Picture this: your company's purchasing process is like a chaotic kitchen. Paper orders are lost, invoices don't match up with what was delivered, and payments to suppliers are constantly late. It’s a mess.

Now, imagine a modern, organized restaurant where digital orders zip straight from the customer to the kitchen, inventory is tracked in real-time, and payments happen automatically. This is the kind of transformation we're talking about with procure to pay automation.

From Messy Paperwork to Strategic Control

At its heart, procure to pay (or P2P) automation isn’t just about swapping paper for PDFs. It’s a complete rethinking of how your business buys everything it needs.

It connects every single step—from an employee first requesting a new software license to the final payment clearing the supplier's bank account—into one smart, seamless system. This eliminates the daily friction of manual work and gives you a crystal-clear, live view of your entire purchasing cycle. Suddenly, your financial decisions are driven by hard data, not just guesswork.

Why Is This Shift Happening Now?

It's simple: businesses are hitting a wall with their old, disjointed methods. Manual procurement is painfully slow, riddled with expensive human errors, and offers zero real-time visibility into where company money is actually going. These aren't just minor annoyances; they directly hurt the bottom line and stifle growth.

This is why the market is exploding. The global procure to pay solution market, currently valued around USD 8.02 billion, is on track to hit USD 14.07 billion by 2033. Companies are racing to boost their efficiency and get a tighter grip on their spending. You can dive deeper into these numbers in a detailed P2P market analysis from Grand View Research.

Manual P2P vs. Automated P2P: A Quick Comparison

To really see the difference, it helps to put the old way and the new way side-by-side. The table below breaks down how automation completely changes the game at each stage of the procurement process.

| Process Stage | Manual Approach (The Problem) | Automated Approach (The Solution) |

|---|---|---|

| Requisition & Approval | Slow, paper-based or email chains with no tracking. | Digital forms with pre-set approval workflows for instant routing. |

| Purchase Order (PO) | Manual PO creation, often leading to errors and delays. | Automatic PO generation from approved requisitions. |

| Invoice Processing | Manual data entry from invoices; high risk of errors. | AI-powered data extraction and validation; no manual entry. |

| Matching & Payment | Time-consuming manual three-way matching; late payments. | Automated matching and scheduled, on-time digital payments. |

| Visibility & Reporting | Limited to no real-time view of spending; difficult reporting. | Centralized dashboard with real-time spend analytics and insights. |

By connecting all these dots, procure to pay automation creates a single, cohesive system. Information flows freely, compliance rules are automatically enforced, and your finance team is finally free to focus on high-value work like analyzing budgets and negotiating better deals with suppliers—instead of just chasing paperwork.

Exploring the Engine of P2P Automation

To really get what procure-to-pay automation does, you have to look under the hood. A modern P2P system isn't just one piece of software. It's a powerful engine with connected parts, each built to handle a specific stage of the buying journey. Think of it as a financial assembly line for your company.

It all starts where every purchase begins—with your team needing something.

E-Procurement and Digital Requisitions

The front door to most automated P2P cycles is an e-procurement platform. This is basically a private, Amazon-style marketplace just for your employees. Instead of firing off chaotic emails or, even worse, filling out paper forms, your team can browse pre-approved catalogs from suppliers you already trust.

They find what they need—whether it's software subscriptions, office chairs, or marketing services—and the system instantly creates a digital requisition. This request is then automatically sent through a pre-set approval chain, landing in the right manager's inbox without anyone having to chase them down.

A great e-procurement portal does more than just make ordering easy. It bakes your company's spending rules into the very first click, guiding employees toward compliant, on-budget choices and stopping "maverick spend" before it ever gets started.

This first step takes a messy, disorganized process and turns it into something structured, controlled, and completely trackable. As soon as a request gets the green light, the system automatically kicks off the next stage.

Automated Purchase Order Management

With an approved requisition ready to go, the system generates a professional and accurate purchase order (PO). This simple step wipes out the risk of manual data entry mistakes—like wrong prices or quantities—that so often mess up the purchasing process.

The system then sends the digital PO straight to the supplier. But it doesn't stop there. It also acts as the central command center for tracking that order’s status. You get real-time updates on when items are expected or if there are any hiccups along the way. This creates a crystal-clear, auditable paper trail for every single purchase.

