For many small business owners, managing finances feels like a second full-time job. Juggling invoices, tracking expenses, and preparing for tax season can quickly become overwhelming, pulling focus from core business operations. Ineffective financial management isn't just a headache; it's a critical threat to sustainability and growth. But what if you could transform this complex chore into a strategic advantage?

This guide moves beyond generic advice to provide 8 essential, practical small business accounting tips designed to give you clarity and control. We will dive into actionable strategies that help you master cash flow, streamline bookkeeping, and leverage smart technology to automate tedious tasks. Implementing these methods will not only prepare you for tax season but also uncover hidden savings and provide the financial insights needed to make smarter decisions. Let's get your financial house in order and build a more resilient, profitable business for 2025 and beyond.

1. Separate Business and Personal Finances

The most foundational of all small business accounting tips is to draw a firm line between your business and personal finances. This means establishing dedicated bank accounts, credit cards, and payment systems exclusively for business activities. Commingling funds, where you pay for a business expense with a personal card or deposit a client check into your personal account, creates a bookkeeping nightmare. It complicates tracking, blurs financial clarity, and can lead to serious tax and legal vulnerabilities.

This separation is crucial from day one. For a freelancer, it’s as simple as opening a separate checking account to receive client payments and a business credit card for software subscriptions. For a small restaurant owner, it means all supplier invoices, payroll, and daily sales are processed through distinct business accounts, never personal ones.

Why This Practice is Non-Negotiable

Maintaining this financial boundary is essential for several reasons. It simplifies bookkeeping and tax preparation immensely, as all your business-related income and expenses are consolidated in one place. More importantly, it reinforces your business’s legal structure, such as an LLC or corporation, by upholding the “corporate veil.” This protects your personal assets, like your home and car, from being targeted in the event of business debts or lawsuits.

Actionable Steps for Implementation

- Open Dedicated Accounts: Immediately open a business checking account and a business savings account. Consider using a different bank than your personal one to create an even clearer mental and logistical separation.

- Secure a Business Credit Card: Use this card for all business-related purchases, no matter how small. This helps build business credit and simplifies expense tracking.

- Establish a Payment Process: Pay yourself a formal salary or owner’s draw by transferring a set amount from your business account to your personal account on a regular schedule. Avoid sporadic, undocumented withdrawals.

- Review Transactions Weekly: Dedicate time each week to categorize transactions in your business accounts. This helps you quickly spot any accidental commingling and maintain accurate records for tax time.

2. Implement Regular Bookkeeping Schedules

Procrastinating on bookkeeping until tax season is a recipe for stress, inaccuracies, and missed financial opportunities. One of the most impactful small business accounting tips is to establish and stick to a regular bookkeeping schedule. Instead of facing a mountain of uncategorized receipts and invoices at year-end, this approach involves systematically managing your finances on a daily, weekly, or monthly basis. It transforms accounting from a dreaded annual chore into a manageable, routine business function.

A service-based business, for example, might dedicate every Tuesday and Thursday to recording client payments and sending new invoices. An e-commerce seller could spend 30 minutes each Friday reconciling sales from their payment processors. This consistency prevents backlogs and ensures you always have an accurate, up-to-date view of your company’s financial health, empowering you to make informed decisions.

Why This Practice is Non-Negotiable

Regular bookkeeping provides the real-time financial clarity needed to run a business effectively. It allows you to monitor cash flow, track profitability, and identify potential issues before they escalate. A consistent schedule drastically reduces the risk of errors and omissions that can occur when you’re rushing to piece together a year's worth of transactions. It also makes tax time significantly smoother, as your records are already organized and prepared. Ultimately, treating bookkeeping as a core, recurring task helps build a disciplined financial foundation for sustainable growth.

