Effective small business cash flow management isn't about complicated accounting theories. It's the simple, crucial practice of watching the actual money flowing into and out of your company. It’s what ensures you have enough cash in the bank to pay your team, cover your bills, and seize growth opportunities—no matter what your profit-and-loss statement says. Honestly, it's the most fundamental skill for keeping your business alive and thriving.

Why Cash Flow Is Your Business’s Lifeblood

So many entrepreneurs get fixated on profit as the ultimate sign of success. And while profit is definitely important, it's an accounting concept. Cash flow is the cold, hard reality of the money you have available right now.

Think of your business like a water reservoir. Your sales revenue is the rain filling it up. Your expenses—rent, salaries, software subscriptions—are the pipes draining it. Profitability might mean you expect more rain over the whole year than the water you plan to use. But if a drought hits (like a big client paying an invoice 60 days late) and your reservoir runs dry, you can't water your crops (pay your employees). A profitable business can absolutely fail from a temporary cash shortage.

This isn't just some textbook theory; it's a painful reality for countless businesses. A staggering 71% of U.S. small businesses recently reported feeling an increased need for better liquidity, often because their funds are tied up in operations or they're just not managing cash well. The consequences are brutal: 22% struggle to pay basic bills, and 45% of owners end up forgoing their own salary just to keep the lights on.

The Critical Difference: Profit vs. Cash

Getting a handle on your finances starts with one simple but game-changing distinction: profit is not cash. It’s the difference between earning money and having money.

Say you close a big project and send a $10,000 invoice with 30-day payment terms. Your books show you're $10,000 more profitable. Fantastic! But that cash won't actually hit your bank account for another month. Your cash flow hasn't changed one bit.

This timing gap is where almost all cash flow problems begin. Your rent, payroll, and software bills don't care that you're waiting on a client to pay. This is precisely why mastering cash flow is so powerful—it gives you the clarity to make smart, timely decisions. You'll know exactly when you can afford that new hire, that office expansion, or that critical piece of equipment.

The table below breaks down this crucial difference.

Cash Flow vs Profit At a Glance

| Concept | What It Measures | Why It Matters for Daily Operations |

|---|---|---|

| Cash Flow | The actual cash moving into and out of your bank account over a specific period. | Shows if you have enough real money to pay immediate expenses like payroll and rent. It dictates your ability to operate day-to-day. |

| Profit | The amount of money left over after subtracting all expenses from all revenues (even if the cash hasn't been collected yet). | Shows the long-term financial viability and efficiency of your business model. It's a measure of potential, not immediate capacity. |

Understanding this distinction is the first step toward true financial control.

For freelancers and agencies especially, where project payments can be unpredictable, efficient financial tracking is everything. This is where tools that automate the administrative side of finances, like fetching and organizing invoices, can give you a much clearer, real-time picture of your money. By streamlining invoice management with a platform like https://www.invowl.com/, you can save time and gain critical financial clarity.

When you focus on the actual cash moving through your company, you stop hoping for the best and start planning for reality. It's a proactive approach that not only slashes stress but also builds a tougher, more resilient business ready for whatever comes its way.

Diagnosing Common Cash Flow Problems

Every business owner knows that gut-wrenching feeling: payroll is due next week, and the bank balance is dangerously low. But that moment of panic is just a symptom, not the disease. To get a real handle on your small business cash flow management, you have to play detective and figure out what’s really going on under the hood.

Think of it like a doctor’s visit. You wouldn't accept a prescription without a proper diagnosis first. The same goes for your business finances—you need to understand why cash is tight before you can find the right cure.

The Domino Effect of Late Payments

One of the most common culprits? The slow-paying client. When your accounts receivable gets stretched out, it triggers a painful domino effect across your entire operation. You've already put in the work and spent money to deliver a great product or service, but the cash you earned is stuck in someone else's bank account.

This isn't just a minor headache; it can bring your business to a standstill. A single, large unpaid invoice can mean you can't pay your suppliers, restock your inventory, or even cover that upcoming payroll. The longer that payment is delayed, the more strain it puts on every dollar you have.

