If you want to get a real handle on your business finances, you have to ditch the spreadsheets. A proper system that automatically grabs receipts, sorts your spending, and gives you a live look at your numbers is no longer a "nice-to-have." It's how you turn a painful chore into a smart way to boost profits and stay on the right side of the tax authorities.

Why Tracking Business Expenses Matters More Than Ever

Let’s be honest, nobody gets into business because they love managing expenses. But in today’s economy, having a real-time pulse on your spending isn't just good practice—it's a critical tool for survival and growth. Think of it as the foundation of a healthy business, giving you the clarity to make financial decisions with confidence.

When you don't have a solid system, you're essentially flying blind. You miss out on cost-cutting opportunities, fail to notice that you're paying for two tools that do the same thing, and find it nearly impossible to build an accurate budget. It's time to shift from reactive bookkeeping to proactive financial management.

Before we dive deeper, let's look at the concrete benefits. Moving from a messy shoebox of receipts to a modern system has a direct and measurable impact on your business.

Key Benefits of Modern Expense Tracking

| Benefit | Business Impact |

|---|---|

| Increased Profitability | Identify and eliminate wasteful spending, redirecting cash to growth areas. |

| Maximized Tax Deductions | Ensure every eligible expense is captured and categorized, lowering your tax bill. |

| Improved Budgeting | Create accurate, data-driven budgets based on real spending patterns. |

| Audit-Proof Records | Maintain a clean, digital audit trail that stands up to scrutiny. |

| Time Savings | Automate manual data entry, freeing up hours each month for strategic work. |

| Negotiating Power | Use detailed spending data to negotiate better rates with suppliers. |

As you can see, the advantages go far beyond simple organization. It's about transforming raw data into actionable business intelligence.

Uncover Hidden Costs and Boost Profitability

Every business has financial leaks. It could be a software trial that quietly converted to a paid plan or a supplier's prices creeping up month after month without you noticing. A meticulous approach to tracking your expenses shines a bright light on these hidden costs.

For example, by looking at your categorized spending, you might discover you’re paying for three different project management tools when a single subscription would do the job. Spotting these inefficiencies directly impacts your bottom line. It allows you to redirect funds from wasteful spending to revenue-generating activities, boosting your profitability without needing to make a single extra sale.

A detailed expense log is more than just a record; it's a negotiation tool. When you can show a supplier exactly how much you've spent with them over the last year, you gain significant leverage to ask for better rates or terms.

This has become even more critical as operational costs rise. Consider that business travel costs alone are projected to jump by 58%. This puts immense pressure on companies to manage every dollar. Accurate tracking gives you the financial visibility needed to spot these money leaks and optimize your spending. You can learn more by exploring some detailed findings on business expense management.

From Tax Season Panic to Year-Round Confidence

Let's face it, tax season can be a frantic scramble. But it doesn't have to be. When every purchase is categorized and documented throughout the year, filing your taxes becomes a simple administrative task. You're no longer digging through shoeboxes of faded receipts or trying to reconstruct an entire year's worth of spending from memory.

A systematic approach creates a clean, undeniable audit trail. With a tool like Invowl, every invoice and receipt is automatically captured and organized, building an unshakeable record of your financial activities. This ensures you claim every legitimate deduction—potentially saving you thousands of dollars annually—and gives you the peace of mind that your books are always accurate and compliant.

Laying the Groundwork for Smart Expense Tracking

Before you even think about downloading an app or subscribing to a service, there's some crucial groundwork to do. I’ve seen countless businesses stumble because they skipped this step, leading to messy books and missed opportunities down the road.

Building a rock-solid foundation for how you track business expenses starts with getting organized. The goal is to create a system that truly reflects how your business spends money, giving you clarity for both internal decisions and making tax season a breeze. When your financial data is structured correctly from day one, tools like Invowl become exponentially more powerful.

Ditch Generic Categories for Real Insights

Sure, standard categories like "Marketing" or "IT" are a start, but they don't tell you the whole story. To get genuine business intelligence, you need to dig deeper. Think about what you actually want to measure.