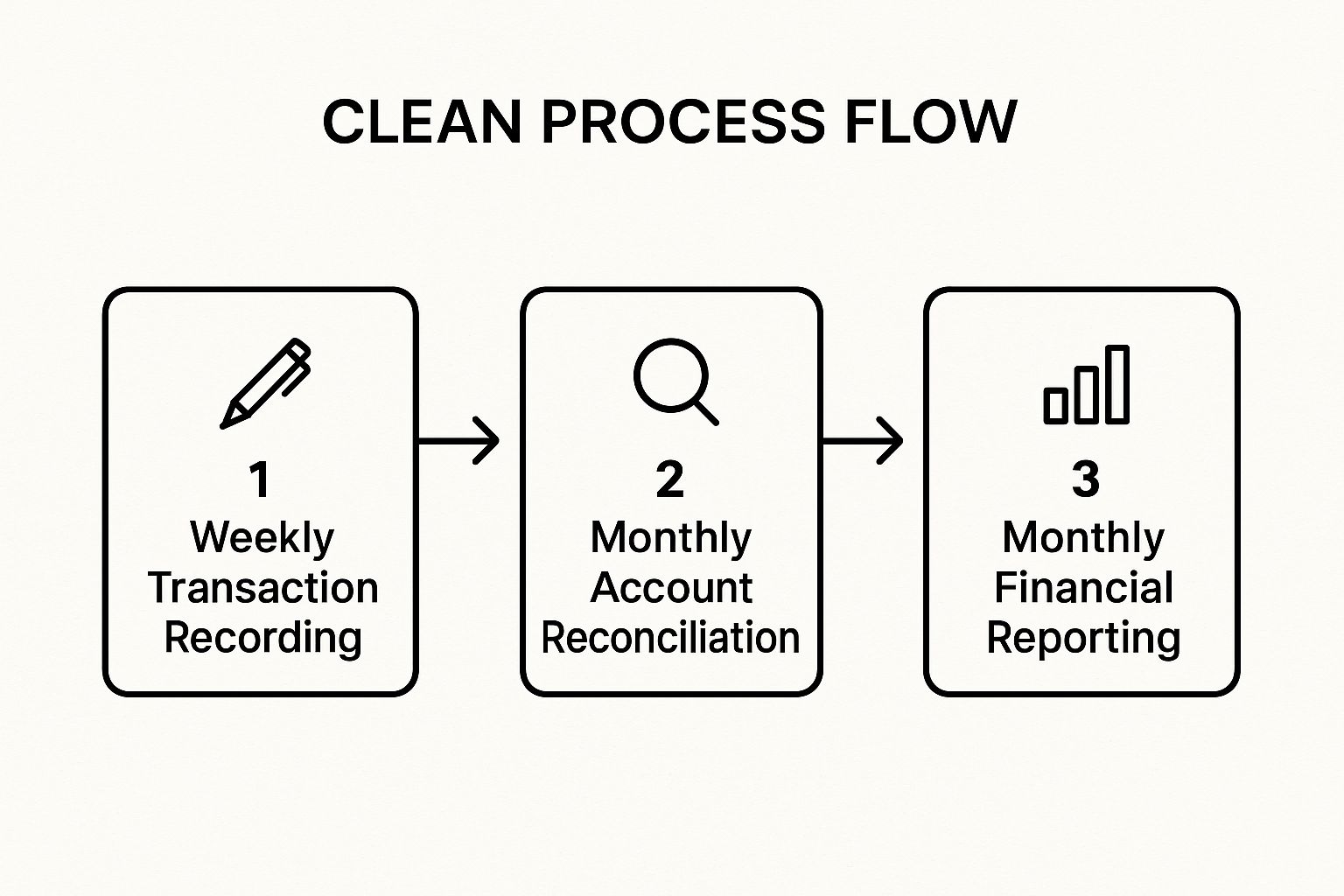

This structured process flow illustrates a simple yet powerful monthly bookkeeping cycle.

By breaking the process down into weekly, monthly, and reporting stages, you create a system that is both manageable and highly effective for maintaining financial control.

Actionable Steps for Implementation

- Schedule It: Block out time on your calendar for bookkeeping and treat it like a non-negotiable client meeting. Start with a one-hour session each week.

- Batch Similar Tasks: Dedicate specific time blocks to related activities. For instance, handle all invoicing at once, then move on to categorizing all expenses. This improves efficiency.

