Think about your accounts payable team. Are they drowning in a sea of paper invoices, endlessly keying in data, and chasing down approvals across different departments? It’s a familiar, frustrating scene for many businesses.

Now, imagine a different reality: a digital command center where invoices arrive, get scanned, verified, and sent for payment automatically. That’s the core promise of invoice process automation—using smart technology to handle vendor invoices with barely any human effort.

What Is Invoice Process Automation Anyway?

Instead of chaotic mailrooms and cluttered desks, you get a clean, digital, and error-free workflow. At its heart, invoice process automation is about swapping tedious manual work for intelligent, automated systems. It’s like hiring a team of hyper-efficient digital assistants who work 24/7 without ever making a typo.

These systems manage the entire life of an invoice, from the moment it hits your inbox to the final payment confirmation. This isn't just about scanning a piece of paper; it's a complete overhaul of your AP operations. The tech is built to read, understand, and act on financial documents just like a person would, only much, much faster and more accurately.

The Core Technology That Makes It Work

Modern invoice automation isn't just one piece of software; it’s a powerful cocktail of technologies working together. These tools create a sophisticated workflow that takes an invoice from receipt to payment with very little human supervision. The key players include:

- Artificial Intelligence (AI) and Machine Learning (ML): Think of these as the "brains" of the system. They learn from every new invoice, getting smarter over time and improving accuracy with each document processed.

- Optical Character Recognition (OCR): This is the "eyes" of the operation. OCR technology scans PDFs, images, and paper documents, turning printed text into digital data the system can actually use.

- Automated Workflows: These are the "hands and feet," routing invoices to the right people for approval based on rules you set. No more invoices getting lost on someone's desk or stuck in an email chain for weeks.

This combination is so effective that today’s platforms can achieve data extraction accuracy above 90%. By intelligently reading and routing invoice data, they slash the need for manual checks and corrections. You can dig deeper into how modern platforms use hidden features to shape the future of finance.

The goal is simple: turn one of the most repetitive, error-prone back-office tasks into a strategic, data-rich asset. By automating the grunt work, you free up your finance team to focus on what actually moves the needle—analysis, strategy, and growing the business.

Manual vs. Automated Invoice Processing

To really get why this is such a big deal, it helps to see the old way and the new way side-by-side. The difference isn't just a small improvement; it's a total transformation of how work gets done.

Here’s a quick comparison showing the stark contrast between traditional invoice handling and a modern automated system.

| Process Step | The Manual Approach | The Automated Approach |

|---|---|---|

| Data Entry | A team member manually types every detail from each invoice into the accounting system. | AI-powered OCR automatically extracts all data in seconds with high accuracy. |

| Validation | Staff must manually check invoices against purchase orders and delivery receipts. | The system performs 3-way matching automatically, flagging any discrepancies. |

| Approval | Invoices are physically carried or emailed around the office, often getting stuck on desks. | Invoices are routed instantly through digital workflows to the right approvers. |

| Archiving | Paid invoices are stored in bulky filing cabinets, making them difficult to find later. | All documents are stored in a secure, searchable digital archive for easy retrieval. |

As you can see, automation doesn't just speed things up—it introduces a level of accuracy, visibility, and control that's simply impossible to achieve with a manual process. It's the difference between navigating with a paper map and using a real-time GPS.

The True Benefits of Automated Invoicing

While it’s good to understand the "how" of invoice process automation, the real magic happens when you see its impact. This isn't just about shuffling documents around faster with new software; it’s a strategic shift that sends positive ripples across your entire company.

The most obvious win is cutting operational costs. Picture your traditional accounts payable process: a slow, expensive assembly line where every invoice needs human hands for sorting, data entry, checking, and filing. Automation shuts that costly line down for good.

It slashes the hours your team spends typing in data and gets rid of the costs for paper, printing, and physical file cabinets. These savings might seem small at first, but they add up fast and go straight to your bottom line.

