Let's be honest, manual invoice processing is a relic. It’s the slow, frustrating, and mistake-prone system that has finance teams buried under piles of paper or drowning in disorganized inboxes. Invoice processing automation is the answer.

Think of it as hiring a hyper-efficient digital clerk who works 24/7. This clerk never misses an email, never makes a typo during data entry, and never takes a vacation. That’s the core idea here. It’s a fundamental shift away from the chaotic, manual world of accounts payable and into a smart, streamlined system.

From Piles of Paper to Perfect Payments

We all know the old way. Invoices trickle in through mail and email, creating messy piles on desks and getting lost in the shuffle of a crowded inbox. Someone from your team then has to sit there and manually punch every single detail into your accounting system—vendor name, invoice number, date, every line item, the total amount. It’s not just tedious; it's a recipe for costly errors.

Invoice processing automation changes the entire game. It's not just about going paperless. It’s about making the entire journey, from the moment an invoice arrives to the moment it's paid, completely intelligent and hands-off.

The Automated Journey of an Invoice

So, what does this actually look like in practice? An automated system takes control of the entire invoice lifecycle with speed and precision, completely overhauling the manual grind. It frees up your finance team from the mind-numbing, repetitive tasks they hate.

Here’s how an invoice typically travels through the system:

- Automatic Receipt: The system acts like a digital net, automatically catching invoices from all your sources—email attachments, scanned paper documents, or supplier portal uploads. No more printing or manually forwarding emails.

- Intelligent Data Extraction: This is where the real magic happens. Using powerful tech like Optical Character Recognition (OCR) and AI, the software reads the invoice and pulls out the key data. It’s smart enough to know what an "invoice number" is, no matter where it’s placed on the document.

- Automated Validation: The system instantly cross-references the extracted data for accuracy. It can perform a "three-way match", comparing the invoice against its purchase order (PO) and the goods receipt note to make sure everything lines up perfectly. No more manual checking.

- Smart Approval Routing: Once validated, the invoice is automatically sent to the right person for approval based on rules you’ve already set (e.g., all invoices over $1,000 go to the department head). Approvers get instant notifications, which means no more chasing people down and no more delays.

- Seamless Payment: After the final sign-off, the approved invoice is queued up for payment right inside your integrated accounting software, like Xero or QuickBooks. The cycle is complete without a single manual touchpoint.

Empowering Finance Teams for Strategic Growth

This end-to-end automation does so much more than just save time. It liberates your highly skilled finance pros from the drudgery of administrative work.

Instead of hunting down approvals or fixing data entry mistakes, they can finally focus on what they were hired to do: high-value activities. This means digging into strategic financial analysis, spotting real cost-saving opportunities, and actively contributing to the company's growth. By handing the grunt work over to a reliable automated system, you empower your team to be a strategic partner, not just a back-office processing center. That’s the true power of invoice processing automation.

The Strategic Benefits of Automating Invoices

Bringing invoice processing automation into your business isn't just a minor tech upgrade—it's a strategic move with benefits that ripple across the entire organization. It’s about transforming your finance team from a reactive group buried in paperwork to a proactive force that drives value.

Think about the hours your team loses to manual data entry, fixing typos, and chasing down approvals. Automation wipes out this tedious labor. A process that once dragged on for days now takes minutes, slashing the cost of every single invoice and freeing up your best people for more important work.

And it’s not just about speed. Manual entry is a recipe for mistakes, leading to wrong payments, duplicate invoices, and painful reconciliation. An automated system, on the other hand, delivers near-perfect accuracy. This builds a foundation of reliable data that strengthens financial reporting and makes audits a breeze.

