Paying a contractor isn't as simple as just cutting a check. To do it right, you need to lay down a solid legal and financial foundation before any work even begins.

This means getting worker classification right and collecting a W-9 upfront—not scrambling for it during tax season. A detailed contract is the final piece of the puzzle, giving you a clear rulebook that prevents headaches down the road.

Setting Up Your Contractor Payment Foundation

Before you even think about payment methods, you have to build this compliant groundwork. I’ve seen too many businesses rush this part and end up tangled in legal and financial messes. The first moves you make aren't about money; they're about paperwork and clear agreements.

Getting these fundamentals in place from the start creates a professional relationship built on transparency. It protects both your business and the freelancer you’re bringing on board, setting crystal-clear expectations, which is the secret to any successful collaboration.

Nail Down Worker Classification

First things first: you have to be absolutely sure the person you're hiring legally qualifies as an independent contractor, not an employee. The IRS has very specific guidelines on this, and it all boils down to how much control you have over their work.

Getting this wrong is a costly mistake. Misclassifying an employee as a contractor can lead to a world of pain, including back taxes, fines, and other penalties.

Ask yourself these questions:

- Behavioral Control: Are you telling them how, when, and where to do the work? If you’re dictating the process, they might lean toward employee status.

- Financial Control: Do you control the business side of their job? Think about things like how they get paid, if you reimburse expenses, or who provides the essential tools.

- Relationship Type: Is there a contract in place? Do you offer benefits like health insurance or paid vacation? These are typically signs of an employer-employee relationship.

Key Takeaway: The responsibility for getting this right is squarely on your shoulders as the hiring business. When in doubt, talk to a legal or tax professional. It's much cheaper than getting it wrong.

Secure a W-9 Before Anything Else

This is non-negotiable. For every U.S.-based contractor, you need a completed and signed Form W-9 in your hands before you pay them a single dollar. This form gives you their legal name, address, and Taxpayer Identification Number (TIN).

Waiting until year-end to collect W-9s is a classic rookie mistake and a recipe for absolute chaos. You need this info to file Form 1099-NEC for any contractor you pay $600 or more in a year. Having it on file from day one turns tax time into a simple administrative task instead of a mad dash.

The best way to handle this is to make it a mandatory part of your contractor https://www.invowl.com/onboarding process. No W-9, no work.

Draft a Rock-Solid Contract

A handshake and a verbal agreement just won't cut it in the business world. A formal, written contract is the single most important document you'll have. It’s the official rulebook for the entire project, eliminating any "he said, she said" arguments later on.

Your agreement needs to spell out the specifics:

- Scope of Work: A very detailed description of the exact services and deliverables. Be specific!

- Project Milestones and Deadlines: Clear checkpoints and due dates to keep everyone on track.

- Payment Terms: The nuts and bolts—how much they’ll be paid, on what schedule (hourly, per-project, etc.), and by what method.

- Termination Clause: The "what if" scenarios. This outlines how either of you can end the contract if things don't work out.

Choosing the Best Payment Method for Contractors

How you pay your contractors is a bigger deal than you might think. It directly impacts your cash flow, their happiness, and frankly, your reputation. There's no single "best" way to do it; the right choice for a solo entrepreneur paying a local freelancer is completely different from a growing agency juggling a dozen remote specialists.

Let's be real: contractors talk. Becoming known as a client who pays on time, without any drama, is worth its weight in gold. A recent survey of freelancers revealed that a staggering 79% have been stiffed on a payment. This makes reliability one of the most powerful tools you have for attracting and keeping top-tier talent. The right payment system makes you the client they want to work with again.

Traditional vs. Digital Payments

The old-school, tried-and-true method is a direct deposit through an Automated Clearing House (ACH) transfer. It’s dependable, secure, and usually very cheap. Most business bank accounts offer this right out of the box, making it a simple go-to for domestic payments.