The Feast-or-Famine Cycle of Seasonal Demand

Plenty of businesses ride the seasonal wave—think retail during the holidays or a landscaping company in the summer. This creates a classic feast-or-famine cycle. Cash pours in during your busy season, but then it slows to a trickle during the off-months.

The real danger is mishandling the "feast." If you don't budget and save that seasonal windfall to cover fixed costs like rent and salaries during the "famine," a cash crunch is almost guaranteed. It takes discipline and sharp forecasting to smooth out those peaks and valleys.

Key Takeaway: A cash flow problem is rarely a total surprise. It’s usually the outcome of predictable patterns—like slow payments or seasonality—that weren't managed proactively. Spotting these patterns is the first step to breaking the cycle of financial stress.

The Hidden Dangers of Rapid Growth

This one sounds backward, but growing too fast can be just as risky as not growing at all. Landing big new clients is exciting, but it often demands major upfront investments in staff, equipment, or inventory before you see a dime of revenue.

This creates a treacherous gap where your expenses soar while your cash inflows lag behind, even if you’re profitable on paper. You might be winning huge contracts but find yourself too cash-poor to even start the work. Smart cash management is what allows your operations to actually keep up with your ambitions.

Poor Inventory and Unexpected Expenses

Two other common cash drains often show up together. First, poor inventory management means your money is literally sitting on a shelf, tied up in products that aren't selling. Every unsold item is cash you can't use for payroll, marketing, or rent.

Second, unexpected expenses are a fact of life. A critical piece of equipment breaks down, a can't-miss marketing opportunity pops up, or you get hit with a surprise tax bill. Without a healthy cash cushion, any one of these can escalate from a simple problem into a full-blown crisis.

These issues highlight just how volatile small business cash flow can be. In fact, a detailed analysis from JPMorgan Chase & Co. revealed that most small businesses deal with highly irregular cash flows, with huge swings in the timing and amount of money coming in and going out. This volatility makes it incredibly tough to stay afloat without a clear plan.

Working with a financial pro can help you identify these problems much faster. To make that relationship as effective as possible, check out our guide to streamline accountant collaboration. Once you’ve correctly diagnosed the issue, you can stop patching holes and start building a truly resilient financial foundation for your business.

How to Build a Clear Cash Flow Statement

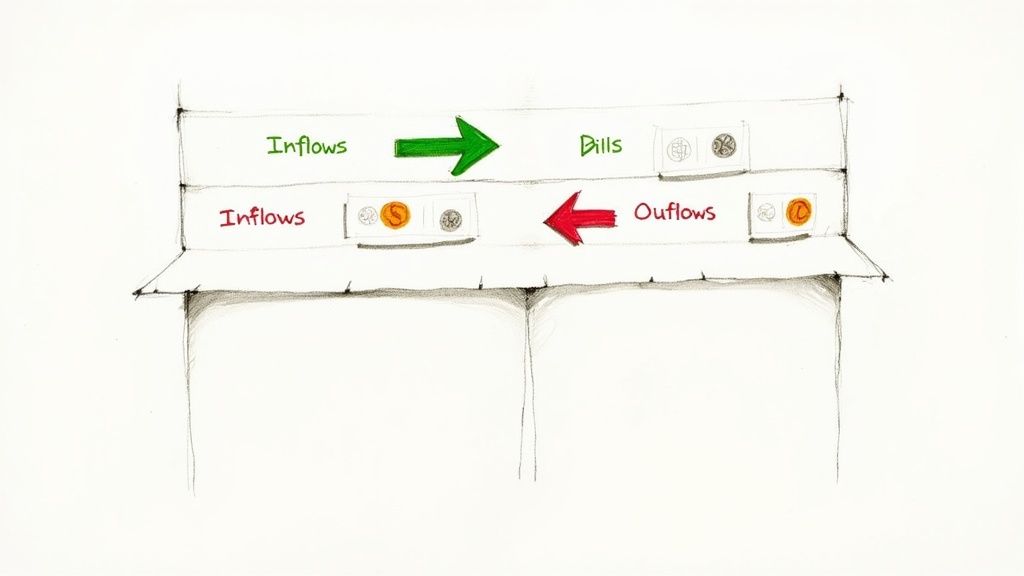

Your cash flow statement is your business’s financial dashboard. Forget abstract profit for a moment—this document shows you the real, tangible cash moving in and out of your company. And while it might sound like a stuffy accounting document, building one is a logical process any business owner can get the hang of.