Speed Up Your Entire Financial Cycle

Slow invoice processing is a classic business bottleneck. Invoices get lost in email chains or sit on someone's desk for weeks, waiting for a signature. This sluggish pace doesn't just slow things down—it can damage vendor relationships and make you miss out on easy savings.

Automation flips the script completely. Invoices get captured, coded, and sent for approval in minutes, not days. This new speed has some powerful knock-on effects:

- Capture Early Payment Discounts: Many suppliers offer a 1-2% discount if you pay them early. When approvals are fast, you can consistently grab these discounts, effectively turning your AP department into a source of profit.

- Build Better Vendor Relationships: Paying suppliers on time, every single time, builds a foundation of trust and goodwill. This can lead to better payment terms, priority service when you need it most, and a more resilient supply chain.

- Get a Clearer View of Cash Flow: With a real-time picture of what you owe, you can forecast your cash flow with much greater accuracy and manage your working capital like a pro.

This is a huge reason why the global Invoice Processing Software market is set to jump from $33.59 billion in 2024 to $40.82 billion in 2025, according to market analysts. Businesses are hungry for these kinds of efficiency gains. You can learn more about the trends driving this invoicing software market expansion.

Free Your Finance Team for High-Impact Work

Here’s a benefit that’s often overlooked: the human one. When your skilled finance team is stuck doing mind-numbing data entry, their real talents are wasted. They become data clerks instead of the financial strategists you hired them to be.

Invoice process automation liberates your team from the tyranny of tedious tasks. It frees up their time and mental energy to focus on what truly matters—financial analysis, strategic planning, budgeting, and finding new opportunities for growth.

This shift from tactical drudgery to strategic work doesn't just drive better business decisions; it boosts job satisfaction and prevents burnout. Instead of chasing paperwork, your team can start analyzing spending patterns, negotiating smarter vendor contracts, and giving you the insights needed to steer the company in the right direction. For a deeper dive, see our guide on how to automate invoice management to save significant time.

Lock Down Security and Nail Compliance

Finally, automation gives your financial security a massive upgrade. Manual processes are full of holes—they’re vulnerable to human error, lost documents, and outright fraud. An automated system builds a transparent, ironclad process from the ground up.

It’s all about control and visibility. Key features include:

- Advanced Fraud Detection: Smart algorithms can spot red flags that a busy human might miss, like duplicate invoice numbers, sketchy vendor details, or payment amounts that just don't look right.

- Ironclad Audit Trails: Every single action, from the moment an invoice arrives to the second it’s paid, is logged with a user and a timestamp. This gives you a complete, unchangeable record for any audit.

- Secure Digital Archives: Invoices are stored in one central, secure place. You’ll never have to worry about a coffee spill ruining a crucial document or a physical file going missing again.

This level of control means you can face any audit with confidence, knowing your records are accurate, complete, and easy to pull up. It turns invoicing from a compliance headache into a secure, well-oiled machine.