A vague "Marketing" bucket, for example, might be hiding the fact that your paid ads are crushing it while your trade show spending is a money pit. Splitting them up gives you that clarity instantly.

Here’s how you can rethink some common categories:

- Instead of a single "Marketing" bucket, try:

Paid Advertising (Google/Social)Content & SEOConferences & Events

- Instead of a generic "IT/Software" label, use:

Monthly SaaS SubscriptionsHardware & EquipmentWebsite Hosting & Domains

This level of detail transforms your expense list from a simple chore into a strategic weapon. You can spot spending trends, find budget cuts, and finally understand the true cost of acquiring a customer.

Key Takeaway: Setting up detailed categories isn't just an accounting task; it's a business intelligence exercise. The more specific your categories, the clearer the story your financial data will tell you.

Create a Simple, Clear Expense Policy

Once your categories are nailed down, the next step is to create a dead-simple expense policy. This doesn’t need to be a 50-page legal document. Honestly, a clear, one-page guide is far more effective, especially for small teams.

The whole point is to make sure everyone—from your newest hire to your trusted freelancers—submits expenses the same way, every time.

Your policy should briefly cover three things:

- What's a reimbursable expense? Clearly define what the company pays for and what it doesn't. No more gray areas.

- How do we submit expenses? Specify the process and deadlines. For example, "All receipts must be uploaded to Invowl by the 5th of the following month."

- What proof is needed? Mandate a digital receipt for every single transaction. This completely eliminates the "I lost the receipt" problem.

A solid policy cuts down on compliance headaches and ensures the data going into your system is clean from the start. This is the foundational work that lets automated tools do their magic, giving you the reliable financial oversight you need to grow your business with confidence.

Moving From Manual Chaos to Automated Clarity

Are you buried under a mountain of paper receipts and staring at spreadsheets that just don't make sense anymore? I've been there, and so have most business owners I know. The daily grind of tracking expenses by hand—hunting down receipts, fixing typos in spreadsheets, and just trying to keep everything compliant—is exhausting. It’s more than just a time-waster; it’s a genuine source of risk and frustration.

But what if you could have a system that automatically grabs invoices right from your inbox? A system that categorizes your spending based on rules you set, giving you back hours every single month. This isn't some far-off dream. The right tools are completely changing how we track business expenses, transforming a dreaded chore into a real strategic advantage.

The True Cost of Manual Tracking

The problem with doing things by hand goes way beyond the hours you lose. It’s a breeding ground for expensive mistakes. We're talking about simple typos that throw off your books or, worse, miscategorized expenses that could land you in hot water during tax season. Every lost receipt is a missed tax deduction. Every messy spreadsheet is a potential nightmare if an auditor comes knocking. These "small" issues add up, creating a serious financial drag on your business.

And let's be honest, it's only getting more complicated. With more people working remotely and the economy always shifting, the old-school methods just can't keep up. This is a huge deal. In fact, 71% of finance leaders say their biggest challenges with expense compliance and fraud prevention come directly from relying on manual tracking. If you want to see the numbers for yourself, you can dig into the detailed findings on business expense management challenges.

By automating how you track business expenses, you’re not just saving time. You're building a more resilient and financially sound operation from the ground up.

