-the-box" compliance activity into a strategic function. It helps identify partners who are not just fulfilling a contract but are invested in your success, often leading to co-innovation and exclusive access to new technologies.

When to Use This Approach

This scorecard is indispensable for your most strategic, high-dependency suppliers where the potential for joint value creation is highest. It is perfect for long-term relationships involving complex services, custom manufacturing, or critical technology components. While it might be overkill for commoditized, low-spend suppliers, it's the gold standard for managing partners like Boeing's key aerospace component suppliers, where trust, collaboration, and shared risk are paramount to launching a successful product. Use this vendor performance scorecard example to cultivate a supply chain that is not just efficient, but also resilient, innovative, and deeply aligned with your mission.

7. The Tiered Vendor Classification Scorecard: Optimizing Management Effort

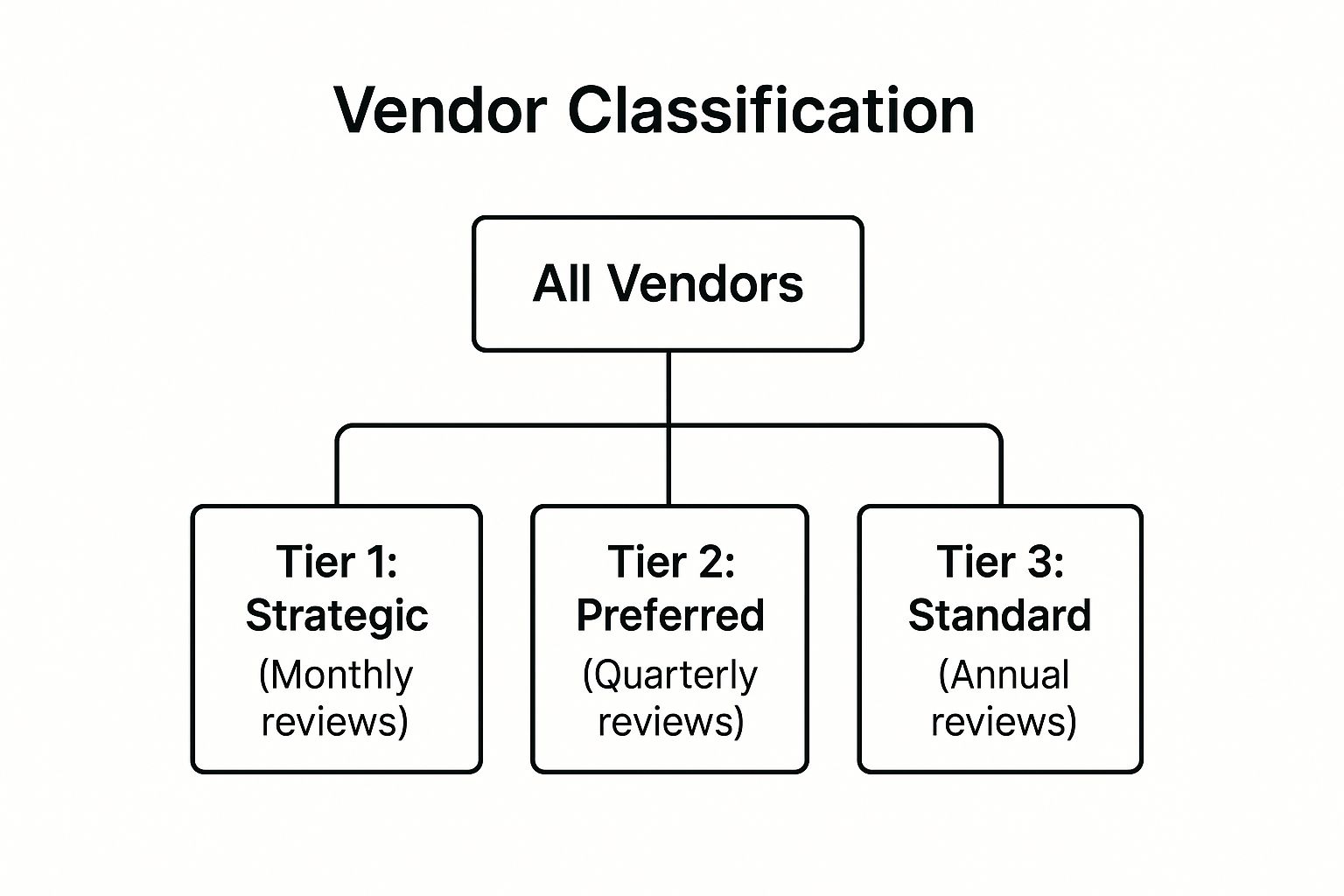

Not all suppliers are created equal, and this vendor performance scorecard example recognizes that fundamental truth. The Tiered Vendor Classification Scorecard is a strategic framework that segments suppliers into different tiers based on their importance, risk profile, and performance. This approach allows you to apply different levels of management rigor and resources where they matter most, avoiding a one-size-fits-all strategy that can be both inefficient and ineffective.