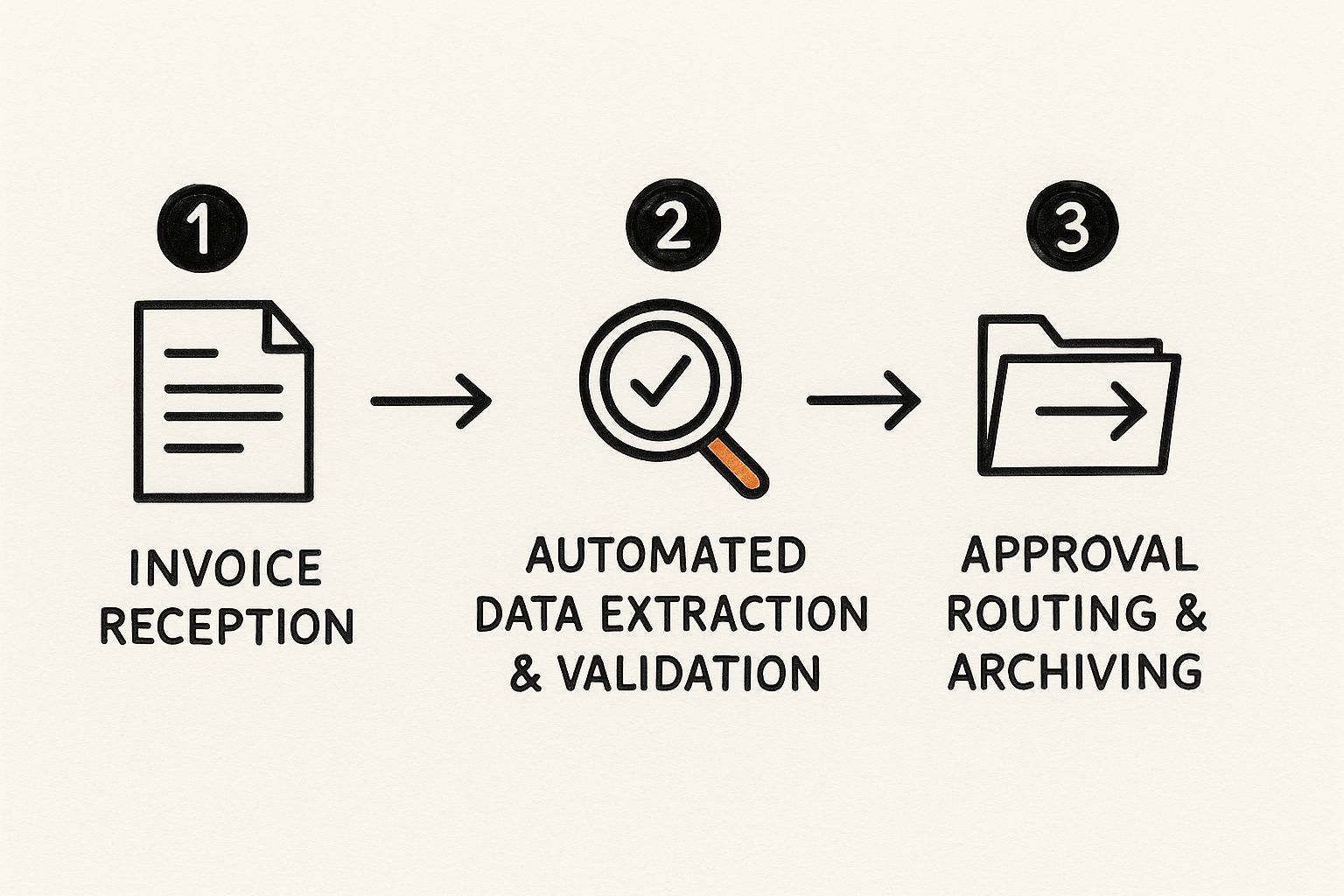

How Modern Invoice Automation Works

To really get why invoice process automation is such a game-changer, you have to look under the hood. It’s not just one piece of software; it's more like a super-efficient digital assembly line. Every invoice that comes in is passed from one specialized station to the next, turning a messy pile of documents into a predictable, orderly flow.

It all starts at what you could call a digital mailroom. This is where every single invoice—whether it’s a PDF in an email, a scanned paper document, or a download from a vendor portal—gets collected into one central spot. No more hunting through inboxes or desk trays. Everything starts its journey from the same place.

AI-Powered Data Capture and Extraction

Once an invoice is in the system, the first job is to actually read it. This is where Optical Character Recognition (OCR) technology comes in, but we're talking about something far more advanced than the OCR of a few years ago. Today's tools use AI-driven OCR that doesn't just see letters and numbers—it understands what they mean.

This intelligent data extraction can:

- Pinpoint key details like the invoice number, due date, vendor name, and total amount, even if they're in a different spot on every single invoice.

- Read and understand every line item, from product codes and quantities to unit prices.

- Teach itself new invoice layouts on the fly. The AI learns from every document it processes, so you don't have to manually create templates for new vendors.

