Figuring out how to categorize your business expenses is really just about organizing your spending into common-sense groups. Think operations, marketing, and payroll. This simple act takes that messy pile of receipts and invoices and turns it into a powerful tool for budgeting, tax planning, and making smarter business moves. It’s like creating a clear map of exactly where your money is going.

Why Smart Expense Categorization Is a Game Changer

Let's be honest, most business owners see tracking expenses as a mind-numbing chore—a necessary evil you rush through during tax season. But looking at it that way misses the entire point. Good expense categorization isn't just about bookkeeping; it's a foundational habit for building a business that can actually weather storms and scale up. It gives you a real-time, high-definition picture of your company’s financial health.

When your spending is clearly defined, you stop guessing and start knowing. Instead of wondering "where did all the money go?" at the end of the month, you can pinpoint exactly how much you spent on new software versus what it cost to land that new client last quarter. That clarity is the first step toward having real control over your finances.

Fueling Smarter Business Decisions

A well-organized system for your expenses is your secret weapon for making informed choices. It has a direct, practical impact on how you operate day-to-day and plan for the future.

- Sharper Budgeting and Forecasting: With clean categories, you can easily see your historical spending patterns. This makes setting realistic budgets and forecasting future cash flow a whole lot easier and more accurate. You'll know instantly if your marketing spend is actually bringing in results or if your utility costs are slowly creeping up.

- Spotting Cost-Saving Opportunities: Are you overspending on software subscriptions you barely use? Are your shipping costs eating away at your profit margins? Precise categories make these trends jump right off the page, showing you exactly where you can trim costs without hurting your quality or growth.

A detailed expense system transforms your financial data from a simple historical record into a forward-looking guide. It’s the difference between driving while only looking in the rearview mirror and having a clear GPS for the road ahead.

Maximizing Deductions and Minimizing Risk

Beyond just running your business better, smart categorization has a major impact on your bottom line—especially when the taxman comes knocking. The IRS requires expenses to be ordinary and necessary to be deductible, and grouping them properly is how you prove it.

Getting this right ensures you can confidently claim every possible deduction, from office supplies to employee benefits, which directly lowers your taxable income. More importantly, it creates an organized, defensible record of your finances. This dramatically lowers your risk if you ever face an audit. This isn't just about staying compliant; it's about building a business that's financially sound and ready for anything.

Get to Know Your Core Expense Categories

Before you can build any system, you need to know the parts you're working with. For your business finances, this means getting a real handle on the fundamental groups that show where your money is going. Think of these as the main folders for your company's financial life.

The whole point is to see the difference between different kinds of costs, because each one tells a unique part of your financial story. For instance, Operating Expenses (OpEx) are the everyday costs you need to just keep the lights on—things like your office rent or that monthly software subscription. You pay these whether you make one sale or one thousand.

On the other hand, there's the Cost of Goods Sold (COGS). This bucket only matters if you sell a product, whether it's physical or digital. COGS includes every cost directly tied to making what you sell, from the raw materials for a handmade chair to the direct developer salary for a piece of software.

Why These Differences Matter

Getting these distinctions right isn't just for show; it's critical for accurate financial reports and, importantly, your tax strategy. Take a capital expense, for example. This is a big-ticket purchase that will provide value for years, like a new company truck or a heavy-duty piece of machinery. You can't just write off the entire cost in the year you buy it; instead, you depreciate its value over time.

In sharp contrast, paying for a Google Ads campaign or your monthly CRM subscription is a totally different beast. Those fall under Sales & Marketing or general Operating Expenses and are deducted in the year you incur them. Knowing this difference is absolutely vital for managing your cash flow and making sure you're not overpaying (or underpaying) your taxes.

The real magic happens when you see how these categories work together. A spike in marketing spend should, hopefully, lead to a rise in revenue. Meanwhile, keeping a tight grip on your operating expenses protects your profit margins. It's about seeing the complete picture.

Having a solid grasp of these categories also makes conversations with your financial partners infinitely more productive. To dive deeper into that, check out our guide on how to streamline accountant collaboration.