This system moves beyond uniform evaluation by creating distinct categories, such as Strategic, Preferred, and Standard. Each tier has its own set of performance criteria, review frequency, and relationship management goals. This ensures your most critical partners receive the intensive collaboration they require, while transactional suppliers are managed efficiently, optimizing your team's time and effort. Companies like Cisco and HP have famously used similar tiering systems to build resilient and high-performing supply chains.

Breaking Down the Tiers

Implementing a tiered system involves defining clear criteria for each level and tailoring your performance management approach accordingly.

- Tier 1: Strategic Partners: These are the most critical vendors, integral to your competitive advantage. They often involve high spend, significant risk, and deep collaboration.

- Metrics: Focus on joint value creation, innovation contribution, risk mitigation plans, and long-term TCO. Reviews are intensive and frequent, often monthly or quarterly.

- Tier 2: Preferred Suppliers: These are important, high-performing vendors who are reliable but less critical than Tier 1. The goal is to maintain strong performance and identify potential for future strategic partnership.

- Metrics: Key metrics include on-time in-full (OTIF) delivery, quality compliance, cost competitiveness, and service level agreement (SLA) adherence. Reviews are typically held quarterly.

- Tier 3: Standard/Transactional Suppliers: This group includes vendors for non-critical, easily substitutable goods or services. The relationship is primarily transactional, and the focus is on efficiency.

- Metrics: Core metrics are simple: price, on-time delivery, and order accuracy. Performance is often monitored through automated systems with annual or semi-annual reviews.

The following diagram illustrates a typical three-tier vendor classification structure, showing how review frequency intensifies for more strategic suppliers.

This visualization clearly shows how management attention and resources are allocated based on a vendor's strategic importance, from intensive monthly oversight for Tier 1 to more streamlined annual checks for Tier 3.

Strategic Insight: A key benefit of tiering is resource optimization. It stops your team from spending as much time managing a low-spend office supply vendor as they do a critical component manufacturer. This focus directs valuable resources toward relationships that drive the most significant business impact.

When to Use This Approach

A tiered classification system is essential for any organization with a diverse and sizable supplier base. It is particularly effective for large manufacturing, technology, and retail companies managing hundreds or thousands of vendors. If your procurement team feels stretched thin and you want to align vendor management activities directly with strategic business priorities, implementing a tiered scorecard is a powerful and efficient solution. It provides a clear roadmap for managing supplier relationships at scale, ensuring every vendor receives the appropriate level of attention.

7 Vendor Performance Scorecard Comparison

| Vendor Scorecard Type | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Balanced Scorecard for Vendor Performance | High – multi-perspective data integration | High – extensive data collection | Holistic performance view aligned with strategy | Strategic vendor management | Comprehensive insights; encourages long-term partnerships |

| Quality-Cost-Delivery (QCD) Scorecard | Low – straightforward scoring and metrics | Low – standard industry metrics | Clear operational performance indicators | Operational/vendor quality focus | Simplicity; easy adoption; industry standard |

| Risk-Based Vendor Performance Scorecard | High – specialized risk assessment skills needed | Medium to High – risk & compliance data | Proactive risk management; regulatory compliance | Risk-sensitive sectors (finance, healthcare) | Early warning; optimized resource focus |

| KPI-Driven Performance Dashboard | Medium – requires data infrastructure | High – automated data collection & dashboards | Real-time, data-driven vendor performance visibility | Data-centric, high-volume vendor oversight | Real-time tracking; objective metrics; scalable |

| Sustainability and ESG Vendor Scorecard | Medium to High – integration of ESG frameworks | Medium – ESG data and expertise | Supports sustainability goals; reputational risk mitigation | Companies prioritizing ESG compliance | Addresses ESG factors; long-term value creation |

| Relationship-Based Vendor Scorecard | Medium – qualitative assessments | Medium – time-intensive relationship building | Enhanced partnerships; innovation & communication | Strategic partnerships and collaboration | Builds trust; fosters innovation; reduces turnover |

| Tiered Vendor Classification Scorecard | Medium to High – tier criteria and monitoring | Medium – tier-specific management focus | Efficient resource allocation; focused vendor management | Large supplier base with varied strategic importance | Prioritizes critical vendors; enables development focus |