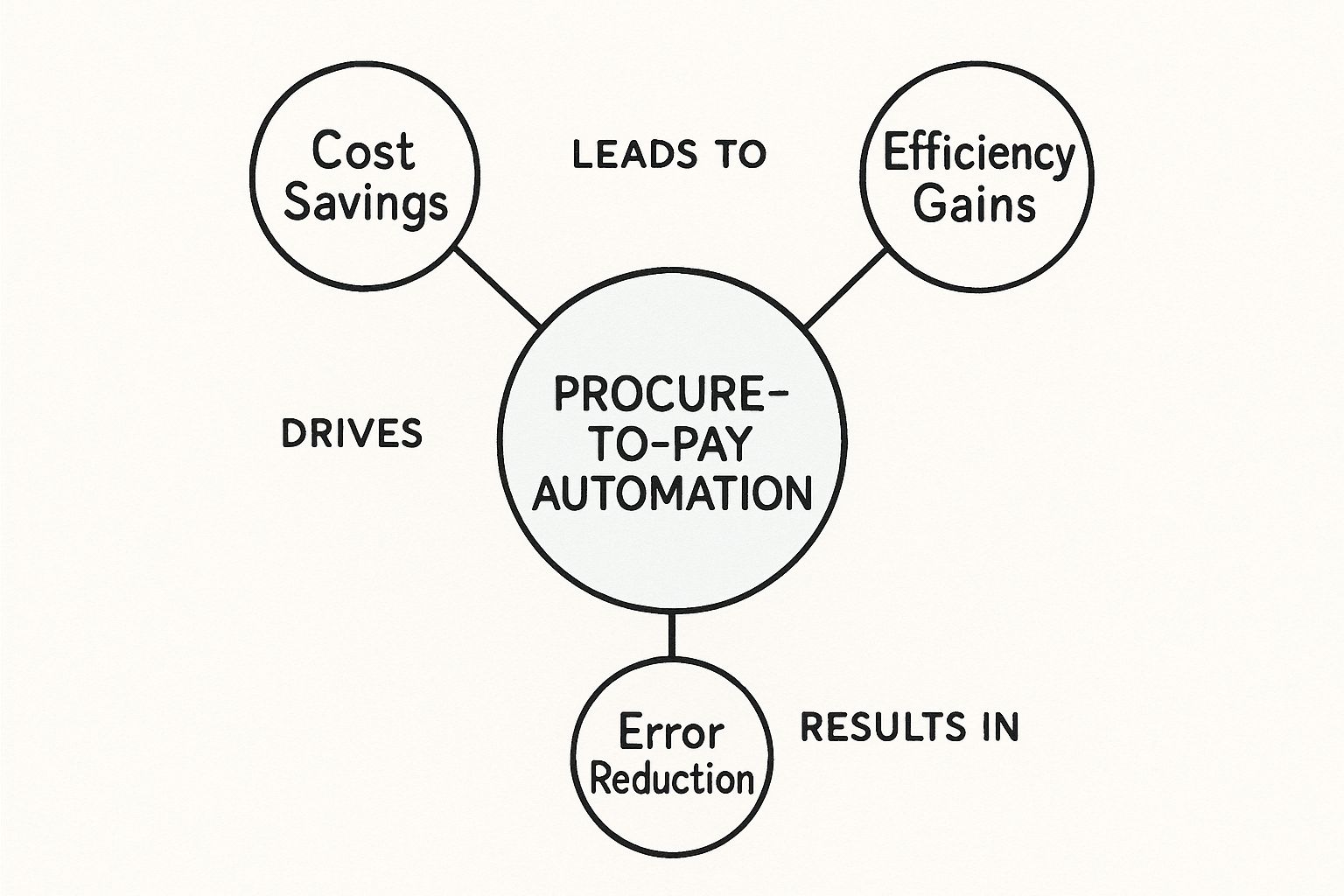

The infographic below shows how these automated pieces work together to drive real business results.

This visual highlights how the core P2P automation engine boosts the bottom line by improving cost control, efficiency, and accuracy.

Intelligent Invoice Processing and Matching

This is where the technology really gets impressive. When a supplier's invoice arrives, the system captures it—often by pulling it directly from an email inbox. Using Optical Character Recognition (OCR) and Artificial Intelligence (AI), the software literally reads the document.