Common Business Expense Categories and Examples

To help you get started, we've put together a quick-reference table. It breaks down the most common categories that nearly every business, big or small, will encounter. Think of this as your cheat sheet for bringing order to your financial tracking.

| Category | Description | Common Examples |

|---|---|---|

| Operating Expenses (OpEx) | Costs to keep the business running daily, not directly tied to production. | Rent, utilities, payroll for administrative staff, office supplies, insurance. |

| Cost of Goods Sold (COGS) | Direct costs of producing the goods or services you sell. | Raw materials, direct labor, manufacturing supplies, hosting costs for SaaS. |

| Sales & Marketing | Expenses incurred to promote and sell your products or services. | Advertising spend, social media tools, sales commissions, trade show fees. |

| Capital Expenditures (CapEx) | Major purchases of long-term assets that are depreciated over time. | Machinery, equipment, vehicles, buildings, major software development. |

Using these core classifications as your foundation provides the structure you need to track, analyze, and ultimately control where your money is going. This clarity is the first step toward true financial control.

How to Build a Custom Chart of Accounts

Now that you’ve got a handle on your core expense types, it's time to build your company’s financial map: the Chart of Accounts. Don't think of this as some rigid accounting rulebook. It's a living document that should perfectly mirror how your business actually spends money. The goal is to get deep insights without making it a nightmare to manage day-to-day.

A generic template can be a decent starting point, but the real power is in the customization. Your industry completely changes what matters. For a local coffee shop, you’ll want granular subcategories under "Cost of Goods Sold," like ‘Coffee Beans,’ ‘Milk & Dairy,’ and ‘Paper Goods.’ But a freelance web developer might not even have a COGS category. Their focus will be on things like ‘Software Subscriptions’ and ‘Project Management Tools’ under Operating Expenses.

Tailoring Categories to Your Business Model

The whole point is to create categories that answer real questions about your spending. If you run a digital marketing agency, a single "Marketing" expense line is pretty much useless. You need to know exactly how much you’re spending on specific channels to figure out your ROI.

Here are a few more real-world examples:

- E-commerce Store: You'd want subcategories for 'Platform Fees' (like Shopify), 'Shipping & Fulfillment,' and 'Payment Processor Fees.'

- Construction Company: Think detailed categories like 'Subcontractor Labor,' 'Equipment Rentals,' and 'Building Materials.'

- Consulting Firm: Your categories might include 'Professional Development,' 'Client Travel,' and 'Liability Insurance.'

A quick tip from experience: Don't overcomplicate it from the start. Begin with broader categories. Only create a new subcategory when an expense gets big enough that you feel you need to track it more closely. Your Chart of Accounts should grow with your business, not get ahead of it.

