Let’s talk about automating data capture. In simple terms, it's about using smart tech, like AI and Optical Character Recognition (OCR), to pull information from your documents and drop it right into your business software.

This means you can finally stop the soul-crushing task of manual data entry. Automation turns those chaotic piles of invoices, forms, and receipts into organized, useful data—all with very little human effort. Your team can finally stop transcribing and start thinking.

Why Automating Data Capture Is a Strategic Move

Let's cut through the buzzwords. Manual data entry isn't just boring; it's a silent killer for your business. It slowly eats away at your profits, your team's productivity, and even their morale. The frustration is real, and the costs add up fast.

Picture your finance team at month-end, buried under a mountain of supplier invoices. Every single one needs to be opened, read, and typed into the accounting system. This hands-on process is a perfect breeding ground for mistakes.

A simple typo—like a misplaced decimal or the wrong invoice number—can cause overpayments, missed discounts, and hours of painful reconciliation work. These aren't just minor slip-ups; they're expensive errors that hit your bottom line directly.

The True Cost of Manual Processes

The dirty secret of manual data entry is its shockingly high error rate, which can climb as high as 4%. That number might seem small, but if you process thousands of documents, it means a huge volume of bad data is poisoning your financial reports and leading to terrible business decisions.

This reliance on manual work creates bottlenecks that send ripples across your entire company.

Just think about these real-world headaches:

- Logistics and Supply Chain: A coordinator is keying in data from dozens of bills of lading every single day. One tiny error or delay can halt an entire shipment, leading to missed delivery slots, angry clients, and even penalty fees. The whole supply chain is held hostage by how fast one person can type.

- Finance and Accounts Payable: An AP clerk spends the last week of every quarter just chasing approvals and punching in invoice details. This frantic rush means early-payment discounts get missed, and vendor relationships get strained because of late payments. The focus is all on clearing the backlog, not on smart financial management.

The real problem isn't just about speed—it's about opportunity cost. Every hour an employee spends typing is an hour they aren't spending on customer service, financial analysis, or making your processes better.

Gaining a Competitive Edge

This is where automating data capture stops being a "nice-to-have" and becomes a must-do. Businesses that make the switch get an immediate, measurable advantage over the competition. When you take people out of the repetitive data-punching equation, you fundamentally change how work gets done.

To see the difference in black and white, here's a quick look at how manual and automated processes stack up against each other on the metrics that actually matter.

Manual vs Automated Data Capture At a Glance

| Metric | Manual Data Capture | Automated Data Capture |

|---|---|---|

| Accuracy | Prone to human error (up to 4% error rate). | Highly accurate (often >99%), with built-in validation. |

| Processing Speed | Slow; limited by individual employee capacity. | Near-instantaneous; processes thousands of documents in hours. |

| Cost | High long-term labor costs and error correction expenses. | Higher initial setup cost but significant long-term savings. |

| Scalability | Difficult and expensive; requires hiring more staff. | Easily scalable to handle fluctuating data volumes. |

| Employee Focus | Tedious, repetitive data entry and verification. | High-value tasks like analysis, strategy, and problem-solving. |

When you automate, you're not just buying software; you're buying back time and brainpower.

Imagine your finance team, freed from the drudgery of data entry, now focused on negotiating better supplier terms or analyzing spending to find new savings. That’s how automation turns a reactive administrative chore into a proactive, strategic powerhouse that actually drives growth.