This is a huge leap forward. Older systems demanded rigid, pre-built templates for every vendor format. It was a nightmare to maintain. In contrast, companies like Uber have reported that modern AI models can hit a data extraction accuracy rate of 90% across all sorts of messy and inconsistent invoice formats.

Automated Validation and Three-Way Matching

After pulling out the data, the system puts on its quality control hat. It performs automated three-way matching, a critical check that confirms an invoice is legitimate before it gets anywhere near your payment queue.

The system cross-references three key documents in a split second:

- The Purchase Order (PO): What your team agreed to buy.

- The Goods Receipt Note: Proof of what you actually received.

- The Vendor Invoice: What the vendor is billing you for.

When all three of these documents line up perfectly, the invoice gets a green light and moves on. But if there's a problem—a price mismatch, a wrong quantity, a surprise shipping fee—the system immediately flags it and sends it to the right person to sort out. This one feature alone stops overpayments and catches costly errors that are nearly impossible to spot manually.

The name of the game is "no-touch processing." The ultimate goal is for as many invoices as possible to flow from receipt to payment approval without a single human click, freeing up your team to focus only on the exceptions that need their attention.

Smart Approval Workflows

Okay, the invoice is validated. Now it needs approval for payment. In the old days, this meant tracking people down, sending endless email reminders, and literally walking papers from one desk to another. With automation, this becomes a swift, hands-off process run by smart, customizable approval workflows.

You can build rules based on practically any piece of data from the invoice. For instance:

- Any marketing invoice under $500? Automatically approved. No need to bother anyone.

- An IT invoice over $1,000? Route it straight to the CTO for a sign-off.

- An invoice shows up without a PO number? Send it directly to the procurement manager to investigate.

These rules ensure every bill instantly lands on the right person's virtual desk, with automatic nudges if an approval is taking too long.

Seamless ERP and Accounting Integration

The final stop on this digital assembly line is integration. The platform has to talk perfectly with your company's financial brain—whether that's a big enterprise resource planning (ERP) system or accounting software like QuickBooks or Xero.

This seamless handshake creates a single, reliable source of truth for your financial data. Once an invoice is fully approved, all its validated data is automatically pushed into your general ledger. This completely kills manual data entry. Not only does it save a staggering amount of time, but it guarantees your financial records are always accurate and up-to-the-minute, making reconciliation and reporting a breeze.

Your Step-by-Step Implementation Guide

Making the switch to invoice process automation can feel like a massive undertaking. I get it. But it’s far more manageable when you break it down into a clear, actionable roadmap. Think of it less like a monumental leap and more like a series of deliberate steps, where each one builds on the last. A successful transition is all about careful planning, not just speed.

Let's walk through how to pull off a successful implementation, from taking a hard look at your current mess to getting your team excited about the new way of working. Following these phases helps ensure a smooth rollout that minimizes chaos and starts delivering results from day one.

This is the goal: transforming a tangled, multi-step manual task into a clean, digital workflow.

As the visual shows, you're moving from chaotic manual work to a simple, three-part flow: receiving the invoice, letting the system do the heavy lifting, and archiving it for safekeeping.

Phase 1: Audit Your Current Process

Before you can build a better system, you need to be brutally honest about the one you have now. Start by mapping out your existing accounts payable workflow from the moment an invoice lands to the second it's paid and filed. Don't leave anything out—document every single step, no matter how small or tedious.

- How do invoices even get to you? (Email attachments, snail mail, vendor portals?)

- Who is stuck doing the manual data entry?

- What’s the exact path an invoice takes to get approved? (And who has to chase who?)

- Where are the most common bottlenecks and delays?

This audit will expose the painful truths about where your time and money are slipping through the cracks. It's the foundation for building a rock-solid business case for change.

Phase 2: Define Your Goals and KPIs

With a clear picture of your problems, you can set specific, measurable goals for your automation project. Vague objectives like “be more efficient” won’t cut it. You need concrete targets that will prove the project’s return on investment (ROI) and justify the effort.

Good examples of key performance indicators (KPIs) look like this:

- Reduce invoice processing time from an average of 15 days down to 3 days.