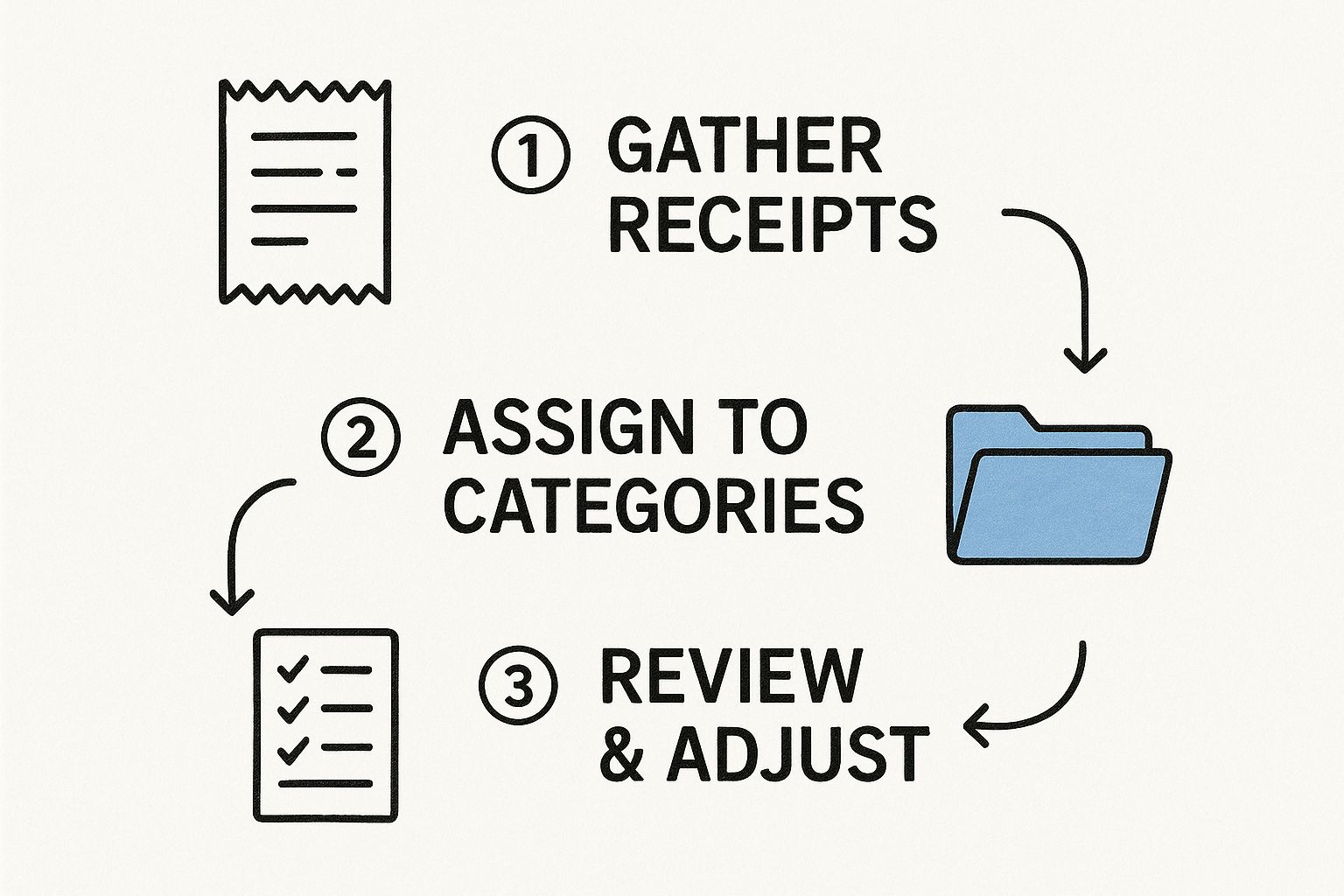

This visual breaks down the basic flow for getting your expenses categorized, from gathering the raw data to giving it a final review.

This process really drives home the point that good expense management isn't a one-and-done task. It’s a continuous cycle of collecting, assigning, and adjusting your categories to keep your financial picture crystal clear.

Handling Complex Expenses Like Business Travel

Let's be honest, not every expense fits neatly into a tidy little box. Some spending is just messy. Business travel is the perfect example—a single trip can spit out receipts for flights, hotels, client dinners, and Ubers. Lump it all under one "Travel" category, and you've got a black hole in your financial data.

Let's be honest, not every expense fits neatly into a tidy little box. Some spending is just messy. Business travel is the perfect example—a single trip can spit out receipts for flights, hotels, client dinners, and Ubers. Lump it all under one "Travel" category, and you've got a black hole in your financial data.

The trick is to stop thinking of it as one big expense. Instead, break the event—the business trip—down into its essential parts. Think of it like a parent category with specific children. This simple shift gives you a much sharper picture of where your money is really going.

Breaking Down Travel Costs

For a typical work trip, your subcategories under a main "Business Travel" heading should look something like this:

- Transportation: This is for the big tickets—airfare, train journeys, and car rentals.

- Accommodation: The cost of the hotel room or other lodging for the trip.

- Meals: Specifically, business-related meals with clients, partners, or your team. It's vital to separate these, as they are often only 50% deductible for tax purposes.

- Local Transport: This bucket catches all the in-destination travel, like taxis, ride-sharing services, or subway passes.

This level of detail is where the magic happens. You might discover that while your flight costs are under control, your team is spending a fortune on last-minute ride-shares. That's an insight you'd never get from a single, jumbled "Travel" total.

This matters because travel spending can vary wildly. The accommodation and food services sector, for instance, saw a 37.4% explosion in business travel spending in 2023. Meanwhile, the utilities industry accounts for a staggering $93.6 billion in global travel costs.

By mastering how to categorize a multi-faceted expense like travel, you're building a mental model you can use again and again. You can apply the same "break it down" method to other complex costs, whether it's a big marketing conference or an intensive employee training program.

Ultimately, this structured approach ensures no detail falls through the cracks. And a tool like Invowl makes it even easier by pulling the data from your invoices automatically. You can then quickly assign each line item to the right subcategory right from your Invowl dashboard.