- Use Checklists: Create a simple checklist for your daily, weekly, and monthly bookkeeping tasks to ensure nothing is overlooked.

- Leverage Automation: Streamline your invoicing and payment tracking to reduce manual entry. You can learn how to automate invoice management and save time with the right tools, making your scheduled sessions even more productive.

3. Track Cash Flow Meticulously

Profitability doesn't guarantee survival; cash flow does. This vital accounting tip involves systematically monitoring the money flowing into and out of your business, focusing on the timing of receipts and payments. While profit is a long-term indicator of success, cash flow is the short-term lifeblood that covers daily expenses like payroll, rent, and inventory. A profitable company can fail if its cash is tied up in unpaid invoices or slow-moving stock.

This meticulous tracking is essential for operational stability. A seasonal retail business, for example, must build cash reserves during peak months to survive the slow periods. Similarly, a construction company needs to align its own bill payments with the timing of project milestone payments from clients to avoid a cash crunch.

Why This Practice is Non-Negotiable

Effective cash flow management is what separates thriving businesses from those that constantly struggle. It provides the visibility needed to make informed decisions, such as when to hire a new employee, invest in equipment, or take on a large project. Without a clear picture of your cash position, you are essentially flying blind, risking overdraft fees, missed payments to suppliers, and an inability to meet payroll, all of which can severely damage your business's reputation and viability.

Actionable Steps for Implementation

- Create a Rolling Forecast: Develop a 13-week rolling cash flow forecast. This document projects your incoming and outgoing cash on a weekly basis, helping you anticipate shortfalls and surpluses.

- Monitor Payment Patterns: Actively track customer payment habits. Follow up on overdue invoices immediately to shorten your collection cycle and improve cash inflow.

- Align Your Payment Cycles: Where possible, negotiate payment terms with your suppliers that align with your customer collection cycles. This prevents paying out large sums before you have received your own payments.

- Build a Cash Reserve: Aim to maintain a cash buffer equal to 3 to 6 months of operating expenses. This reserve acts as a critical safety net for unexpected downturns or opportunities.

4. Maximize Tax Deduction Tracking

Effectively managing your small business accounting tips involves more than just recording income; it demands the diligent tracking of every legitimate business expense to reduce your taxable income. Maximizing tax deductions is a powerful strategy to lower your tax bill, freeing up cash flow that can be reinvested into your business. Many owners miss out on significant savings by overlooking common but valuable write-offs.

This process means meticulously identifying, documenting, and categorizing all costs associated with running your business. A freelance designer can deduct home office space, internet bills, and software subscriptions. Similarly, an online retailer can write off packaging materials, shipping fees, and inventory storage costs. Every documented expense is a potential reduction in your tax liability.

Why This Practice is Non-Negotiable

Failing to track deductions is like leaving money on the table. The IRS allows businesses to deduct all "ordinary and necessary" expenses, but the burden of proof is on you. Without proper records, you cannot claim these deductions, resulting in a higher tax payment than necessary. Comprehensive tracking not only ensures tax compliance but also provides a clearer, more accurate picture of your business's true profitability. It transforms record-keeping from a chore into a strategic financial activity.

Actionable Steps for Implementation

- Use Digital Tools for Receipts: Digitize every receipt the moment you get it. Use apps like Expensify to scan and categorize receipts, eliminating the risk of losing paper copies.

- Track Mileage Automatically: If you use your vehicle for business, use a GPS-based mileage tracking app like MileIQ or TripLog. These apps automatically log trips, making it easy to calculate your mileage deduction.

- Document Home Office Expenses: Carefully calculate your home office deduction. You can use the simplified method (a standard rate per square foot) or the actual expense method, which requires tracking a percentage of your mortgage interest, utilities, and repairs.

- Annotate Meal and Entertainment Costs: When deducting a business meal, keep the receipt and make a note on it detailing who attended and the business purpose of the meeting. This documentation is crucial in an audit.