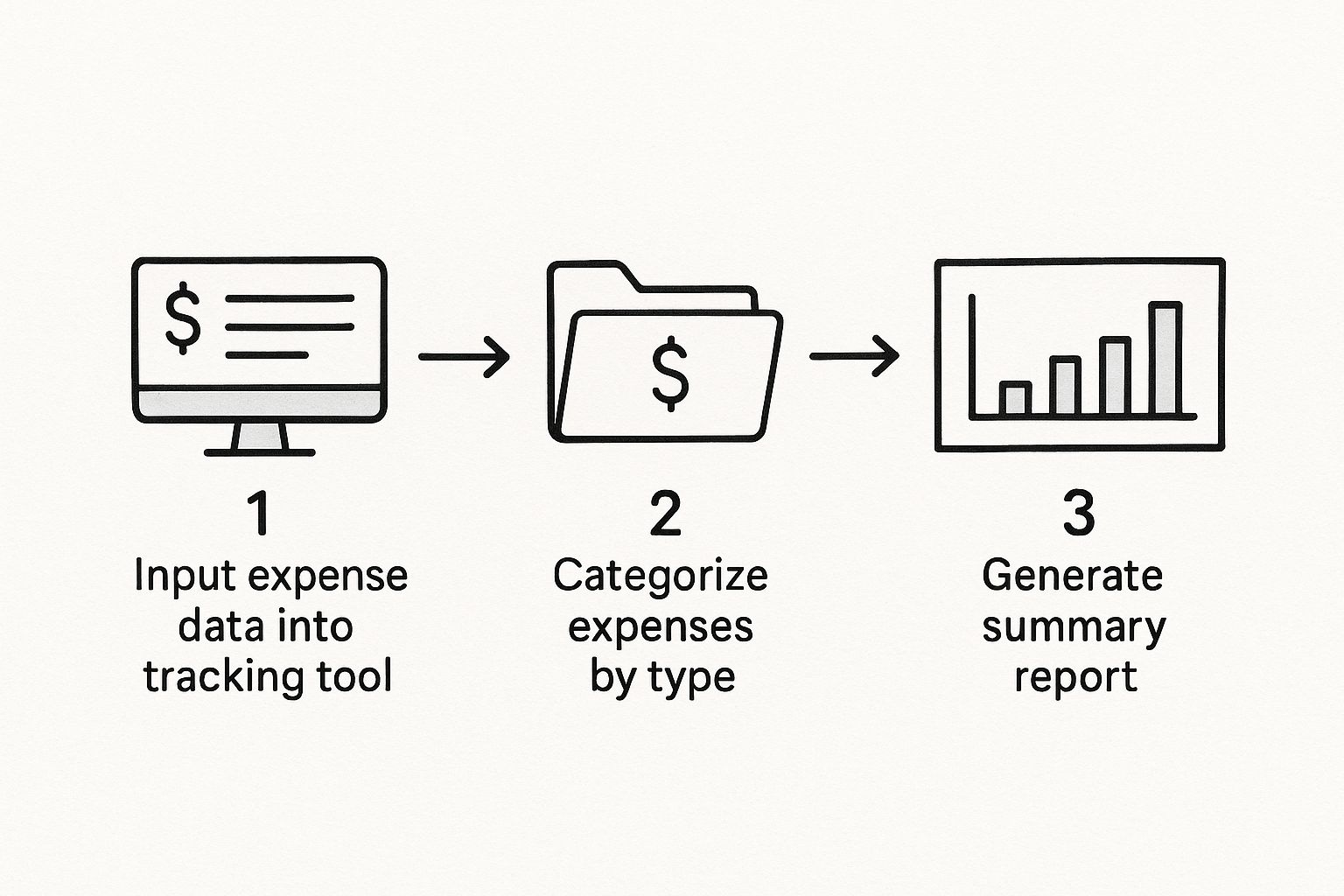

Shifting to an Automated Workflow

This is where automated tools like Invowl come in. They’re built specifically to eliminate that chaos. By connecting straight to your inbox, Invowl finds, extracts, and organizes all your invoice data on its own. That means no more data entry for you and a perfect digital paper trail of every transaction.

This image shows just how simple the flow becomes—data comes in, gets categorized, and then reported. Clean and straightforward.

As you can see, automation takes a messy, multi-step manual headache and turns it into a simple, linear process. This frees up your mental energy for the work that actually grows your business.

But the real power here goes beyond just grabbing data. You can set up your own rules to automatically categorize expenses as they arrive. For example, you can tell the system that any bill from a specific software company should always be tagged as a Monthly SaaS Subscription. You set the rule once, and it's done. If you're curious about how this works in more detail, you can learn more about how to automate invoice management to save time and slash your admin workload.