Using Technology to Automate Expense Tracking

Let’s be honest. Nobody starts a business because they love sorting through shoeboxes of receipts or manually typing invoice data into a spreadsheet. This kind of admin work is a massive drain on your time—your most valuable asset.

Thankfully, you don't have to do it anymore. Modern expense management software can put your entire categorization system on autopilot, turning a tedious chore into a hands-off, automated workflow.

These tools use AI to instantly scan and digitize receipts and invoices, pulling key details like vendor names, dates, and amounts. An employee snaps a photo of a lunch receipt, and the software immediately recognizes the restaurant and slots the expense into "Business Meals." No fuss, no mistakes.

From Reactive to Proactive Financial Management

The real magic here isn't just about saving time; it's about changing how you see your company's finances. Instead of reacting to last month's spending reports, you get a real-time view of your cash flow as it happens.

This isn’t some future-state fantasy. It's quickly becoming the standard.

By 2025, it's projected that over 70% of medium to large enterprises will adopt automated expense management systems. These platforms do more than just sort expenses—they use AI for predictive analytics, helping businesses forecast costs and spot savings.

A good system enforces the financial rules you've set up. You can cap spending in certain categories or flag any purchase over a specific amount for manager approval. This gives you proactive control over your budget instead of just cleaning up the mess afterward.

Tools like Invowl take this a step further by connecting directly to your inbox. It finds invoices, pulls out all the critical data, and syncs everything with your accounting software like Xero or QuickBooks. This creates a seamless, unbroken chain of information from purchase all the way to reconciliation.

When you can automate invoice management to save time, you don’t just close your books faster. You make the entire process of categorizing business expenses more accurate, efficient, and genuinely strategic.

Common Questions About Categorizing Expenses

Even with a perfect system on paper, you'll always hit weird little questions when you're actually in the trenches, doing your books. Getting these sticking points sorted out is how you go from just having a system to actually trusting it.

Let's clear up some of the most common questions that pop up when you're trying to wrangle your business expenses.

How Detailed Should My Expense Categories Be?

The goal here is clarity, not complexity. Your categories need to be detailed enough to give you real answers about where your money is going, but not so granular that you spend all day categorizing a coffee receipt.

A great starting point is to use broad categories like 'Marketing' or 'Office Supplies.'

You only need to break it down further when the spending in one of those buckets gets significant. For example, once your marketing spend grows, it suddenly makes a lot of sense to see the difference between 'Paid Social Ads,' 'Content Marketing Tools,' and 'SEO Consultants.' You're looking for the sweet spot that helps you make smarter decisions, not create a hundred categories you never look at.

A simple rule of thumb: create categories that mirror how you actually run your business. If a category doesn't help you answer a specific question about your spending, it’s probably just adding noise.

What’s the Difference Between COGS and Operating Expenses?

Getting this right is absolutely crucial. Cost of Goods Sold (COGS) covers all the costs directly tied to making your product or delivering your service. Think raw materials for a physical product or the software subscriptions you couldn't run your service without.

Operating Expenses (OpEx), on the other hand, are the costs of keeping the lights on—the expenses you have whether you make a single sale or not. This is stuff like your office rent, administrative salaries, or liability insurance.

Here’s the simplest way to tell them apart: You have to pay your office rent (OpEx) even if you sell nothing. But you only pay for raw materials (COGS) when you actually produce something to sell.

Can I Change My Expense Categories Later On?

Yes, and you absolutely should. Your Chart of Accounts isn't set in stone; it's a living document that should evolve with your business. As you launch new products, enter new markets, or your team grows, your costs will naturally change.

It's smart to review and tweak your categories at least once a year. This keeps your financial reports relevant and accurate. Just make sure you document any major changes so you can still make sense of year-over-year comparisons.

How Do I Handle an Expense That Fits Two Categories?

This happens all the time. The best approach is to pick the one category that makes the most sense and stick with it. Consistency is everything.

For instance, if a software subscription is used by both your marketing and sales teams, you could put it under 'Marketing' if that's its primary function. Or, you could create a more general 'Shared Software' category. What you don't want to do is split a single small invoice across multiple categories—it's usually more hassle than it's worth and can make your reports a mess.

Ready to stop guessing and start automating? Invowl connects to your inbox, finds every invoice, and extracts all the key data for you. Reclaim hours of manual work and get clear insights into your spending. Try it today at https://www.visusly.com.