But the game has changed. Modern platforms like PayPal, Gusto, or Wise bring a lot to the table. They often offer near-instant transfers, seamless currency conversion for your international talent, and extra features that can make your accounting life easier. The trade-off? You'll typically pay higher transaction fees compared to a basic ACH transfer.

Expert Tip: Don't get hypnotized by the percentage fee. Do the actual math. A 2.9% fee on a $5,000 invoice is $145 out of your pocket. Over a year, that adds up fast. A flat-fee ACH might save you a ton of money on larger, recurring payments.

Contractor Payment Method Comparison

Picking the right method means weighing the pros and cons. You need to think about fees, how fast the money moves, and whether the platform can handle your specific needs, like paying someone in a different country or helping with tax forms.

To help you sort through the noise, here’s a quick breakdown of the most common options.

| Payment Method | Typical Fee Structure | Processing Speed | Best For |

|---|---|---|---|

| Direct Deposit (ACH) | Low flat fee (often $0-$5) or free | 2-5 business days | Domestic contractors, recurring payments, and businesses prioritizing low costs. |

| PayPal | 2.99% + fixed fee for commercial transactions | Instant to 1-3 days | Quick one-off payments, international contractors, and those who prefer a familiar platform. |

| Wise (formerly TransferWise) | Low variable fee based on currency | Varies (often same-day) | Businesses working with a global workforce needing fair exchange rates. |

| Gusto | Monthly subscription fee | 2-4 business days | Companies needing an all-in-one solution for payroll, benefits, and contractor payments. |

Ultimately, your choice should fit the rhythm of your business. If you need to move money across borders quickly, a service like Wise might be perfect. If you’re laser-focused on keeping overhead low, sticking with ACH for domestic talent makes a lot of sense.

Setting Clear Payment Terms

Once you've picked your tool, the next critical step is setting clear payment terms. This isn't just about how you pay, but when.