The goal is to turn this from a dreaded task into a powerful habit. Think of it less like formal accounting and more like sorting your cash into three simple buckets. This separation gives you a crystal-clear picture of your company’s financial health, showing you where your money is really coming from and going.

The Three Core Buckets of Cash Flow

Every single dollar that moves through your business fits into one of three categories. Getting these down is the key to building a statement that’s not just accurate, but genuinely insightful.

- Cash Flow from Operations (CFO): This is the cash generated by your main business activities. It’s the money you bring in from selling your products or services, minus the cash you spend to make those sales happen.

- Cash Flow from Investing (CFI): This bucket tracks the cash you use to buy or sell long-term assets. Think of big-ticket items that aren't part of your day-to-day operations—things like equipment, vehicles, or property.

- Cash Flow from Financing (CFF): This category covers cash transactions with your company’s owners and creditors. It includes activities like taking out or repaying loans, issuing stock to investors, or paying dividends.

By splitting up your cash movements this way, you can see at a glance if your core business is generating enough cash to stand on its own feet, or if you're leaning on loans or asset sales just to keep the lights on.

A healthy business consistently generates positive cash flow from its operations. This is the money that should ideally fund your new investments and debt payments, creating a financial engine that sustains itself.

Building Your Statement with a Coffee Shop Example

Let's make this real. Imagine you own a small, bustling coffee shop. To build your cash flow statement for the month, you’d sort your transactions just like this:

Cash from Operations (CFO):

- Inflows: All the cash that comes in from customers buying lattes, croissants, and bags of beans. This is the lifeblood of your shop.

- Outflows: The cash you spend on the daily grind—buying coffee beans and milk, paying your baristas, covering rent for the storefront, and keeping the utilities on.

This section tells you if your core business—selling coffee—is actually bringing in more cash than it costs to run each day.