- Lower the cost-per-invoice by 50% within six months.

- Eliminate 95% of manual data entry errors in the first quarter.

- Increase the capture rate of early payment discounts to 80%.

These numbers aren't just for show; they give you clear benchmarks to measure success and keep the entire project focused on delivering real, tangible value.

Phase 3: Choose the Right Software Partner

Not all invoice automation tools are created equal. Your goal here isn't just to buy software; it's to find a partner who understands your pain points. Consider platforms like InvOwl, which is built specifically to connect to your email, find every single invoice automatically, and pull out the key data you need with just one click.

When you’re comparing your options, ask the tough questions:

- Ease of Use: Is the interface actually intuitive? Can someone who isn't a tech genius use it without a week of training?

- Integration: Does it play nicely with the accounting software you already use, like Xero or QuickBooks?

- Scalability: Will this tool grow with your business, or will you outgrow it in a year?

- Vendor Support: What kind of help can you expect when you’re setting things up and if you hit a snag later on?

Choosing the right tool is the most critical decision you'll make. A system that fits your team's natural workflow and plugs into your existing tech will get adopted quickly and deliver the biggest wins.

Phase 4: Plan for Data Migration and Training

Once you’ve picked your software, it's time to plan the actual switch. This phase is all about preparing your data and, more importantly, your people. A clean data migration is crucial—work with your new software provider to make sure vendor lists and past invoice data are moved over accurately. Nobody wants to start with a messy database.

At the same time, you need to get your team on board. Effective training is non-negotiable. Don't just show them which buttons to click; explain why this change is happening. Show them how automation will get rid of their most mind-numbing tasks, freeing them up for more valuable (and interesting) work.

Successful training sessions should cover:

- The Big Picture: A quick tour of the new dashboard and its best features.

- The New Workflow: How the automated approval process actually works day-to-day.

- Handling Exceptions: What to do when the system flags an invoice that needs a human eye.

A team that understands and actually wants to use the new system is your secret weapon for a smooth rollout.

Here’s a simple checklist to keep your implementation project on track.

Implementation Phase Checklist

| Phase | Key Action | Success Indicator |

|---|---|---|

| 1. Audit | Map every step of the current AP workflow. | You have a detailed process map identifying all bottlenecks. |

| 2. Goals | Set specific, measurable KPIs for the project. | Goals like "Reduce processing time to 3 days" are defined. |

| 3. Software | Research, demo, and select an automation partner. | You've signed with a vendor that integrates with your stack. |

| 4. Data | Plan and execute the migration of vendor & invoice data. | Historical data is accurately imported into the new system. |

| 5. Training | Conduct hands-on training sessions with the AP team. | The team can confidently process an invoice in the new system. |

| 6. Go-Live | Officially switch to the new automated process. | The first batch of invoices is processed successfully. |

| 7. Review | Monitor KPIs and gather feedback from the team. | You're tracking progress against your initial goals. |

Use this checklist as your guide. Ticking off each box ensures you're not just installing software, but truly transforming your accounts payable function for the better.

Choosing the Right Automation Software

Picking the right software for your invoice process automation is less like shopping and more like hiring a key team member. It's a strategic partnership. Not all platforms are built the same, and the best one for you hinges entirely on your business, your team, and the tools you already use. Get this decision right, and you'll save yourself from major headaches down the road.

Think of it this way: you wouldn’t use a sledgehammer to hang a picture frame. A small business doesn't need a sprawling, complex enterprise system that costs a fortune. Likewise, a fast-growing company needs a tool that can keep up, not one that will buckle under pressure in six months. The goal is to find software that fits your workflow like a glove, not one that forces you to contort your operations to fit its mold.

Core Evaluation Criteria

Before you even start looking at fancy demos, you need a checklist. A little structure now prevents a lot of confusion later, helping you compare different tools fairly and keeping you focused on what actually matters.