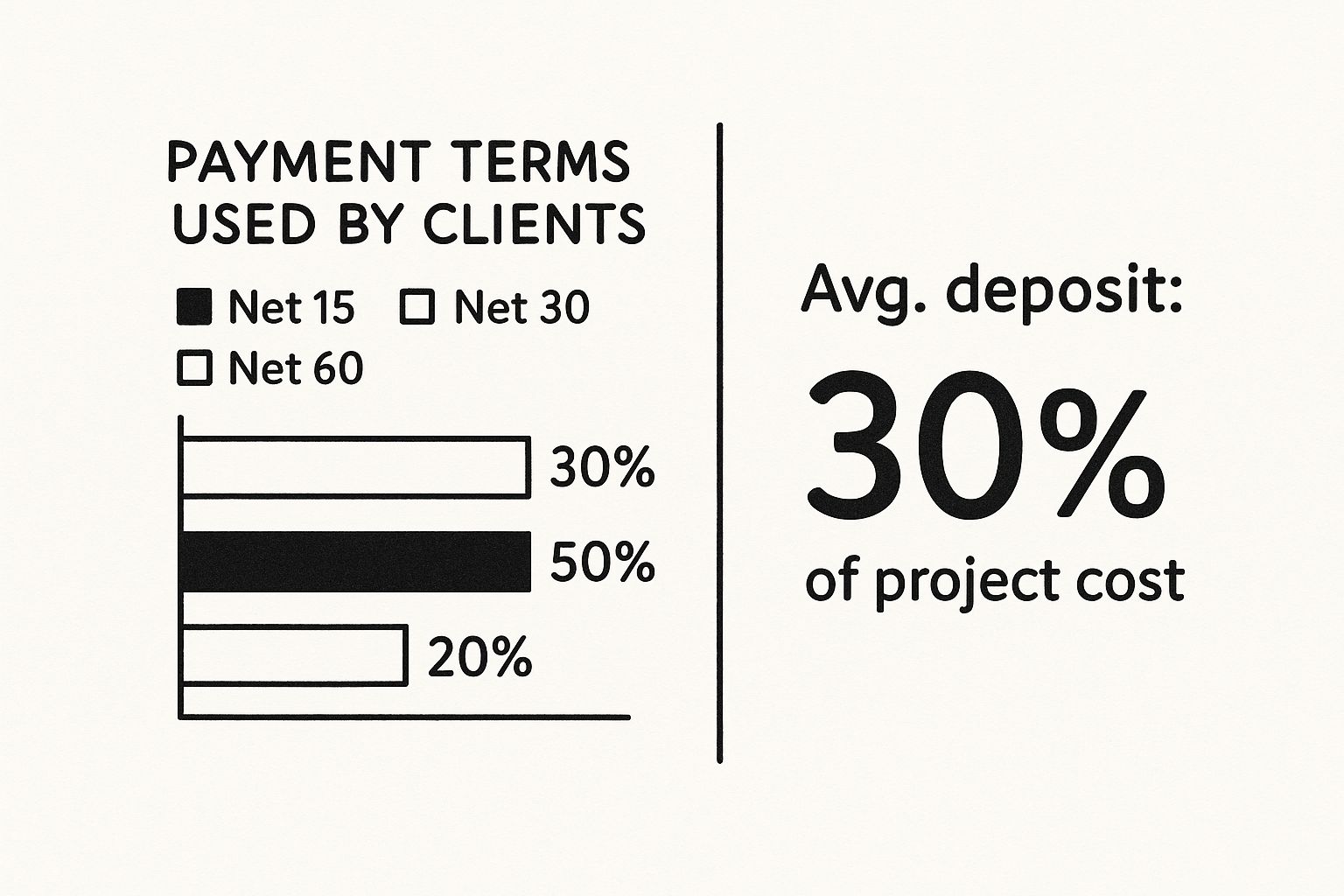

This visual breaks down the most common payment cycles clients use, plus the average deposit requested for new projects.

As you can see, Net 30 is still the king, but faster Net 15 terms are gaining ground. Whatever you choose, spell it out clearly in your contract. It eliminates confusion and ensures your contractor knows exactly when their money will arrive, which is all they really want to know.

Managing International Contractor Payments

Hiring the best talent often means looking beyond your own borders. While tapping into a global contractor pool can be a huge advantage for your business, it throws a wrench into the simple act of paying someone. Suddenly, you're not just sending money—you're dealing with currency conversions, tangled international banking rules, and a minefield of transfer fees.

The goal is to find a payment method that's not only reliable for you but, just as importantly, fair to your contractor. Nothing sours a great working relationship faster than a contractor receiving less than they expected because of hidden fees or a terrible exchange rate. It's about making sure the amount you send is the amount they actually get, or at least very close to it.

Navigating Currencies and Global Platforms

Let's be honest: your standard domestic payment tools just weren't built for this. Sending money across borders is where specialized platforms really shine, taking the headache out of the entire process.

Thankfully, paying international contractors is easier than ever. Platforms have popped up to solve exactly this problem. You have giants like PayPal, which operates in over 160 countries, and Wise (formerly TransferWise), which is a powerhouse for handling more than 40 different currencies at near-real-time rates.

Then you have dedicated global payroll platforms like Deel, which offers over 15 payment options across 150 countries. While these services are incredibly convenient, you have to keep an eye on their transaction and currency conversion fees. You can get more great insights on these global payment options on Remote People.

Fixed vs. Real-Time Exchange Rates

Here’s a detail that trips up a lot of people: the exchange rate. Some payment services let you lock in a rate when you send the money, while others use the "mid-market" or real-time rate. A fixed rate gives you predictability; you know exactly what the payment will cost you in your home currency.

A real-time rate, however, is usually much more transparent. It reflects the true value of the currency at that exact moment and is often a better deal for your contractor.

A Practical Example: Let's say you owe a contractor in the UK £1,000. If you use a service that pads the exchange rate, you could end up paying way more in USD than you should. By using a platform that offers the fair mid-market rate, the conversion is honest, and you both get the best value.