Understanding The Tech Behind Data Automation

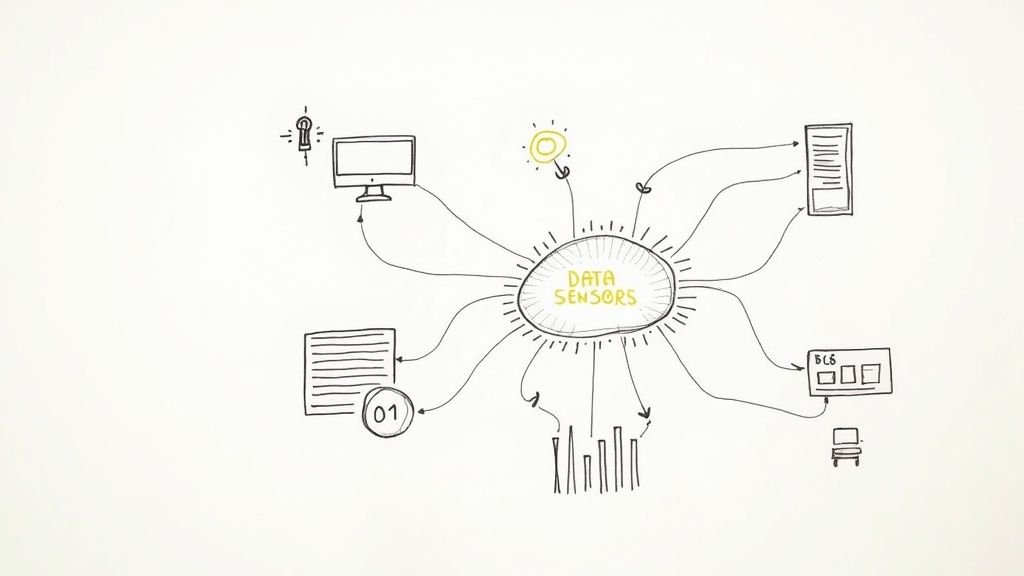

To really get why automated data capture is such a big deal, you have to peek under the hood at the tech that makes it all click. This isn't just a list of confusing acronyms; it's a team of smart tools working together, each with a specific job to do, turning messy documents into clean, usable information.

Think of it as building a super-efficient digital assembly line for your company's data. The first stop on this line is usually Optical Character Recognition (OCR).

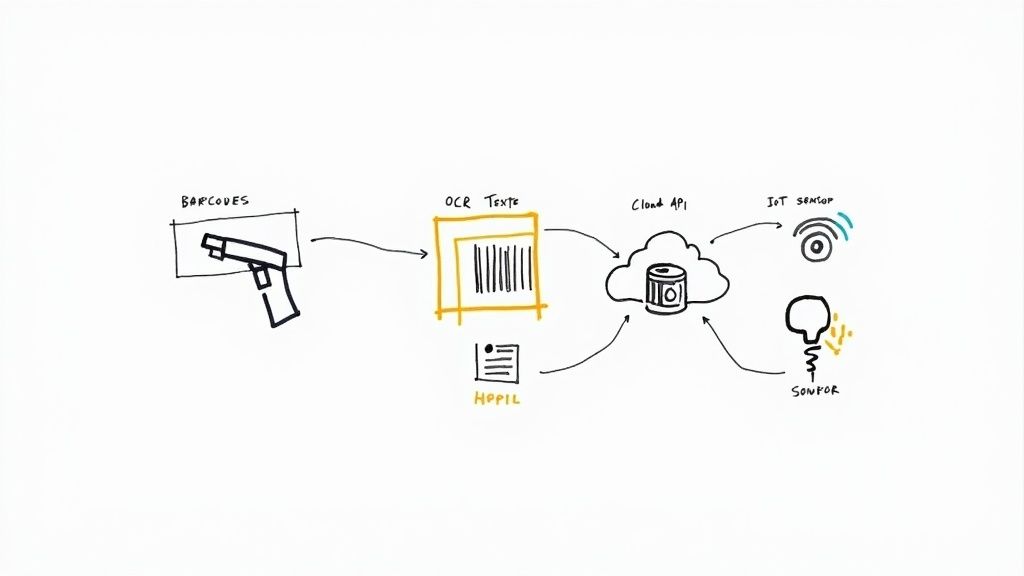

Optical Character Recognition: The Digital Eyes

At its core, OCR is the tech that "reads" text from images, scanned documents, or PDFs. If you snap a picture of a receipt, OCR is the magic that turns the printed letters and numbers in that photo into text you can actually copy, paste, and work with.

It's the foundational layer—the digital eyes of your whole automation system. Without it, your computer just sees a picture, not the valuable information trapped inside it.

But OCR by itself is like hiring someone who can read but can't understand what any of it means. It pulls out the text, but it has no idea what that text is. That's where its smarter cousin comes in.

Intelligent Document Processing: The Strategic Brain

If OCR provides the eyes, then Intelligent Document Processing (IDP) is the brain. IDP takes the raw text from OCR and uses artificial intelligence (AI) and machine learning to figure out its context and meaning. It's the difference between just reading "INV-12345" and knowing that's an invoice number.

IDP is what lets a system do the really clever stuff:

- Find specific data on any document, even if the layout is completely different from the last one. It can find the "Total Amount" on an invoice whether it's at the top, bottom, or buried in the middle.

- Classify documents on the fly. The system instantly knows if it's looking at a purchase order, a utility bill, or a shipping manifest.

- Validate information by checking it against data you already have, like making sure a PO number on an invoice actually matches a real PO in your accounting software.

This ability to understand context is a massive leap forward. For any business drowning in vendor invoices, having a system that can intelligently find and pull out key details is a game-changer. You can see these principles in action in our guide on how to automate your invoice management and save time.