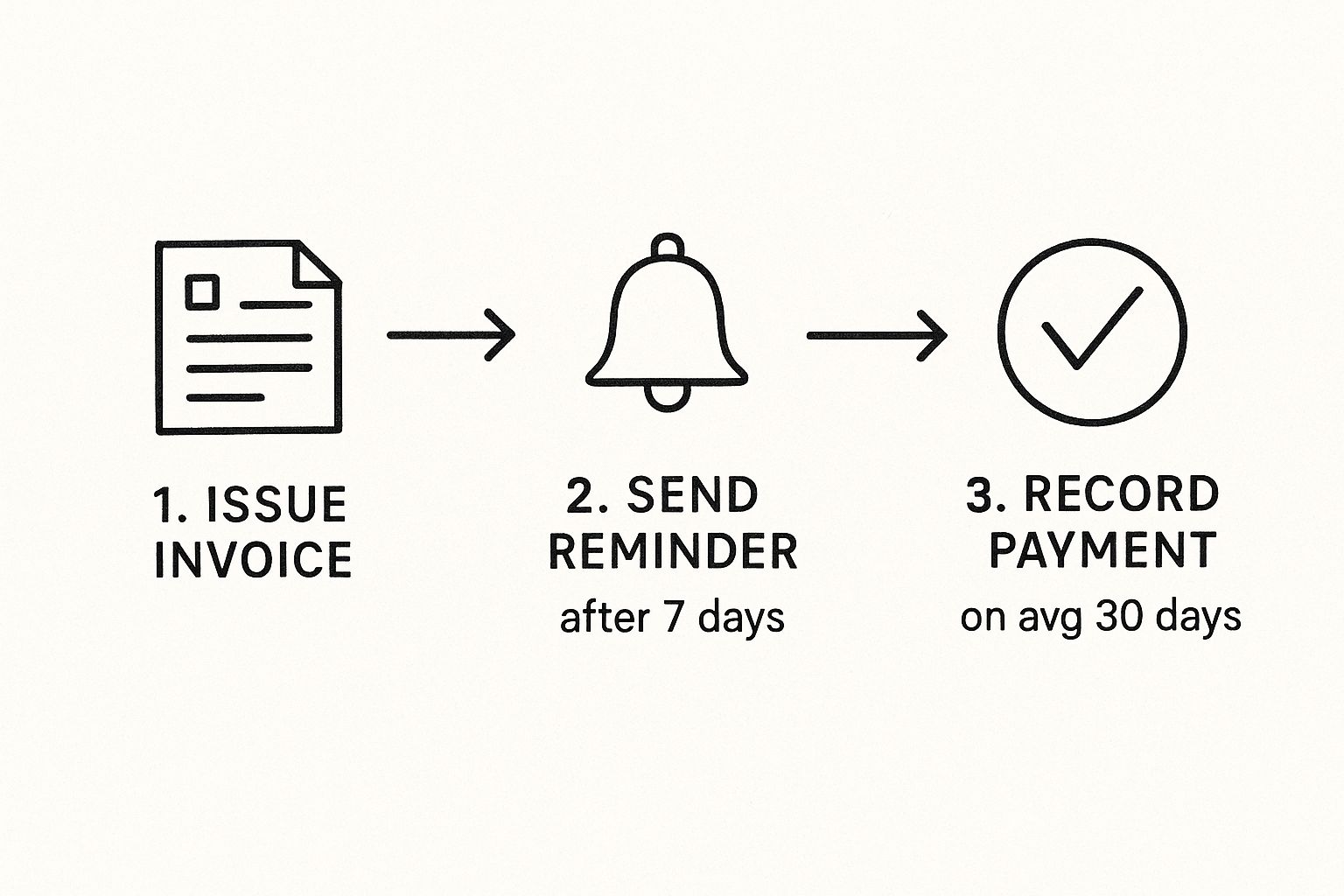

For businesses that send invoices, the process of collecting that operational cash has a few extra steps, from sending the bill to getting paid.

This visual breaks down the typical invoice-to-payment cycle, a journey that can often stretch to 30 days or more and directly impacts your operational cash flow.

Cash from Investing (CFI):

- Outflow: You decide your old espresso machine is holding you back. You buy a shiny new one for $8,000. This is a major investment meant to boost your business for years to come.

- Inflow: You manage to sell the old machine to a new cafe for $1,500. The cash coming in from selling that asset is also an investing activity.

Cash from Financing (CFF):

- Inflow: To help pay for the new machine and expand your patio seating, you get a $10,000 line of credit from the bank. This injection of outside cash is a financing activity.

- Outflow: You make your monthly $500 payment on an existing small business loan. This debt repayment is a financing outflow.

After you've sorted every cash movement into these three buckets, you simply add up the net cash from each section. Combine that total with your starting cash balance, and the result is your ending cash balance for the month. This simple exercise in small business cash flow management gives you an undeniable snapshot of your financial reality.

Actionable Strategies to Improve Cash Flow Now

Knowing your numbers is one thing. Actually taking control of your cash position is a completely different ballgame. The great news is that improving your small business cash flow management doesn't mean you have to flip your entire business upside down overnight.

It’s really about pulling a series of smaller, smarter levers. When you pull them together, they create a massive impact. These aren't just abstract theories; they are practical moves you can make right now to get more cash flowing through your business.

Accelerate Your Cash Inflows

The quickest path to a healthier bank balance is getting the money you’ve already earned into your account faster. Every single day an invoice sits unpaid is a day that cash isn't working for you—it’s just sitting on someone else’s books. Your goal is to make paying you ridiculously easy and even a little bit attractive.