It intelligently pulls out all the critical information, such as:

- Supplier name

- Invoice number and date

- Line-item details

- Total amount due

This data is digitized without a human ever having to type a single character. But the real magic is the automated three-way matching. The system instantly checks the invoice details against the original PO and the goods receipt note (which confirms the items were delivered). If everything lines up, the invoice is approved for payment. If there's a problem—a price mismatch or a short shipment—the system flags it for a human to review.

Integrated and Timely Payments

The final gear in the engine is the payment module. Once an invoice is verified and approved, it’s moved into the payment queue right inside the system. These modules connect directly with accounting software like QuickBooks or Xero, and even with your company's banking systems.

Payments can be scheduled to go out automatically, making it easy to grab early payment discounts—a surprisingly powerful way to save money. This also guarantees your suppliers are paid on time and accurately, which is absolutely essential for building strong, lasting partnerships. Each of these parts works in harmony, creating one seamless flow that gives you total control and visibility from request to payment.

The Real-World Payoff: What P2P Automation Actually Does for Your Business

Let's move past the technical jargon for a minute. Why are so many businesses getting on board with procure-to-pay automation? The real magic isn’t in the software itself, but in the powerful, tangible results it delivers across the entire company.

Think of it as a strategic upgrade that pays for itself over and over, impacting everyone from the finance team to the people managing supplier relationships.

The most immediate win you'll notice is a significant drop in costs. And I’m not just talking about saving a few bucks on manual data entry. Automation gets to the root of those sneaky, hidden costs that quietly bleed a company's budget dry.

For instance, automated three-way matching catches overpayments and duplicate invoices before they ever get paid. On top of that, by streamlining invoice approvals and payments, you can consistently snag early payment discounts. Suddenly, your accounts payable department isn't just a cost center—it's actively saving you money.

Boost Your Speed and Efficiency

Let's be honest: manual procurement is slow. It’s a traffic jam of paper approvals, lost invoices, and never-ending email chains. Procure-to-pay automation is like building a high-speed rail line through that traffic.

Requisitions get routed instantly, purchase orders are created automatically, and invoices get processed in minutes, not weeks. This massive speed boost directly translates into a more efficient, agile business.

Here’s what that looks like in practice:

- Drastically Faster Cycles: The time from someone needing something to the final payment being sent can shrink by over 50%. Your business can just move faster.

- Less Tedious Work: Your team is freed from the soul-crushing admin tasks. They can now focus on more valuable work, like analyzing financial data or negotiating better deals with vendors.

- Fewer Human Errors: Automation gets rid of the typos and mistakes that creep in with manual data entry, meaning your financial data is finally reliable.

A well-built P2P automation system does more than just make things faster. It creates a predictable, transparent workflow you can count on. That stability empowers better financial planning and builds rock-solid trust with suppliers, who know they'll be paid on time, every single time.

Get Total Visibility and Control Over Spending

One of the biggest headaches of a manual system is the black hole of spending. It's nearly impossible to know who is spending what, and with which suppliers, in real-time. This is where procure-to-pay automation truly shines.

It pulls all your purchasing data into a single, easy-to-use dashboard, creating one source of truth for all company spending. Finance leaders can see spending patterns instantly, track budgets in real-time, and spot opportunities to save money. This control is absolutely critical for enforcing your company's purchasing policies and stopping "maverick spend" in its tracks.

As companies grow, sticking with manual processes becomes not just inefficient, but risky. It's surprising that only about a third of companies use automation for procurement (33%) and accounts payable (35%). Yet, the ones that fully embrace AP automation report 33% fewer duplicate or incorrect payments. The link between automation and financial control couldn't be clearer.

This leap in accuracy is a massive benefit when you automate invoice management to save time, ensuring your financial records are always spot-on.

Your Roadmap to a Successful P2P Automation Rollout

Making the switch to an automated procure-to-pay system can feel like a massive project, but it doesn’t have to be a headache. The secret is having a clear plan. Don't think of it as one giant leap; see it as a series of smart, manageable steps toward a more controlled and efficient financial future.

It all starts with taking an honest look at how you do things right now. Before you even glance at a software demo, you need to understand your current workflow from the inside out.

Start With a Brutally Honest Process Assessment

Your first move is to map out your entire procurement process, from the moment someone needs something to the final payment confirmation. Don't just rely on what you think happens. Actually follow a few purchase orders on their journey.