Manual vs. Automated Invoice Processing: A Head-to-Head Comparison

To truly grasp the difference, let's put the old way and the new way side-by-side. The contrast is stark, highlighting how automation completely overhauls the efficiency and reliability of your accounts payable function.

| Metric | Manual Invoice Processing | Automated Invoice Processing |

|---|---|---|

| Processing Time | Days or weeks | Minutes or hours |

| Cost Per Invoice | High (labor, overhead) | Low (minimal human touch) |

| Error Rate | High (5-10% typical) | Extremely low (<1%) |

| Data Visibility | Delayed, retrospective | Real-time, instant |

| Audit Trail | Paper-based, often incomplete | Digital, complete, unchangeable |

| Scalability | Poor (requires more staff) | Excellent (handles volume easily) |

| Supplier Payments | Often late, inconsistent | On-time, reliable |

The table makes it clear: sticking with manual methods means accepting higher costs, more errors, and slower performance as a fact of life. Automation flips the script entirely.

Unlock Financial Agility and Insight

One of the biggest wins from invoice processing automation is the incredible clarity it gives you over your company's money. When invoices take weeks to process, your view of cash flow is always looking in the rearview mirror.

Automation gives you a real-time pulse on your liabilities and spending. This allows you to forecast cash flow with stunning accuracy, manage working capital smartly, and make decisions based on what’s happening now, not last month. That kind of financial agility is a massive competitive edge.

By speeding up the entire invoice lifecycle, businesses can finally grab those early payment discounts that suppliers offer. Even a 1-2% discount on dozens of invoices adds up to huge annual savings, effectively turning your AP department into a profit center.

Faster processing also means happier suppliers. Paying vendors on time, every time, builds trust and makes you a preferred customer. Good partners are more likely to give you better terms, prioritize your orders, and stick with you for the long haul. You can learn more about how to automate your invoice management to save time and money in our guide.

Strengthen Compliance and Fuel Growth

A solid automated system creates a perfect, unchangeable digital paper trail for every single invoice. Every touchpoint, from the moment it arrives to the final payment, is timestamped and logged. This takes the stress out of audit prep and slashes the compliance risks.

The market is already voting with its feet. The global invoice processing software market, sitting at $33.59 billion in 2024, is expected to explode to $87.95 billion by 2029, according to a recent invoice processing software market report. That’s not a trend; it’s a fundamental shift away from paper and toward smarter digital systems.

This move is about building a more resilient, scalable financial engine. As your business grows, an automated system handles the rising invoice volume without you needing to hire more people. This ensures your back office can actually support your growth instead of holding it back. By turning your AP process into a well-oiled machine, invoice processing automation lets your finance team focus on what truly matters: fueling sustainable growth.

How Automated Invoice Processing Technology Works

The "magic" behind modern invoice processing automation isn't some black box—it's a clever combination of technologies working in perfect sync. To really get why it’s so powerful, we need to pop the hood and see how these pieces turn a chaotic inbox full of PDFs into clean, structured financial data.

Think of it like an intelligent assembly line. Each station has a specific job, and it all starts the moment an invoice lands in your inbox, whether it's a PDF or a scanned image. This is where the first key technology, Optical Character Recognition (OCR), gets to work.

From Reading to Understanding With OCR and AI

At its most basic, OCR acts like a digital transcriber. It scans a document and turns the pictures of letters and numbers into text a computer can read. Older versions of this tech could see "INV-12345" on an invoice, but it had no idea what that meant. It was just a random string of characters.

This is where the real game-changer comes in: Artificial Intelligence (AI). Modern systems fuse OCR with AI to create something much smarter called Intelligent Document Processing (IDP).

IDP doesn't just read the words; it understands them. It knows "Due Date" is a date, "Total Amount" is money, and "Acme Corp" is the vendor—no matter where they appear on the invoice.

This ability to understand context is what makes today's invoice processing automation so ridiculously effective. It can process invoices from hundreds of different suppliers, each with a unique layout, without needing someone to manually create a template for every single one.

The Key Technologies Powering the System

A few core technologies work together to make the whole process feel seamless. Each one plays a vital part in turning a messy document into financial data you can actually use.

- Optical Character Recognition (OCR): This is the foundation. It takes an image of an invoice (like a PDF or JPG) and converts it into raw text that the system can start working with.