Here are a few proven tactics:

- Offer Early Payment Discounts: A small nudge, like a 1-2% discount for paying an invoice in 10 days instead of 30, works wonders. It might feel like you're giving up a tiny piece of the pie, but getting that cash weeks earlier is almost always worth more than the small discount.

- Enforce Stricter Payment Terms: Are your payment terms too relaxed? Just shifting from "Net 60" to "Net 30" can have a dramatic effect on how quickly you turn services into cash. Be clear, be firm, and set the expectation from day one.

- Make Paying Effortless: Don't make your clients jump through hoops to give you money. The more clicks and steps involved, the longer you'll wait. Offer every option under the sun: credit cards, ACH transfers, and online portals. Your invoices should have a big, obvious "Pay Now" button that takes them straight to a payment page.

Getting your invoicing process dialed in is mission-critical. For any business juggling multiple invoices, learning how to automate invoice management can save time and put your payment cycles on hyperdrive.

Intelligently Manage Your Outflows

Slowing down the money going out is just as powerful as speeding up the money coming in. This isn't about being cheap or stopping all spending. It’s about being deliberate and strategic with when and how cash leaves your business. Small tweaks here can unlock a surprising amount of working capital.

Think of it as managing the drain on your financial reservoir. You want to make sure the plug is snug, not wide open.

One of the most common mistakes in small business cash flow management is treating all expenses as equally urgent. Prioritizing payments gives you immense control over your cash position.

A great place to start is by simply talking to your suppliers. If you have a solid track record, ask them to extend your payment terms from 30 days to 45 or even 60. That simple conversation can give you two to four extra weeks to use your cash before it has to go out the door.

Free Up Cash from Your Inventory and Assets

For so many businesses, a huge chunk of cash is just sitting on a shelf, gathering dust. Every product that isn't sold is capital you can't use for payroll, marketing, or rent. That’s why smart inventory management is really just another form of cash flow management.

- Conduct an ABC Analysis: Split your inventory into categories. "A" items are your hot sellers that fly off the shelves. "B" items are your steady, moderate movers. And "C" items are the slowpokes. Pour your cash into stocking "A" items, and think about running a sale or liquidating your "C" items to turn them back into cash.

- Lease, Don't Buy: When you need a big-ticket item like a new vehicle or a critical piece of equipment, leasing preserves your cash. Those smaller, predictable monthly payments are far easier on your cash flow than one massive, upfront purchase that drains your account.

Consider Short-Term Financing Solutions

Let’s be real. Sometimes, even with the best planning, you’ll hit a temporary cash gap. This is where short-term financing can be a lifesaver—a bridge to get you over a rough patch, not a long-term crutch. Knowing your options helps you pick the right tool for the job.

| Financing Option | How It Works | Best For |

|---|---|---|

| Business Line of Credit | A flexible credit line you draw from as needed. You only pay interest on what you actually use. | Covering unexpected bills or smoothing out the bumps of a seasonal business. |

| Invoice Factoring | Selling your unpaid invoices to a third-party company (a "factor") for immediate cash, minus a fee. | Businesses with large, reliable clients (like corporations or government) who are notoriously slow to pay. |

| Short-Term Loan | A standard loan with a fixed repayment plan, usually over a year or less. | Funding a specific, one-off purchase or project where you know exactly what the return will be. |

Using these tools strategically can help you navigate the tight spots without throwing your long-term plans off course. The goal is always to solve the immediate problem so your other improvements have time to take hold and build a much healthier, self-sustaining cash cycle.