5. Use Cloud-Based Accounting Software

Gone are the days of manual ledgers and desktop-bound spreadsheets. Modern small business accounting tips almost universally point toward leveraging cloud-based accounting software. These internet-based platforms store your financial data securely online, providing real-time access from any device with an internet connection. They automate tedious tasks like transaction imports, categorization, and financial reporting, transforming accounting from a chore into a strategic tool.

For a food truck owner, this means using a platform like QuickBooks Online on a tablet to track daily sales and log supplier expenses in real-time. A marketing agency can use Xero to grant its remote bookkeeper access to financial data and generate client profitability reports without exchanging files. Even a small retail store can use a free platform like Wave to manage basic bookkeeping and invoicing, keeping overhead low while maintaining professional financial practices.

Why This Practice is Non-Negotiable

Cloud-based software is a game-changer for accuracy, efficiency, and collaboration. It dramatically reduces the risk of human error by automating data entry through bank feeds and receipt scanning. With financial data updated in real time, you always have a clear, current picture of your business's health, enabling better decision-making. This accessibility also makes it seamless to collaborate with an accountant or bookkeeper, as you can both work on the same live data set from different locations.

Actionable Steps for Implementation

- Test Before You Invest: Most platforms, like FreshBooks and Xero, offer free trials. Use them to test the user interface, features, and reporting capabilities to find the best fit for your business needs.

- Set Up Bank Feeds Immediately: The first step after signing up should be connecting your business bank and credit card accounts. This automates transaction imports and is the foundation for efficient bookkeeping.

- Embrace Mobile Apps: Download the platform’s mobile app to capture receipts on the go. Snapping a photo of a receipt and uploading it instantly ensures no expense gets lost.

- Explore Integrations: Check for integrations with other tools you use, such as point-of-sale (POS) systems, CRM software, or payment processors. This creates a connected and highly efficient business ecosystem.

6. Conduct Monthly Financial Reviews

Many small business owners fall into the trap of only looking at their finances during tax season. One of the most impactful small business accounting tips is to shift from this reactive approach to a proactive one by conducting systematic monthly financial reviews. This practice involves setting aside dedicated time each month to analyze your financial statements, track key performance indicators (KPIs), and assess your overall financial health. It turns your accounting data from a historical record into a powerful decision-making tool.

This habit allows you to spot trends, identify opportunities, and catch potential problems before they escalate. For an e-commerce business, this means tracking customer acquisition costs against lifetime value. For a restaurant owner, it involves reviewing monthly food costs and labor percentages to optimize menu pricing and staffing schedules. These regular check-ins provide the clarity needed to steer your business with confidence.

Why This Practice is Non-Negotiable

Monthly financial reviews are your business’s early warning system. They help you understand your cash flow cycles, identify your most and least profitable services or products, and make informed adjustments to your budget. Ignoring these regular check-ups is like flying a plane without looking at the instruments; you might be okay for a while, but you’re blind to turbulence ahead. This consistent analysis also ensures your financial records are always clean and up-to-date, which simplifies everything from applying for a loan to collaborating with your accountant.

Actionable Steps for Implementation

- Schedule a Non-Negotiable Meeting: Block out 1-2 hours on your calendar at the same time each month dedicated solely to this review. Treat it as you would a critical client meeting.

- Create a Standard Report Template: Use your accounting software to generate a consistent monthly report package. Include your Profit & Loss Statement, Balance Sheet, and Cash Flow Statement.

- Focus on 5-7 Key Metrics: Don't get overwhelmed. Identify the handful of KPIs that matter most to your business’s health, such as gross profit margin, customer acquisition cost, or monthly recurring revenue.

- Compare and Document: Analyze your numbers against the previous month, the same month last year, and your budget goals. Document key insights and create a list of action items to address before the next review. If you work with an accountant, these reviews are a perfect time to streamline accountant collaboration.

7. Maintain Organized Receipt and Document Systems

A shoebox overflowing with faded receipts is the classic cliché of small business chaos for a reason. Failing to maintain organized receipt and document systems is a direct path to stress, missed deductions, and audit-related panic. This practice involves the systematic collection, categorization, and storage of all crucial financial documents, including receipts, vendor invoices, bank statements, and contracts, in both physical and digital formats. It ensures every piece of financial data is accounted for and easily retrievable.