- Artificial Intelligence (AI) and Machine Learning (ML): This is the brain. AI algorithms dig through the raw text from OCR to find and pull out key data points. It understands the layout, context, and language. The Machine Learning part means it gets smarter over time, learning from new invoice formats and any corrections you make.

- Robotic Process Automation (RPA): Think of RPA as a pair of digital hands that handle all the repetitive, boring tasks. Once the data is extracted and checked, RPA bots can log into your other software, plug in the data, and kick off the next step, like sending an invoice for approval.

The best invoice processing automation systems today use these technologies to pretty much eliminate manual work. Modern AI-powered OCR can hit accuracy rates in the high 90s, and with other tools like Natural Language Processing (NLP), the software can make sense of all kinds of invoice layouts and vendor-specific lingo. As you work with more suppliers, the system just keeps getting better. You can find out more about these hidden features in modern invoice automation systems.

Creating a Single Source of Truth

The final, and most critical, piece of the puzzle is integration. An automation tool is only truly powerful when it talks directly to your company's financial hub—your accounting software or ERP.

This connection creates a two-way street for information. The automation platform pushes approved invoice data straight into your accounting system. For example, Invowl syncs seamlessly with platforms like Xero and QuickBooks, killing the risk of typos from manual data entry.

But it also pulls data back. The system can automatically check an incoming invoice against a purchase order or delivery receipt that’s already sitting in your ERP. This closes the loop and creates a self-verifying process.

By combining smart data capture with robotic task-handling and deep integration, invoice processing automation builds a single, reliable source of truth for your accounts payable. It locks in accuracy from start to finish, giving you a rock-solid foundation for all your financial reports.

Your Implementation Roadmap for Invoice Automation

Making the switch to invoice processing automation isn’t like flipping a switch. Think of it more like a well-planned project. A solid roadmap is your best friend here, helping you turn what could be a messy overhaul into a series of clear, manageable steps. The real goal is to get from your current, often manual, system to a fully automated one without blowing up your day-to-day financial operations.

This whole journey doesn't start with buying software. It starts with taking a hard, honest look at how you do things right now. You can't fix a problem until you truly understand it.

Phase 1: Assess and Define Your Goals

First things first, you need to map out your current invoice process. I mean every single step. Trace the path an invoice takes from the second it lands in your inbox until it’s paid and filed away. Pinpoint every person who touches it, every handoff, and—most importantly—every bottleneck.

Where do invoices get stuck? How many hours are you losing to manual data entry? What are the most common (and costly) errors you see?

Once you have that map, you can set real, measurable goals. Vague targets like "be more efficient" are useless. You need concrete goals that will guide your decisions and prove the project was a success down the road.

A well-defined goal isn't just a wish—it's a benchmark. For example, instead of "process invoices faster," aim to "reduce the average invoice processing time from 15 days to 3 days" or "cut the cost per invoice by 50% within six months."