This isn't just about pinching pennies. It’s about showing your international team that you value them and are committed to paying them fairly. When you're transparent about how you handle exchange rates and fees, you build the kind of long-term trust that great partnerships are made of.

Understanding Your Tax and Compliance Duties

Paying contractors isn't just about sending money. If you get the legal and tax side wrong, you can land in hot water with the IRS, facing penalties that create massive headaches later on. Think of this as the non-negotiable foundation of hiring independent talent.

When you get compliance right, you do more than just avoid trouble. You build a reputation as a professional, trustworthy business—the kind that top-tier contractors want to work with again and again. It all boils down to two critical IRS forms and being absolutely meticulous with your records.

The First Step: Get That Form W-9

Before a single dollar leaves your bank account, you need a completed Form W-9 from every U.S.-based contractor you hire. This is non-negotiable.

This form is how you officially collect their legal name, address, business structure, and—most importantly—their Taxpayer Identification Number (TIN).

Trust me, chasing down W-9s in January is a nightmare you want to avoid. Make it a mandatory part of your onboarding. My rule is simple: no signed W-9, no work. That one piece of paper is your golden ticket for accurate tax reporting and proves you're doing things by the book.

What to Do with Form 1099-NEC

The info you collect on the W-9 is used to fill out another crucial document: Form 1099-NEC (Nonemployee Compensation). This is the form you'll send to both the contractor and the IRS to report what you paid them.

Here's the lowdown on your 1099-NEC duties:

- Who needs one? Any individual, partnership, or LLC you paid $600 or more for services during the calendar year. Generally, you don't need to send one to C-Corporations or S-Corporations.

- When is the deadline? You have to get the form to your contractor and the IRS by January 31 of the following year. Miss it, and you're looking at penalties.

Key Insight: That $600 threshold is cumulative for the year. Paid a designer $300 in April and another $400 in September? That's $700 total, which means you absolutely must issue them a 1099-NEC.

If you're working with talent outside the U.S., the rules get even more complex. You'll be dealing with different forms (like the W-8BEN) and international tax treaties. It's a different ballgame, and understanding the nuances is critical. For a glimpse into these challenges, check out this freelancer tax guide for the Netherlands to see how different regulations can be.

Your Best Defense? Meticulous Records

Finally, your most important compliance task is to keep spotless records. I'm talking about documenting every single payment you make to every contractor, all year long.

Your records are your best defense. They should include:

- The contractor's full name and contact details.

- A copy of every single invoice they sent you.

- Clear proof of payment, with dates and amounts.

- The signed W-9 form for each U.S. contractor.

This documentation is your source of truth. It guarantees your 1099s are spot-on and gives you the backup you need if the IRS ever comes knocking. Using an invoice management tool can put this entire process on autopilot, so you can be confident nothing ever falls through the cracks.

Best Practices for a Seamless Payment Workflow

Once you’ve sorted out the legal and tax paperwork, it's your day-to-day payment habits that really shape your relationships with contractors. A smooth, professional workflow isn't just about moving money around. It's about building the kind of trust that makes top talent want to work with you again and again.

This is where you shift from a purely transactional mindset to a true partnership. Simple things, like paying on time and keeping communication lines open, can instantly set you apart as a great client to work for.

Establish a Predictable Payment Schedule

Nothing builds trust faster than predictability. Whether you decide to pay upon milestone completion, on a bi-weekly schedule, or using standard net-30 terms, the most important thing is that you stick to it.

A consistent payment rhythm lets contractors manage their own cash flow, which is a huge deal for any independent professional. When they know exactly when to expect payment, it removes a major source of stress and frees them up to focus on what matters: delivering incredible work for you. Honestly, this reliability is one of the most powerful tools you have for retention.