This is your diagnostic phase. It’s where you’ll uncover the real bottlenecks that are secretly draining your time and money. Are approval requests dying in a manager's inbox? Is your finance team burning hours manually punching in invoice data? These are the exact pain points that automation is built to fix. Nailing them down gives your project a clear direction.

Define What "Success" Actually Looks Like

Once you know what's broken, you can decide what a fix will look like. Simply saying you want to be "more efficient" is not a goal—it's a wish. You need concrete, measurable objectives, often called Key Performance Indicators (KPIs), to prove that this investment is actually working.

A successful rollout isn't just about plugging in new software. It’s about hitting specific business targets. Your KPIs are the scoreboard that proves you're winning the game.

Get specific with your targets. Aim for goals like:

- Slash invoice processing time by 75%, taking it from two weeks down to just three days.

- Cut down on invoice errors and mismatches by 90% within the first six months.

- Capture early payment discounts on at least 80% of invoices that offer them.

- Achieve 100% spend visibility by funneling all company purchases through the new system.

These aren't just numbers; they’re your North Star. They guide every decision you make and give you a powerful story to tell leadership when they ask for the ROI.

Choose the Right Software Partner, Not Just a Vendor

With clear objectives in hand, you can finally start shopping for the right technology. The market is crowded, so it’s easy to get distracted by flashy features you’ll never use. Instead, stay laser-focused on finding a partner whose tool directly solves the problems you identified in your assessment.

Ask the tough questions. Does the software play nicely with the accounting system you already use? Can it grow with you, or will you need to replace it in two years? A great partner will feel more like an extension of your team, providing real support and guidance. Effective collaboration is everything, and the right tools make it possible. For example, setting up clear communication channels for your finance team is crucial, which is why it's so important to streamline accountant collaboration with better systems in place.

Don't Forget the People: Change Management and Training

The human element is the most common point of failure for any new technology project. You could have the world's greatest software, but if your team doesn't get it, doesn't like it, or actively resists it, the entire initiative is doomed.

Secure stakeholder buy-in from the very beginning by explaining the "why" behind the change. Show them how this new system will eliminate their most tedious tasks and make their jobs better, not make their jobs disappear. Comprehensive training is completely non-negotiable. Plan for hands-on sessions for everyone, from the employees making purchase requests to the finance pros who will manage the payments.

Roll It Out in Phases, Not All at Once

Finally, fight the urge to flip the switch for the whole company at once. A "big bang" implementation is incredibly risky and can bring your operations to a grinding halt if something goes wrong.

A much smarter—and safer—approach is a phased rollout. Start small. Pick one department or even just one specific category of purchase. This creates a controlled environment where you can test the system, iron out the kinks, and gather valuable feedback from real users. Once that pilot is a success, you can use that momentum to expand the system across the rest of the organization, ensuring a smooth and successful journey to a fully automated P2P process.

How New Technology Is Shaping P2P's Future

The world of procure to pay automation is evolving way beyond just digital invoices and simple approval workflows. We're seeing a new wave of technology that’s making procurement smarter, more predictive, and a genuine strategic partner to the business. These tools aren't just making old processes faster; they're creating entirely new ways for finance and procurement teams to add value.

Think of it this way: today's standard automation is like a well-oiled assembly line—it's fast and consistent. The future is a self-improving, intelligent factory that actually anticipates what you need and flags problems before they happen.

The Rise of AI and Machine Learning

Leading this charge are Artificial Intelligence (AI) and Machine Learning (ML). These aren't just buzzwords; they're giving P2P systems the power to think and learn from your company's own data. Instead of just blindly following preset rules, an AI-powered system can sift through years of spending to spot patterns, make recommendations, and predict what's next.

This unlocks some seriously powerful functions:

- Predictive Analytics: AI can look at past trends to forecast future demand for parts or services, helping you sidestep stockouts or avoid tying up cash in things you don't need yet. It can even predict which invoices are most likely to have issues, letting your team get ahead of them.

- Anomalous Spending Alerts: Machine learning is brilliant at spotting weird purchases that might indicate fraud or non-compliant "maverick spending." It could, for instance, flag an unusually large order from a brand-new supplier or a sudden price hike on a routine purchase that would otherwise go unnoticed.

- Intelligent Supplier Recommendations: By analyzing real-world supplier performance—like on-time delivery rates, invoice accuracy, and quality—AI can recommend the best vendor for a specific purchase, perfectly balancing cost with reliability.