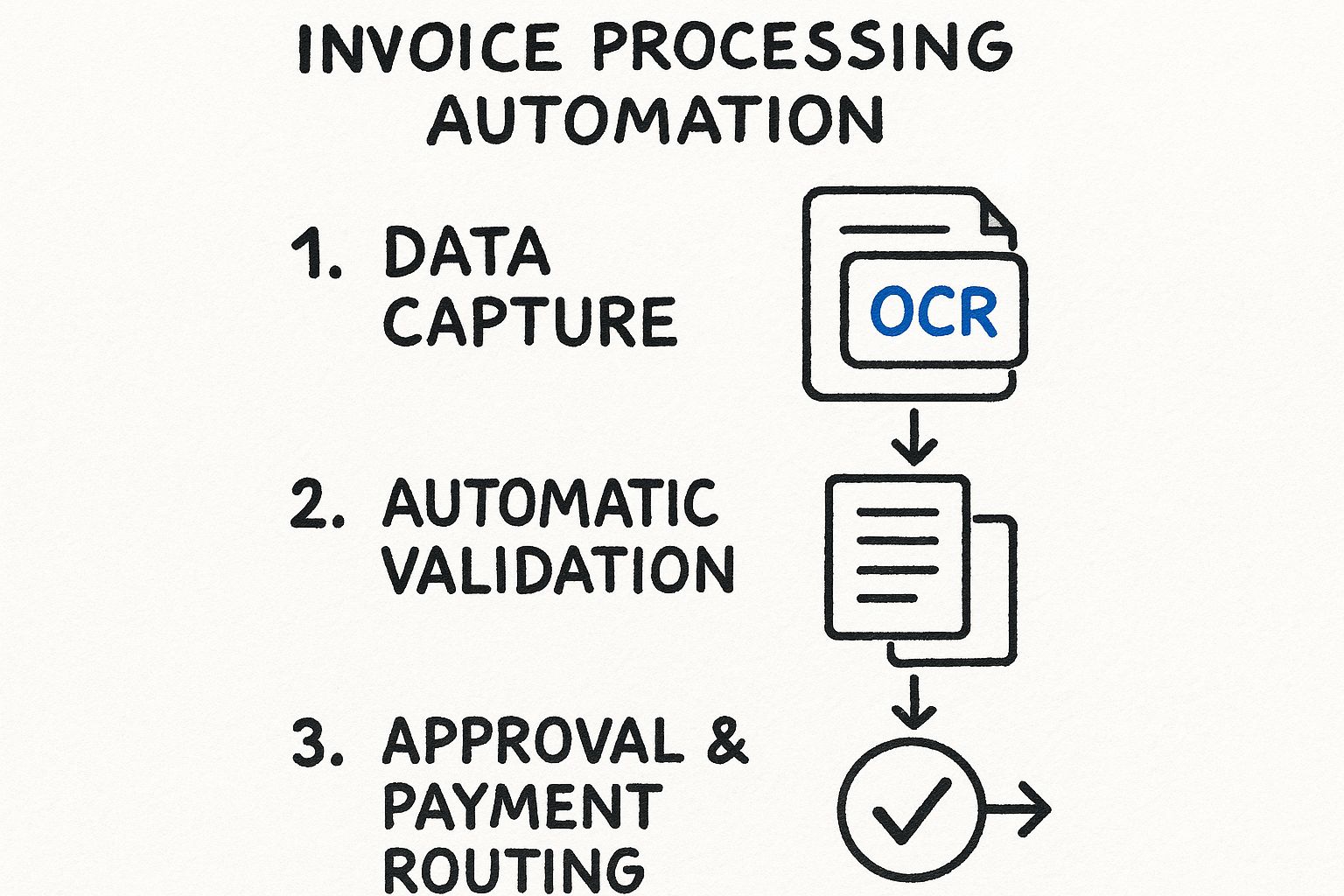

This diagram shows exactly how automation overhauls these core stages.

As you can see, the system captures the data, instantly checks it against your records, and then sends it for approval and payment. Manual work at each step is simply eliminated.

Phase 2: Plan Your Integration and Configuration

With your goals locked in, it's time to get technical. The single most critical piece here is integration. Your new invoice processing automation software has to talk flawlessly with your existing accounting or ERP system, whether that’s Xero, QuickBooks, or something else. A botched integration creates more headaches than it solves, leading to mismatched data and painful reconciliation work.

Sit down with your software vendor and map out exactly how data will flow between the systems. What information needs to go where? Get a clear plan in place. This is also when you'll set up your custom approval rules.

Think through these key questions for your approval workflows:

- Who needs to approve invoices? You can define roles by department, project, or the invoice amount.

- What are the approval thresholds? For instance, maybe all invoices over $5,000 need a director's sign-off.

- What happens if an approver is on vacation? Build rules to automatically escalate or delegate approvals so nothing gets held up.

Getting these rules right from the start is what makes the system work for you, not against you. A well-configured system also makes it much easier to streamline accountant collaboration, as they'll receive clean, pre-approved data ready for their books.

Phase 3: Test, Launch, and Optimize

Whatever you do, don't go live without testing. This is your chance to catch any gremlins before they mess with your actual finances. Start by feeding a batch of real, historical invoices into the new system. This lets you check if the data is being pulled correctly, that your approval rules are working, and that the integration is solid.