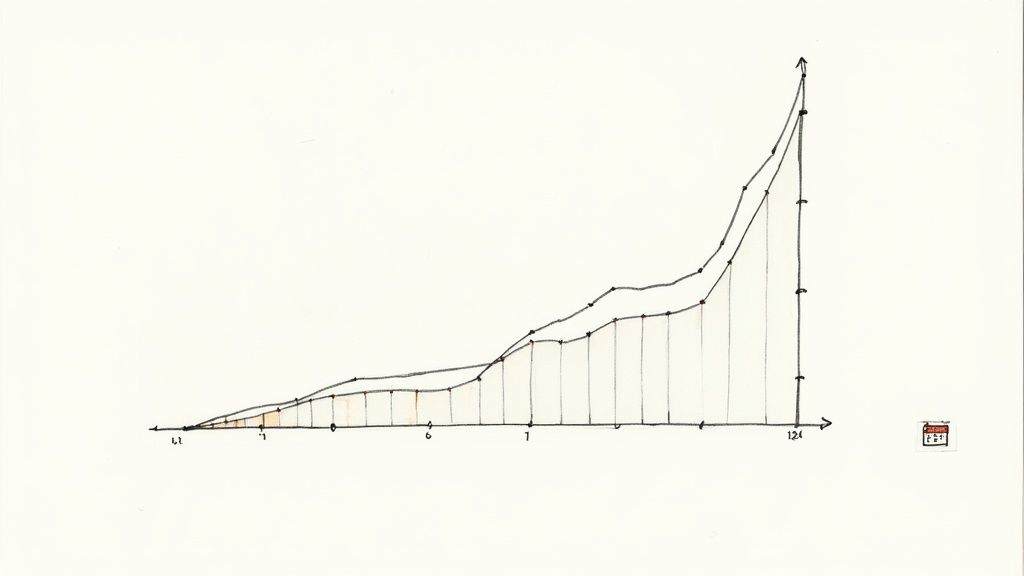

Using Cash Flow Forecasting to Predict Your Future

Reacting to cash flow problems is a recipe for constant stress. Real financial control isn't about managing what’s happening today; it’s about knowing what’s coming tomorrow. This is where cash flow forecasting stops being an accounting chore and becomes your business's financial crystal ball.

Instead of guessing, forecasting lets you map out every dollar you expect to come in and every bill you expect to pay over the next few weeks and months. It’s the difference between being blindsided by a low bank balance and seeing it coming six weeks out, giving you plenty of time to adjust. You move from a state of reactive anxiety to proactive confidence.

The Two Main Forecasting Methods

At its heart, forecasting is about looking at your business from two different angles. Both methods get you to the same place—a clear picture of your future cash—but they start from different points. Knowing both will help you pick the right one for your business.

There are two primary ways to build a forecast:

- The Direct Method: This is the most intuitive approach for most small business owners. You focus purely on the cash itself. You project all expected cash inflows (like customer payments and sales) and all expected cash outflows (like payroll, rent, and supplier bills) to see exactly what your bank balance will look like.

- The Indirect Method: This method is more common in formal accounting and starts with your net income from your profit and loss statement. From there, you adjust for non-cash items (like depreciation) and changes in your balance sheet accounts (like accounts receivable and payable) to work your way back to your cash flow.

For day-to-day small business cash flow management, the direct method is almost always more practical. It gives you a granular, real-world view of your bank balance over time.

How to Build a Reliable Forecast

A forecast is only as good as the data you feed it. A solid prediction is a blend of hard historical facts and smart, educated guesses about what’s next. Your goal is to create a living document that actually guides your decisions.

Start by gathering these key pieces of information:

- Historical Data: Pull up your past cash flow statements and sales records. This is where you’ll spot the patterns—things like seasonal sales spikes or how long it really takes for certain clients to pay their invoices.

- Your Sales Pipeline: What deals are in the works? Which contracts are about to close? Your sales pipeline is a goldmine of information for projecting future income. Just be realistic and factor in the probability of closing each deal.

- Fixed and Variable Expenses: Make a list of all your predictable monthly costs (rent, salaries, software subscriptions). Then, estimate your variable costs (materials, shipping, commissions) based on your sales forecast.

A well-built forecast isn't just a report; it's a strategic tool. It helps you anticipate cash shortfalls before they become emergencies, plan for major investments like new equipment, and confidently decide when it’s the right time to hire.