Start with these three pillars:

- Scalability: Will this software still work for you in one year? Three years? A tool that’s perfect for a team of two might completely fall apart when your invoice volume triples. You need a platform that can handle more users, more vendors, and more documents without grinding to a halt.

- Integration Capabilities: Your automation tool can't be a silo. It has to talk to your accounting system, whether that's Xero, QuickBooks, or something else. A deep, reliable integration isn't just a "nice-to-have"—it's non-negotiable. It’s what stops you from having to manually copy-paste data and ensures your books are always accurate.

- Vendor Support and Training: What happens when you hit a snag or have a question at 5 PM on a Friday? Solid customer support and easy-to-understand training materials are the hallmarks of a company that’s invested in your success. A good partner makes the whole setup and adoption process feel smooth, not like a chore.

Understanding the Total Cost of Ownership

It’s tempting to just look at the monthly subscription fee, but that's a rookie mistake. That sticker price is only one piece of the puzzle. To really understand the total cost of ownership (TCO), you have to dig deeper into the pricing models and what they truly include.

A cheap platform that requires hours of manual workarounds and constant troubleshooting isn't a bargain—it's a hidden expense. Your goal is to find the best value, which is a blend of price, features, and the time it saves your team.

For example, some tools charge per user, while others charge based on the number of invoices you process. Think about which model fits your business. If you have a lot of people who need to approve invoices but a fairly low volume, a per-invoice model might be a smarter financial choice. Plus, a well-designed platform can radically streamline accountant collaboration, adding even more value that isn't reflected on the price tag.

There's a reason the Invoice Automation Software market is exploding—it's projected to jump from $3.54 billion in 2025 to $8.6 billion by 2032. This incredible growth is happening because businesses are finally demanding smarter, more connected financial tools. You can read more about the growth of the invoice software market to see the trends shaping these products.

Conducting Your Needs Analysis

Okay, before you pull out the company credit card, do one last thing: a thorough needs analysis. This is where you get real with yourself and your team about what you actually need to accomplish.

Sit down and ask these questions:

- What’s our single biggest pain point right now? Is it painfully slow approvals? Mind-numbing data entry mistakes? Or invoices that seem to vanish into thin air?

- What's our average monthly invoice volume? Knowing this number will immediately help you filter out tools that can't handle your workload.

- Who on the team needs access? Think beyond the finance department. Do project managers or department heads need to log in and approve things?

- What are our absolute must-have features? Get specific. Do you need multi-currency support for international vendors? Automatic line-item extraction? Three-way matching for purchase orders?

Answering these questions gives you a concrete scorecard for judging any software you look at. It’s a focused approach that guarantees you’ll pick a solution that solves your real-world problems today and supports your growth tomorrow.

Maximizing Your Automation Investment

Getting your new invoice process automation system live isn't the finish line—it's the starting block. The real win doesn’t come from just flipping a switch. It comes from treating this new tool as a living, breathing part of your business that you can constantly fine-tune.

Going live is just day one. Your goal should be to move beyond the initial setup and into a rhythm of ongoing optimization. This is where you turn a smart purchase into a game-changing investment, squeezing every drop of efficiency out of your new platform.

Standardize and Refine Your Workflows

First things first: create a single, reliable path for all invoices. Work with your vendors and guide them toward using a dedicated email address or a vendor portal for all their submissions. When every document enters the system through the same digital door, you eliminate the chaos of hunting through different inboxes and get cleaner data from the get-go.

Next, look inward at your own processes. Are certain invoices consistently getting stuck in a bottleneck? Maybe an approval threshold is too low, forcing a department head to sign off on tiny, routine expenses.

Think of your automation system like a high-performance engine. It needs regular tune-ups to run at its peak. Small, continuous tweaks to your workflows are what prevent operational drag and keep things moving at top speed.

By digging into the system's own data, you can pinpoint these friction points and make intelligent adjustments. This cycle of review and refinement is what keeps your operation smooth, fast, and genuinely hands-off.