Get a small group of the people who will actually use the system every day involved in this testing. Their feedback is gold for spotting confusing steps or awkward features and will make the full rollout much smoother.

Once you’re confident everything is working, it's go-time. A phased rollout—starting with just one department or a handful of suppliers—is usually safer than a "big bang" launch. It lets you manage the change in a controlled way and handle any surprises on a smaller scale.

But your job isn't done after you go live. The final step is to circle back to the goals you set in Phase 1 and see how you're doing. Keep an eye on key metrics like:

- Average invoice processing time

- Cost per invoice

- Error rate

- Percentage of invoices paid on time

Use this data to keep tweaking your workflows and fine-tuning the system. A great implementation isn't a one-and-done event; it's a continuous process of improvement.

Choosing the Right Invoice Automation Software

Picking a platform for invoice processing automation feels less like buying software and more like choosing a long-term business partner. Let's be honest: not all tools are created equal. The right one will blend into your workflow so smoothly you'll forget it's there, while the wrong one will just create a whole new set of headaches.

Your mission is to find a system that doesn't just put out today's fires but also has the muscle to grow with you. That means looking past the slick marketing and digging into the features that actually matter—like how well it reads your invoices, talks to your other software, and scales when you're suddenly handling ten times the volume.

Evaluate the Engine Under the Hood

The heart of any great automation tool is its ability to accurately pull data from invoices. This is where you separate the real players from the pretenders. Don't be shy about asking vendors for their documented accuracy rates, especially for the types of invoices your business uses most, whether they're simple one-pagers or complex beasts with dozens of line items.

Just as critical is how the software plugs into your existing tech setup. A tool that operates in a vacuum is useless; it just creates another island of data you have to manage.

- Integration Power: Does it have ready-to-go, seamless connections to your accounting platform, like Xero or QuickBooks? A deep integration means approved invoice data flows straight into your books without anyone having to type it in again.

- Data Extraction Accuracy: Look for tools that use AI-powered Intelligent Document Processing (IDP), not just old-school OCR. IDP is smarter—it understands context and can handle different invoice layouts without needing constant hand-holding.

- Scalability for Growth: Think about where you'll be in a year. A system that’s fine for 50 invoices a month might choke on 500. Make sure the platform can handle more volume without slowing to a crawl or hitting you with a surprise price hike.

Don't Underestimate the User Experience

A powerful tool that your team hates using is a worthless tool. The user interface has to be clean, intuitive, and simple enough for your finance team (and anyone else who approves invoices) to navigate without a user manual. If approvers find it confusing, they’ll fall back on old habits like email, completely defeating the purpose of automation.

A great user experience isn't a "nice-to-have"—it's a requirement for adoption. The software should make your team's job easier from day one, with almost no training needed.

This is especially true for platforms like Invowl, which was built to connect directly to your inbox and pull invoice data with a single click. The goal is to turn a complicated, multi-step process into a simple, straightforward action. That’s the mark of great design.

Look at the Real Cost and Who's Got Your Back

The monthly subscription fee is just the beginning. To get the real picture, you need to think about the Total Cost of Ownership (TCO). This includes setup fees, training costs, charges for extra users, and the price of support. A low-ball initial price can easily hide expensive add-ons that bite you later.

Vendor support is another factor that's easy to overlook until it's too late. When something goes wrong during a frantic month-end close, you need a support team that actually responds, not a ticket that gathers dust for days. Check reviews and see what real customers say about their service.

The market for these solutions is booming, which is good news for you—plenty of options. Projections show the invoice automation software market is on track to grow from $3.54 billion in 2025 to $8.6 billion by 2032, all thanks to smarter AI. As the field gets more crowded, picking a forward-thinking partner is more important than ever. You can explore more about these market trends and see what’s next for finance tech.

By carefully weighing these factors—the tech, the user experience, and the long-term costs—you can confidently pick the right invoice processing automation software to help your business thrive.