AI transforms procure to pay automation from a reactive tool that just processes transactions into a proactive partner that offers strategic advice. It's the difference between a system that asks, "What did we buy?" and one that asks, "What should we buy next, and from whom?"

RPA Is Taking Over the Grunt Work

Robotic Process Automation (RPA) is another game-changer. RPA "bots" are basically software programs you can teach to perform high-volume, repetitive digital tasks with perfect accuracy. Think of them as a dedicated digital workforce that handles your most mind-numbing chores, 24/7.

In a P2P process, RPA bots are perfect for things like:

- Pulling data from standard invoices and keying it into your accounting system.

- Automating the new supplier onboarding process by chasing down and verifying their information.

- Generating routine weekly reports and sending status updates via email.

This isn't some far-off concept; the technology is already delivering massive productivity gains. Some organizations have seen a 40% reduction in manual workloads by automating core tasks like creating purchase orders and matching invoices. This frees up your sharpest team members to focus on high-value work like complex negotiations and strategic supplier relationships. You can dive deeper into these industry-shaping trends in a detailed procurement report from Esker.

Blockchain and Building Real Supply Chain Trust

Looking even further down the road, blockchain technology holds the promise of bringing radical transparency and security to the entire P2P cycle. A blockchain is a shared, unchangeable digital ledger. In a procurement world, it could create a single, trusted record of every single transaction that all parties—the buyer, the supplier, and even the shipping company—can see in real-time.

This could virtually eliminate disputes over invoices and shipments because every step would be permanently recorded and verified on the chain for all to see. While it's still in its early days for procurement, blockchain has the potential to build a whole new foundation of trust and efficiency for complex global supply chains. Together, these advancements are redefining what procure to pay automation can truly accomplish.

Common Questions About P2P Automation

Thinking about moving to procure-to-pay automation? It's natural to have a few questions. This isn't just about getting new software; it’s a fundamental shift in how your company handles its money and supplier relationships. Let's walk through some of the most common things business leaders ask to give you a clearer picture.

The first question is always about the bottom line. What's the real cost, and what kind of return can I actually expect? The price tag can vary a lot, depending on your company's size and how complex your current process is.

But the ROI goes way beyond just saving on labor costs. The real value comes from stamping out expensive mistakes like paying the same invoice twice, finally catching those early payment discounts you’ve been missing, and getting the data you need to negotiate much smarter deals with your suppliers.

How Does It Work with Our Current Systems?

This is a big one. People worry about how a new P2P system will play with the critical software they already rely on, especially their ERP or accounting platform. The good news is that modern procure-to-pay automation tools are built for this exact challenge.

They're designed to connect seamlessly with popular platforms like QuickBooks and Xero, as well as more heavy-duty ERPs. They create a smooth, two-way street for information. Once an invoice gets the green light in the P2P system, the data flows automatically and accurately into your financial records. This completely gets rid of manual data entry, slashes the risk of human error, and keeps your general ledger perfectly in sync. The goal is to make your existing tools more powerful, not rip and replace them.

The real magic of P2P automation is how it centralizes and standardizes all your purchasing data. It creates a single source of truth that feeds your other financial systems, giving you a level of accuracy and control that’s nearly impossible to achieve by hand.

What Is the Impact on Our Staff?

Another frequent question is about the people. Will automation make our procurement and finance teams redundant? The answer is a hard no. What it actually does is change their jobs for the better by wiping the most boring, low-impact tasks off their to-do lists.

Instead of spending all day chasing down approvals or mind-numbingly keying in invoice details, your team is suddenly free to focus on work that really matters. Think about it:

- Analyzing spending patterns to uncover new savings.

- Building stronger, more strategic relationships with key suppliers.

- Tackling the tricky exceptions and resolving complex payment problems.

Automation empowers your people to be strategic partners to the business, not just transaction processors. For more ideas on improving financial workflows, you can explore the various topics on our Invowl blog.

So, how long does all this take? A typical rollout can range from a few weeks to several months, depending on the scope. We often see the most success with a phased approach, maybe starting with a single department. This lets you rack up some early wins and fine-tune the process before expanding it across the whole company, ensuring a much smoother journey for everyone.

Are you tired of manually chasing and processing invoices? Invowl is an AI tool that connects to your inbox, finds every invoice, and extracts all the key data automatically. Stop overpaying and reclaim hours of your work week. Get started with Invowl and turn your invoice chaos into financial clarity.