In some industries, this is so critical it’s actually mandated by law. The construction sector, for example, has seen major legal updates to enforce timely payments. In the UK, the Construction Act introduced prompt payment rules, while Australia's Security of Payment legislation helps secure cash flow for contractors and cut down on disputes. You can read more about these global legal frameworks on dlapiper.com.

Create a Crystal-Clear Invoicing Process

Vague instructions are the enemy of a smooth workflow. To prevent any confusion or delays, you need to set crystal-clear guidelines for how invoices should be submitted.

Your process should answer these key questions right away:

- Who gets the invoice? Pinpoint the exact person or email address (e.g.,

invoices@yourcompany.com). No more guessing games. - What information is mandatory? Be explicit. List everything you need, like a project name, PO number, and a detailed breakdown of services.

- What’s the submission deadline? Give a clear cutoff, like "Invoices for the month must be submitted by the 25th to be included in this month's pay run."

A clear system like this eliminates the endless email back-and-forth and ensures you have all the info you need for quick, painless processing. We even have a guide that shows you how to automate invoice management to slash your manual workload even further.

Pro Tip: A quick, friendly email confirming you've received an invoice goes a long way. Even better? Another notification saying "Payment sent!" is a simple touch that contractors love. It closes the communication loop and reinforces your professionalism, letting them know their payment is on its way without them having to ask.

Common Questions About Paying Contractors

Even with a rock-solid payment process, you're going to run into weird situations. It just happens. A contractor ghosts you, an invoice shows up three months late, or the numbers just don't add up.

This is where experience comes in. Let's walk through a few of the most common headaches I see businesses face and how to handle them without blowing up a good working relationship or creating a legal mess.

What Happens if a Contractor Submits an Invoice Late?

This one comes up all the time. Your contract is your single source of truth here. It should spell out exactly when invoices are due and what your payment schedule is.

So, if your cutoff for a monthly pay run is the 25th and an invoice lands in your inbox on the 28th, you are not obligated to scramble and process it. It simply waits for the next payment cycle.

The key is communication. Send a quick, professional email confirming you got the invoice and let them know it will be paid on the next scheduled date. Mention the date specifically. This isn't about being difficult; it's about respecting the process you both agreed to.

Key Takeaway: A clear payment policy in your contract isn't just paperwork—it's your best friend. It prevents awkward conversations and saves you from the chaos of making constant off-cycle payments.

How Should I Handle Disputed Charges on an Invoice?

First, don't just short-pay the invoice and hope they don't notice. That's a fast track to a soured relationship and a bad reputation.

When you see a charge that doesn't look right, here’s what to do:

- Acknowledge you got it. A simple "Got your invoice, thanks!" is perfect.

- Contact them immediately. Don't let it simmer. Politely point out the specific line item you're questioning and ask for clarification. Maybe they billed for the wrong project, or there was a simple typo.

- Pay what you owe. Go ahead and pay the undisputed portion of the invoice by the due date. When you do, make it clear that you're paying the agreed-upon amount while you both sort out the other item.

This approach shows you're acting in good faith. It respects their work and cash flow while giving you both time to get on the same page.

What if I Need to End a Contract Early?

Pulling the plug on a contract is a big deal, and how you do it is dictated entirely by the agreement you signed. Look for the termination clause. It will detail the notice period required (like 30 days written notice) and spell out any final payment duties.

For example, government contracts often include a "termination for convenience" clause that gives the agency a lot of leeway, a right that contractors rarely get.

When you terminate, you’re almost always on the hook to pay for all work completed and accepted up to that termination date. Trying to sidestep this process is a recipe for legal trouble. And the stakes are high; the top 250 international contractors recently managed new contracts worth a staggering $1.75 trillion in a single year, which gives you a sense of the scale and legal complexity involved. You can dive into more data on the international contractor market from ENR.

Ready to stop chasing invoices and get hours of your week back? Invowl connects to your inbox, extracts every invoice automatically, and spots savings opportunities averaging $847 per month. Try Invowl today and turn financial admin into seconds.