Robotic Process Automation: The Tireless Hands

So, you’ve got the eyes (OCR) and the brain (IDP). Now you just need the hands to do the actual work. This is where Robotic Process Automation (RPA) steps in. RPA uses software "bots" that are programmed to handle repetitive, rules-based digital tasks—the boring stuff nobody wants to do.

An RPA bot can take the clean, structured data extracted by IDP and physically enter it into your other business applications. Picture a digital assistant that can log into your accounting software, navigate to the "Enter Bill" screen, and fill in all the required fields—supplier name, date, amount—all without a single human touch. It’s the perfect employee that never gets tired and never makes a typo.

The real power comes when these technologies work together. OCR, IDP, and RPA aren't siloed; they're an integrated team creating a seamless flow from a raw document to the final data entry, all driven by the intelligence of AI.

The incredible growth in this space shows just how valuable this is. The global automatic identification and data capture (AIDC) market was recently valued at $65.93 billion and is expected to jump to $74.68 billion in the next year alone. Experts see it rocketing to $141.31 billion by 2029, which tells you just how quickly businesses are adopting these tools to get more efficient.

This powerful tech combo is what makes modern data capture automation possible, turning a chaotic manual headache into a streamlined, strategic part of your business.

How to Build Your Automated Data Capture Workflow

Alright, let's move from theory to action. This is where it gets exciting. Building an automated data capture workflow isn't some monumental IT project; it's about making smart, incremental changes that save you a ton of headaches.

The journey doesn't start with fancy software. It starts with a hard look at your biggest operational pain points.