Use Analytics for Smarter Forecasting

Modern automation platforms are goldmines of financial data. Ignoring it is like leaving cash on the table. Your analytics dashboard is your new command center, giving you a level of financial clarity that was simply impossible with spreadsheets and paper files.

Start looking for patterns in your spending and payment cycles. This data gives you a massive advantage:

- Improve Cash Flow Forecasting: With a real-time, up-to-the-minute view of your liabilities, you can predict your cash needs with stunning accuracy. No more guesswork.

- Strengthen Vendor Negotiations: When you can show a vendor your exact payment history and invoice volume, you're in a much stronger position to negotiate better terms or early payment discounts.

- Identify Savings Opportunities: Tools like Invowl can automatically flag potential overpayments and highlight opportunities to cut costs, turning your AP department from a cost center into a strategic asset.

Avoid These Common Pitfalls

Even the best technology can stumble if it's managed poorly. To protect your investment and lock in long-term success, watch out for these classic traps:

- Neglecting Master Data Cleanup: Your automation system is only as smart as the data you feed it. If your vendor list is cluttered with duplicates, old contacts, or incorrect information, you're just automating confusion. Keep your master data pristine.

- Failing to Champion the Change: Don't just "set it and forget it." You have to be the champion for this new way of working. Continuously remind your team and other departments of the benefits. When people understand why you made the change, they're far more likely to embrace it and find new ways to make it even more effective.

By actively managing your system, you guarantee that your investment in invoice automation pays off for years to come, driving real improvements across the entire business.

Common Invoice Automation Questions Answered

Even when you see the clear benefits, jumping into invoice process automation can feel like a big step. It’s natural to have questions. After all, you’re talking about changing a core part of how your business runs, and it’s smart to get all your doubts out of the way before you commit.

We get it. Here, we’ll tackle the most common questions and concerns we hear from business owners, giving you straight-up answers so you can move forward with confidence.

How Long Does This Actually Take to Set Up?

This is probably the number one question we get, and the honest answer is: it depends. If you're a freelancer or a small business with a pretty straightforward process, you could be up and running in just a few weeks. It's surprisingly quick.

For bigger companies with different departments, complex approval chains, or deep integrations with an existing ERP system, the timeline is longer. You’re typically looking at somewhere between two and six months. Any good rollout plan will walk you through a few key phases:

- Discovery: First, we need to understand exactly how you do things now.

- Configuration: This is where we tailor the software to your specific workflows.

- Testing: We kick the tires and make sure everything is working perfectly before you go live.

- Training: We get your team comfortable and confident with the new setup.

Is Invoice Automation Really More Secure?

Yes. And it’s not even close. Manual invoice processing is wide open to all sorts of risks—think lost paper invoices, simple payment mistakes, or even internal fraud. Automation builds a digital fortress around your accounts payable.

Modern platforms provide a level of control and transparency that manual methods simply can't match. They excel at flagging duplicate or potentially fraudulent invoices that can easily slip past a busy human reviewer, drastically reducing financial risk.

You get major security upgrades like role-based permissions, which means you control exactly who sees sensitive financial data. Plus, every single action—from viewing to approving an invoice—is logged in a detailed audit trail. This creates a permanent, unchangeable record that’s ready for any compliance check or internal review. For more deep dives into financial operations, feel free to explore our Invowl blog.

Can These Systems Handle All My Weird Invoice Formats?

Absolutely. This is one of the superpowers of modern automation software. Using advanced Optical Character Recognition (OCR) and a layer of AI, the best platforms can intelligently read and pull data from just about any document you throw at them.

This includes things like:

- The clean, structured PDFs you get from major suppliers.

- Scanned images of old-school paper invoices.

- Invoices that arrive as email attachments.

Many systems are also built to handle multiple languages and can even learn the unique layouts of your most frequent vendors. This flexibility is key to getting high accuracy, no matter how your suppliers decide to send their bills.

Ready to stop wasting time on manual data entry and start finding real savings? Invowl connects to your inbox, extracts all your invoice data automatically, and shows you where you can save money. Reclaim your time and take control of your finances with Invowl today.