Making this shift turns expense management from a reactive chore into a proactive strategy. It massively reduces fraud risk, keeps you compliant, and gives you a real-time pulse on your spending. This way, you can make smarter financial decisions with total confidence.

Integrating Systems for Full Financial Visibility

Your expense data should never live on an island. If you're serious about financial control, you need a connected ecosystem where information flows freely. When you track business expenses in one place but do your accounting somewhere else, you’re just creating extra work and opening the door to mistakes. Nobody has time for that.

The real breakthrough comes when you integrate your expense management tool directly with your accounting software, whether it's QuickBooks or Xero. This connection creates a single, reliable source of financial truth, finally putting an end to the soul-crushing task of manual data entry and reconciliation.

Mapping Categories for a Perfect Sync

So, how do you make this connection work flawlessly? The secret is in mapping your expense categories. Before you even think about hitting that "connect" button, take a moment to line up your categories in Invowl with the Chart of Accounts in your accounting software.

For example, you might have a super-specific category like Monthly SaaS Subscriptions in Invowl. If your accounting software doesn't have an exact match, you can simply map it to a broader Software & Subscriptions account. It's that simple.

Spending just 10 minutes on this alignment will save you hours of headaches down the road. It’s the foundation for getting a live, 360-degree view of your company's financial health.

Key Takeaway: A great integration isn’t just about connecting two apps; it’s about making sure they speak the same language. Map your expense categories thoughtfully to create an automated, error-free flow of financial data.

The Power of a Unified Financial View

Once you're connected, the benefits are immediate. Every approved expense in Invowl can now be automatically pushed to your accounting software, complete with the digital receipt attached. This means no more duplicate data entry and books that are always up-to-date.

This shift from manual grunt work to smart automation is a massive leap for modern finance. Today’s tools let businesses maintain electronic records, enforce spending policies, and update the general ledger without anyone lifting a finger. It drastically cuts down on administrative burdens and costly human errors.

With a unified view, you’re not just more efficient—you’re smarter. When your expense data and accounting data are in perfect sync, you can:

- Generate accurate P&L statements with a single click.

- Get a real-time snapshot of cash flow without waiting for month-end reports.

- Trust that every financial report is built on complete, accurate information.

This seamless flow also makes working with your bookkeeper or accountant unbelievably simple. Forget sending messy spreadsheets. Instead, you grant them access to a clean, organized system where everything is already in its place. To learn more about improving this relationship, check out our guide on how to streamline collaboration with your accountant. This is how you turn your financial data from a chore into a strategic asset.

Turning Expense Data Into Actionable Insights

Collecting financial data is one thing. Actually using it to make smarter, more profitable decisions is where the real magic happens. This is the point where the boring task of how you track business expenses transforms into a powerful source of business intelligence.

It all starts with getting into a rhythm. Don't wait until you're putting out a fire to look at your numbers. You need to set aside dedicated time each month—even just an hour—to dig into your spending trends. Are your marketing costs slowly creeping up without you noticing? Is a single software subscription eating a bigger piece of the budget than you realized? These regular check-ins are your early warning system, helping you spot issues and find savings before they snowball.

Uncovering Hidden Savings Opportunities

Think of your expense data as a treasure map. Once everything is clearly categorized, you can start asking some really pointed questions and get immediate answers.

For example, when you can instantly see your top five vendors by total spend, you’re no longer guessing. You're walking into a negotiation armed with a full year's worth of data, giving you serious leverage to ask for better rates or more flexible payment terms.

This data also shines a bright light on underperforming investments. Maybe you’re pouring cash into a specific marketing channel that just isn't bringing in customers. A quick look at your categorized expenses next to your sales data makes this glaringly obvious. It’s a simple, data-backed way to decide where to cut and where to double down.