From Scorecard to Strategy: Putting Your Vendor Data to Work

Throughout this guide, we have journeyed through a comprehensive collection of vendor performance scorecard examples, each offering a unique lens through which to view and manage your supplier relationships. From the holistic, strategic view of the Balanced Scorecard to the granular, operational focus of the Quality-Cost-Delivery (QCD) model, the message is clear: a one-size-fits-all approach to vendor management simply does not exist. The most effective strategy is one that is tailored, intentional, and directly aligned with your business objectives.

The real power of these scorecards is not in the act of grading but in the strategic conversations they ignite. They are catalysts for collaboration, transforming procurement from a transactional, administrative function into a strategic pillar of your organization. By moving beyond simple cost metrics, you begin to build a more resilient, innovative, and value-driven supply chain.

Synthesizing the Scorecard Examples: Core Takeaways

Reflecting on the seven distinct models, from risk-based assessments to sustainability-focused evaluations, several universal truths emerge. Mastering these principles is the key to turning a static document into a dynamic management tool.

- Context is King: The ideal scorecard is a direct reflection of what you value most. A creative agency will prioritize innovation and communication (Relationship-Based Scorecard), while a manufacturing firm will lean heavily on timeliness and quality (QCD Scorecard).

- Data Drives Dialogue: A scorecard filled with accurate, objective data provides the foundation for productive, fact-based conversations with your vendors. It removes ambiguity and emotion, focusing discussions on tangible improvements and shared goals.

- Balance is Essential: No single metric tells the whole story. The strongest vendor performance scorecard examples we analyzed all incorporated a blend of quantitative (e.g., on-time delivery rate) and qualitative (e.g., communication effectiveness) metrics to create a complete picture of performance.

- Segmentation Unlocks Focus: As the Tiered Vendor Classification Scorecard demonstrated, not all vendors are created equal. Applying the same rigorous evaluation to a supplier of office pens as you do to a critical software provider is inefficient. Segmenting vendors allows you to allocate your resources where they will have the greatest impact.

Your Action Plan: Activating Your Vendor Strategy

Moving from theory to practice is the most critical step. The examples in this article are your blueprints. Use the following steps to build a vendor management process that delivers a true competitive advantage.

- Identify Your Critical Few: Start small. Select 3-5 of your most strategic vendors. These are the partners whose performance has a direct and significant impact on your own business outcomes.

- Define "Value" Collaboratively: For each selected vendor, define what a successful partnership looks like. Involve stakeholders from different departments (finance, operations, marketing) to get a 360-degree view of what truly matters. Is it cost reduction, speed to market, access to innovation, or risk mitigation?

- Select and Adapt a Scorecard Model: Choose one of the vendor performance scorecard examples from this article that best aligns with your defined value drivers. Don't be afraid to customize it. Borrow elements from the KPI-Driven Dashboard and merge them with a Relationship-Based Scorecard if that fits your needs.

- Automate to Elevate: The most time-consuming part of scorecard management is often manual data entry, especially for financial metrics like invoice accuracy and payment terms. Automating this data collection frees up your team to focus on strategic analysis, relationship building, and proactive problem-solving.

- Schedule the Conversation: A scorecard is useless if it just sits in a folder. Schedule regular, recurring review meetings with your key vendors. Use the scorecard as the meeting agenda to guide a structured, productive discussion about successes, challenges, and future opportunities for growth.

By implementing this structured approach, you elevate vendor management from a simple compliance check to a powerful engine for strategic growth. A well-executed scorecard system doesn't just measure vendors; it cultivates partnerships, mitigates risk, and ultimately builds a stronger, more agile business.

Ready to automate the financial side of your vendor scorecards? Invowl streamlines the entire accounts payable process, from invoice capture to payment, giving you instant access to the accurate cost and payment data you need. Stop chasing down invoices and start focusing on strategy by visiting Invowl to see how you can build a more efficient financial foundation for your vendor relationships.