This system can be as simple or complex as your business requires. A freelance consultant might use a mobile app like Expensify to instantly scan and categorize receipts for business meals. In contrast, a construction contractor would maintain detailed digital and physical folders for each project, containing all supplier invoices, material receipts, and client payment records to ensure accurate job costing.

Why This Practice is Non-Negotiable

Organized documentation is the backbone of sound financial management and a critical component of any list of small business accounting tips. It provides the irrefutable proof needed to claim business expenses and maximize tax deductions. In the event of an IRS audit, having a well-organized system allows you to produce requested documents quickly, demonstrating compliance and professionalism. Beyond taxes, it offers a clear historical record for business analysis, budgeting, and forecasting.

Actionable Steps for Implementation

- Implement a 'Touch It Once' Rule: Process every receipt and invoice immediately upon receiving it. Scan it, categorize it in your software, and file the physical copy if needed. This prevents a daunting backlog from ever forming.

- Establish a Consistent Naming Convention: For all digital files, use a clear and uniform naming system. A great format is

YYYY-MM-DD_VendorName_Amount, which makes searching and sorting effortless. - Go Digital and Create Backups: Digitize physical documents whenever possible using a scanner or a receipt-scanning app. Store these digital files on a primary cloud service and create a secondary backup on another platform to protect against data loss.

- Schedule Monthly Reviews: Dedicate a short block of time each month to review your filing system. Ensure everything is in its proper place, follow up on any missing documents, and tidy up your digital and physical folders.

8. Plan for Quarterly Tax Payments

Forgetting that the IRS expects its cut throughout the year, not just in April, is a common and costly mistake for new business owners. Planning for quarterly tax payments involves strategically calculating and paying your estimated income and self-employment taxes four times a year. This proactive approach prevents a massive, unexpected tax bill and the steep penalties that come with underpayment.

This isn't just a best practice; for most sole proprietors, partners, and S-corp shareholders who expect to owe at least $1,000 in tax for the year, it's a requirement. A freelance writer might automate a 30% transfer from every client payment into a separate tax savings account. Similarly, a growing startup should work with an accountant to project its tax liability on increasing revenue and budget for these essential payments.

Why This Practice is Non-Negotiable

Failing to pay estimated taxes on time leads to underpayment penalties, which are essentially interest charges on the amount you should have paid. Beyond avoiding penalties, this discipline is a cornerstone of healthy cash flow management. By setting aside tax funds as you earn income, you ensure the money is there when the deadline arrives, preventing a cash crunch that could otherwise disrupt operations, halt growth, or force you to dip into personal funds.

Actionable Steps for Implementation

- Set Aside Funds Immediately: Create a business rule to transfer 25-30% of all gross income into a dedicated high-yield savings account for taxes. Do this weekly or bi-weekly so it becomes a non-negotiable habit.

- Calculate Your Payments: Use IRS Form 1040-ES, Estimated Tax for Individuals, to calculate what you owe. The worksheet helps you project your annual income and determine your required quarterly payment.

- Pay on Time: Mark the four key deadlines on your calendar: April 15, June 15, September 15, and January 15 of the following year. Make payments easily online through IRS Direct Pay or the Electronic Federal Tax Payment System (EFTPS).

- Review and Adjust: Your income can fluctuate. Review your earnings and tax savings at the end of each quarter. If you have a much better or worse quarter than expected, adjust your next payment accordingly to avoid over or underpaying. This kind of tax planning is crucial, whether you operate in the US or abroad. You can learn more about how complex tax situations can become from this freelancer’s VAT nightmare in the Netherlands.