Your expense history isn't just a record of what happened; it's a playbook for what to do next. It shows you what's working, what's a waste, and where every single dollar can have the greatest impact on your bottom line.

Empowering Your Team with Financial Clarity

True financial control isn't a one-person job—it's a team sport. When you track business expenses effectively, you can give your team leaders clear, real-time visibility into their departmental budgets. This doesn't just make them more cost-conscious; it empowers them to take true ownership of their spending.

With your data organized, you can start taking real action:

- Spot Redundant Tools: Quickly see if two different teams are paying for software that does the exact same thing.

- Optimize Subscriptions: Analyze actual usage to decide if you can downgrade a plan or just get rid of an underused tool entirely.

- Build Smarter Budgets: Use the past 12 months of actual spending to create incredibly accurate and realistic budgets for the next quarter.

This kind of transparency builds a culture of financial responsibility across the whole company. When your team understands the "why" behind the numbers and the direct impact of their spending, they're equipped to make smarter decisions that protect the company's financial health.

By consistently reviewing and acting on your expense data, you graduate from simple bookkeeping. You create a dynamic feedback loop that drives efficiency, boosts profitability, and helps you navigate the future with a lot more confidence. For more tips on building strong business habits, check out the resources on the Invowl blog.

Got Questions? We've Got Answers

Even with the best systems, you're bound to have questions when you start getting serious about tracking business expenses. I've been there. Here are some of the most common things we hear from business owners, with straight-to-the-point answers based on real-world experience.

What’s the Smartest Way for a Small Business to Track Expenses?

Honestly, the most effective way is to pair dedicated expense management software with your accounting platform, like QuickBooks or Xero. This combo automates the grunt work—capturing receipts, categorizing spending, and syncing everything so your financial reports are always up-to-date.

Look, I get the appeal of spreadsheets. They seem simple and free. But they're also a breeding ground for manual errors, become a nightmare to manage as you grow, and just don't scale. Investing in a real software solution pays for itself by giving you accuracy, compliance, and genuine insights into where your money is going. It saves you a ton of time and headaches in the long run.

How Do I Actually Categorize My Expenses for Taxes?

This is a big one, because getting your categories right is how you maximize your tax deductions. The trick is to structure your categories to mirror what your local tax authority (like the IRS in the US) expects to see.

Here are some of the most common, tax-friendly categories you'll use:

- Office Supplies

- Travel and Lodging

- Business Meals

- Software and Subscriptions

- Utilities and Rent

- Marketing and Advertising

- Professional Services (think legal or accounting fees)

The absolute key here is consistency. Set these up in your accounting software's chart of accounts and stick to them. When an expense comes in, assign it to the right bucket every single time. If you're ever on the fence about a specific expense, a quick call to your accountant is always a smart move. They'll make sure you're set up to get every deduction you deserve.

My Two Cents: Always, always link a digital copy of the receipt directly to the categorized expense. This creates a bulletproof record that makes tax season a breeze instead of a panic-fueled nightmare. Using a tool that does this automatically is the easiest win you'll get.

Can I Really Track Business Expenses Without Receipts?

Technically, you can, but you really shouldn't. While some tax laws have minor exceptions—for instance, the IRS might let certain expenses under $75 slide without a formal receipt—it’s a risky game to play.

Even for those small expenses, you still need a solid record. This usually means a bank or credit card statement that clearly shows the payee, amount, date, and a note about the business purpose. But relying on this is not a professional or safe strategy.

The best approach, without question, is to use a modern tool that lets you snap a photo of a receipt with your phone the second you get it. This completely removes the "oops, I lost the receipt" problem, guarantees you have proof for every deduction, and ensures you can confidently face an audit. It’s about claiming every dollar you're entitled to without the stress.

Ready to stop chasing down invoices and start getting real insights from your spending? Invowl plugs into your inbox, automatically pulls out all your expense data, and gives you the tools to get a grip on your finances in seconds. Get started with Invowl today and turn expense tracking from a chore into a strategic advantage.