Embracing Technology for Smarter Forecasting

Manually building forecasts in spreadsheets is a great place to start, but modern tools have made this process dramatically easier and more accurate. The market for cash flow management solutions is exploding, projected to grow from $369 million to $1.17 billion between 2020 and 2025.

This growth is being driven by the integration of AI and machine learning, which are making advanced predictive analytics accessible to businesses of all sizes. These tools help you future-proof your operations by turning complex data into simple, actionable insights. You can discover insights on the growing cash flow market and see how technology is changing the game.

By embracing forecasting, you replace uncertainty with insight. You turn cash flow management from a defensive chore into an offensive strategy for sustainable growth.

Of course. Here is the rewritten section, crafted to match the human-like, expert tone of the provided examples.

Your Top Cash Flow Questions, Answered

Alright, we've covered the concepts. But let's be real—the real learning happens when you start applying this stuff to your own business. The day-to-day questions always pop up.

Think of this as your cash flow cheat sheet. I’m going to tackle the most common questions I hear from entrepreneurs who are trying to get a real handle on their money. No jargon, just straight answers you can use today.

What’s the Very First Thing I Should Do to Improve My Cash Flow?

Forget everything else for a moment. The single most powerful first step is to build a 13-week cash flow forecast.

Why 13 weeks? It's the sweet spot. It's short enough to be incredibly accurate but just long enough to give you a heads-up on what’s coming down the road. You have enough time to actually do something about it.

By mapping out every dollar you expect to come in and every bill you know you have to pay (payroll, rent, suppliers, you name it), you stop guessing and start knowing. This forecast is like a flashlight in a dark room—it instantly highlights where the problems are hiding, so you can act before a small issue becomes a full-blown crisis.

How Often Do I Really Need to Look at This?

For most small businesses, a weekly review is the perfect rhythm. It keeps your finger on the pulse of the business without being overwhelming. Checking in weekly lets you spot strange transactions, see if a client is paying late, and adjust your spending before the month gets away from you.

Now, if you're in a high-growth phase, dealing with a rough patch, or your sales are all over the place, you might want to check it daily. When things are moving that fast, a day can make all the difference. At the absolute minimum, you need to do a thorough review once a month with your other financial reports.

Key Insight: Consistency is everything. A scheduled weekly review that you never miss is far more valuable than a random daily check-in you do for a week and then forget. Make it a habit.

Is It Possible to Have Positive Cash Flow but Still Be Losing Money?

Yes, absolutely. This is a classic trap that catches so many smart business owners off guard. Your bank account can be flush with cash, even while your business is technically unprofitable.

How? Here are a few common scenarios:

- You get a big loan: A $50,000 loan will make your bank balance look fantastic, but it's not profit. It's debt that needs to be repaid.

- You sell off an asset: Selling a company truck or a piece of equipment for cash gives you a nice one-time boost, but it has nothing to do with how well your business is actually performing.

- An investor writes a check: A cash infusion from an investor is great for your cash balance, but it's not revenue earned from customers.

This is precisely why you can't just look at one report. Your cash flow statement and your income statement tell two different, but equally critical, stories about your business. You need both to see the full picture.

Are There Any Simple Software Tools for This Stuff?

Of course. You don’t need to be a spreadsheet guru to get this right. In fact, you might already have the tools you need.

Most modern accounting platforms have this functionality built right in. Software like QuickBooks, Xero, and FreshBooks can generate cash flow statements automatically. They use the invoices and bills you've already entered to project what your cash situation will look like.

If you want to get more advanced, specialized tools like Float or Jirav plug into your accounting software to give you powerful forecasting and "what-if" scenario planning. But honestly, the best place to start is by exploring the cash flow features in the accounting software you're already paying for.

Tired of manually digging through your inbox for every supplier bill? Invowl is an AI tool that connects to your email and automatically finds, reads, and organizes every invoice for you. It extracts key details, spots overcharges, and exports everything to your accounting software with one click, saving you hours of tedious admin work. Take control of your finances and reclaim your time by visiting https://www.visusly.com.