Common Questions About Invoice Automation

Making the leap to invoice processing automation is a big move, and it's totally normal to have questions. You're not just buying software; you're changing a core business process. Getting the practical details straight is key to making a decision you feel good about.

Think of this as your personal FAQ. We'll cut through the jargon and tackle the big questions we hear all the time—from the real costs to how the tech handles your most frustratingly complex invoices.

How Much Does Invoice Processing Automation Typically Cost?

This is usually the first thing people ask, and the honest answer is: it depends. The price tag for an automation solution is tied directly to what you need. Things like your monthly invoice volume, how complex your approval workflows are, and which other systems you need to connect with all play a part.

You'll typically see a few pricing models. Some vendors charge per invoice, others have tiered monthly or annual subscriptions based on how many you process, and large companies often get custom quotes. A small business or freelancer might find a great tool for a few hundred dollars a month, while a bigger operation could be looking at a few thousand.

But don't just look at the sticker price. You have to consider the Total Cost of Ownership (TCO). This includes any one-time setup fees, data migration, team training, and ongoing support.

When you're weighing the cost, stack it up against the return. The savings from slashing manual labor, completely wiping out expensive data entry mistakes, and grabbing early payment discounts often mean the system pays for itself way faster than you'd think.

Can Automation Handle Complex Invoices With Many Line Items?

Absolutely. This is a very common worry, but today’s automation systems are built for exactly this kind of complexity. They use smart AI called Intelligent Document Processing (IDP), which is light-years ahead of the basic text-capture tools of the past. IDP is designed to actually understand and pull data from dozens of line items, even if they're in different places on every supplier's invoice.

This means the system can grab all the tiny details from each line, including:

- Product or service descriptions

- SKU or item codes

- Quantity

- Unit price

- Line total

Once it has the data, the system runs an automated two-way or three-way match, comparing every single line item on the invoice to its matching purchase order (PO) and goods receipt. If it spots a problem—like a price mismatch or a different quantity—it instantly flags the invoice for a human to look at. This gives you total accuracy without anyone having to manually check every single line on every invoice.

How Long Does Implementation Usually Take?

The timeline can be anything from a few weeks to several months—it all depends on how big your project is. For a small business using a standard, cloud-based tool with just a few tweaks, you could be up and running in as little as 2-4 weeks.

On the other hand, if you're a large enterprise with custom workflows, a tricky integration with an old ERP system, and a big team to train, you should probably plan for 3-6 months. The biggest factors are how ready your team is, how responsive the vendor is, how complicated your approval rules are, and how much old data needs to be moved over.

A well-planned project with clear goals and a dedicated person on your team to manage it will always get done faster. For more tips on this, check out the articles on the Invowl blog, where we dive into the practical side of improving financial processes.

Is Invoice Automation Secure?

For any tool that handles your money, security isn't just a feature—it's everything. Any trustworthy invoice processing automation vendor makes it their absolute top priority.

In fact, these systems are often far more secure than handling paper. Paper invoices get lost, seen by the wrong people, or become easy targets for fraud. A solid digital system locks everything down tight.

When you're looking at different options, here are the key security measures you should be asking about:

- SOC 2 Compliance: This is a huge seal of approval. It proves the vendor follows incredibly strict rules for keeping customer data safe.

- Data Encryption: Your information must be encrypted both when it’s being stored (at rest) and when it's being sent (in transit).

- Role-Based Access Controls: This lets you decide exactly who can see and do what, ensuring employees only have access to information they need for their jobs.

- Comprehensive Audit Trails: You need a complete, unchangeable log that tracks every single touchpoint on an invoice, from the moment it arrives to when it's paid. This is essential for both security and compliance.

Don’t be shy. Ask every potential vendor for a detailed breakdown of their security protocols and to show you their compliance certificates. A company that's open and proactive about security is a partner you can trust.

Ready to stop wasting time on manual invoice work and start saving money? Invowl connects to your inbox, extracts all your invoice data in seconds, and provides insights to help you cut costs. Reclaim your time and get a clear view of your finances. Discover how much you can save by visiting https://www.visusly.com today