Small Business Accounting Tips Comparison

| Practice | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases | Key Advantages ⭐ / 💡 |

|---|---|---|---|---|---|

| Separate Business and Personal Finances | Low to Medium 🔄 | Low ⚡ | Clear financial boundaries; simplified taxes; asset protection 📊 | Small to medium businesses, freelancers | Legal liability protection ⭐; simplified record-keeping 💡 |

| Implement Regular Bookkeeping Schedules | Medium 🔄 | Moderate ⚡ | Up-to-date financial info; reduced errors; better cash flow 📊 | All businesses wanting timely records | Prevents year-end backlog ⭐; real-time decisions 💡 |

| Track Cash Flow Meticulously | Medium to High 🔄 | Moderate ⚡ | Avoid cash shortages; improved payment timing; strategic growth 📊 | Seasonal or cash-sensitive businesses | Cash availability clarity ⭐; vendor relationship benefits 💡 |

| Maximize Tax Deduction Tracking | Medium 🔄 | Moderate | Reduced tax liability; detailed expense analysis 📊 | Tax-conscious small businesses | Significant tax savings ⭐; audit preparedness 💡 |

| Use Cloud-Based Accounting Software | Medium 🔄 | Moderate to High ⚡ | Automated bookkeeping; anywhere access; collaboration 📊 | Tech-savvy businesses; remote teams | Automation and integration ⭐; real-time reporting 💡 |

| Conduct Monthly Financial Reviews | Medium 🔄 | Moderate | Early problem detection; data-driven decisions; budgeting 📊 | Businesses focused on growth and control | Financial insight ⭐; improved planning 💡 |

| Maintain Organized Receipt and Document Systems | Medium 🔄 | Moderate | Audit readiness; simplified tracking; tax support 📊 | All businesses needing compliance | Easy tax deduction claims ⭐; document retrieval 💡 |

| Plan for Quarterly Tax Payments | Medium 🔄 | Low to Moderate ⚡ | Avoid penalties; smoother cash flow; less tax season stress 📊 | Freelancers, seasonal, variable income | Penalty avoidance ⭐; improved cash management 💡 |

From Accounting Chaos to Financial Clarity

Navigating the financial landscape of a small business can often feel like an overwhelming task, fraught with complex numbers and endless paperwork. However, as we've explored, achieving financial clarity is not about becoming a certified accountant overnight. Instead, it's about adopting a series of consistent, strategic habits that transform your financial management from a source of stress into a powerful engine for growth.

The eight fundamental small business accounting tips covered in this guide are your building blocks. From the non-negotiable first step of separating business and personal finances to the disciplined practice of monthly financial reviews, each tip contributes to a stronger, more resilient business. By meticulously tracking cash flow, proactively planning for quarterly taxes, and maintaining organized records, you eliminate guesswork and replace it with data-driven confidence.

Key Takeaways for Lasting Financial Health

Think of these principles not as a checklist to be completed once, but as an ongoing operational framework. The true value emerges when these actions become second nature.

- Consistency is Your Superpower: The most impactful change comes from routine. A weekly bookkeeping schedule, a monthly financial review, and consistent receipt organization prevent small issues from snowballing into major crises.

- Proactivity Beats Reactivity: Don't wait for tax season to understand your finances. By tracking deductions year-round and planning for tax payments, you stay in control, avoiding costly surprises and penalties. This proactive stance is a hallmark of successful business owners.

- Technology is Your Ally: Manual data entry and disorganized spreadsheets are relics of the past. Modern cloud-based accounting software is no longer a luxury but a necessity for efficiency, accuracy, and security.

Your Actionable Path Forward

Mastering your small business accounting is a journey, and the first step is always the most important. Begin by choosing one or two tips from this article that address your biggest pain point. Is it disorganized receipts? Set up a digital filing system this week. Are you unsure about your profitability? Schedule your first monthly financial review on your calendar right now.

The ultimate goal is to move beyond simply recording transactions and start using your financial data as a strategic tool. When you understand your numbers, you can identify your most profitable services, cut unnecessary costs, and make smarter investments in your company's future. This transition from reactive bookkeeping to proactive financial strategy is what separates businesses that survive from those that thrive. By implementing these essential small business accounting tips, you are not just tidying up your books; you are building a durable foundation for sustainable success and long-term peace of mind.

Ready to automate one of the most time-consuming parts of your accounting? Invowl automatically extracts data from all your invoices, syncs with your accounting software, and helps you find savings, turning your inbox into a command center for financial efficiency. See how much time you can save by visiting Invowl today.