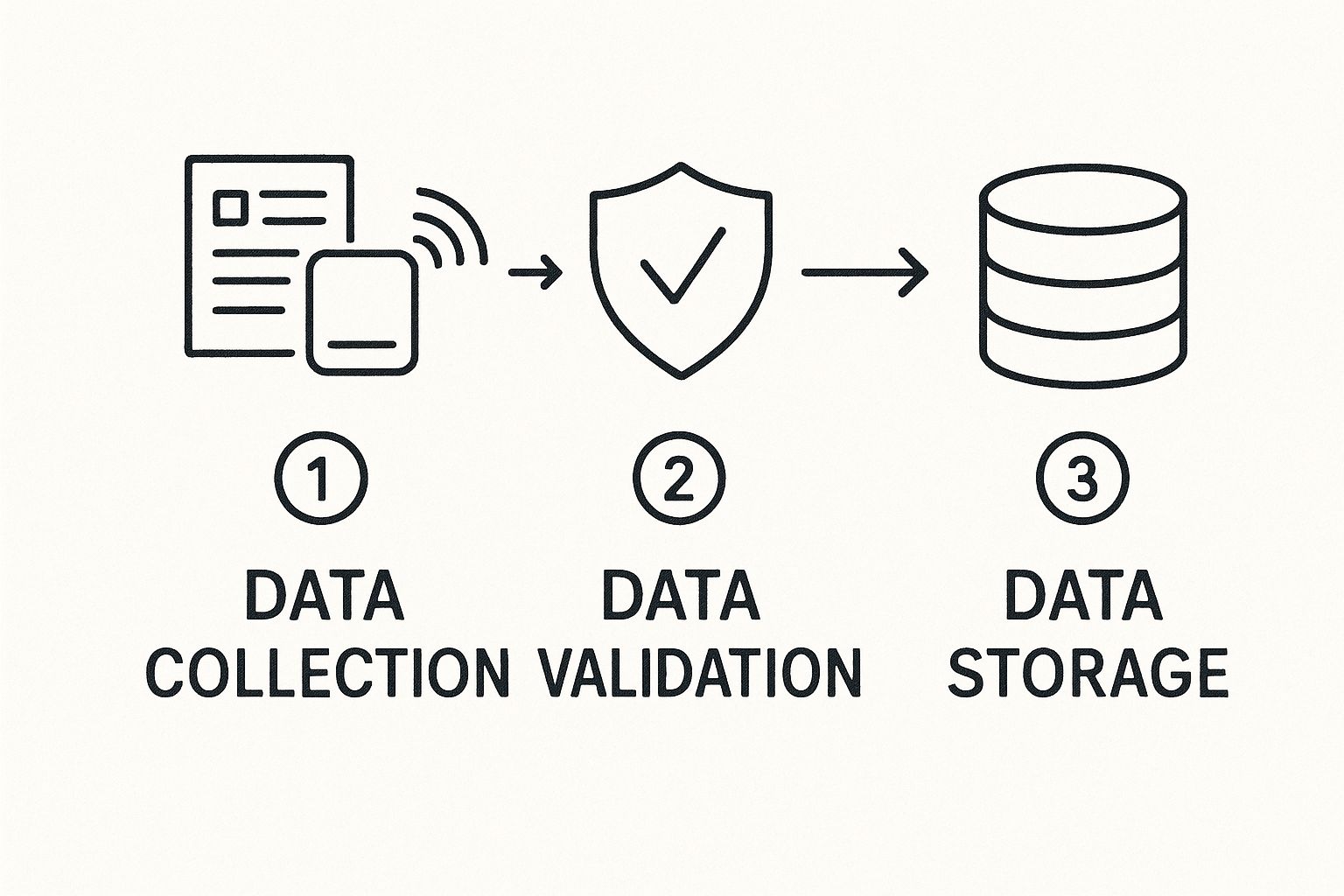

This simple flow chart breaks down the core stages. You see how raw information gets collected, checked for accuracy, and finally organized into structured, usable data.

This visual shows that good automation is a structured process, not a magic button. The goal is to make sure the data entering your systems is clean and reliable from the get-go.

Pinpoint Your Most Pressing Document Problems

Before you even think about tools, you have to find the right problem to solve. Where is manual data entry creating the most friction in your business right now? Don't try to automate everything at once. That’s a recipe for disaster.

Instead, find that one process that's a constant source of delays, mistakes, and sheer frustration. For many businesses, that bottleneck lives in the accounts payable department.

Imagine a small design agency getting dozens of invoices every week from freelancers, software subscriptions, and print shops. Each one lands as a PDF in an email inbox. The owner then burns hours every Friday typing all those details into their accounting software. This is a perfect, bite-sized problem to automate.

Start by asking yourself these questions:

- Which specific documents eat up the most manual labor? (Invoices, purchase orders, expense receipts?)

- Where are data entry errors most frequent and costly?

- Which process delays are causing the biggest downstream impact on other tasks?

The goal is to pick a single, high-impact document type for a pilot project. Nail this, and you'll build momentum and have a rock-solid business case for expanding your efforts later.

Select the Right Automation Tools for the Job

Once you've zeroed in on your target, it's time to pick your tools. The market for data capture automation is crowded, but solutions generally fall into a few camps. Your choice really depends on your technical comfort level, budget, and how complex your documents are.

For a freelancer or a small business, a purpose-built tool like Invowl is often the perfect fit. It's designed to do one thing exceptionally well: connect to your email, find every invoice, and pull out the key data automatically. It cuts out the need for a complex setup or bothering your IT person.

Larger companies with more varied needs might look at a broader Intelligent Document Processing (IDP) platform. These systems can handle a wider range of document types and funky layouts, but they often come with a steeper learning curve and a much higher price tag.

The key is to match the tool to the task. Over-investing in a massive enterprise system just to handle 50 invoices a month is as inefficient as typing them all by hand. Find a solution that fits your current scale and solves your immediate problem.

Configure Your Data Extraction Rules

This is where you teach your new system what information actually matters. Thankfully, modern AI-powered tools make this surprisingly simple. Instead of writing code, you’re often just showing the software what to look for.

Let's go back to our design agency. With a tool like Invowl, the initial setup is minimal because it's already been trained on thousands of standard invoices. But what if they need something specific?

Real-World Scenario: Setting Up Invoice Extraction

The agency owner needs to track costs by project. Many of their supplier invoices include a "Project Code" somewhere in the line items. They can easily teach their automation tool to find and extract this specific field.

This usually involves a few simple steps:

- Upload a sample invoice that has the project code.

- Highlight the "Project Code" area on the document's image.

- Label that highlighted data as "ProjectCode" in the system.

The AI learns from this one example. From now on, it will hunt for that field on all future invoices from that supplier, even if its position moves around a bit. You’ll also want to set up simple validation rules, like making sure the "Total Amount" is always a number or the "Invoice Date" is in a valid format.

Integrate and Test Your New Workflow

This is the final, crucial piece of the puzzle: connecting your new data capture system to the other software you rely on. The whole point of this exercise is to kill manual steps, so a solid integration is non-negotiable. You're aiming for a seamless, hands-off process.

For our design agency, this means linking their invoice tool directly to their accounting software, like QuickBooks or Xero. After the data is pulled from an invoice PDF, it can't just sit in a list. That doesn't solve the problem.

With a proper integration, the extracted data—supplier name, invoice number, total amount, and that custom "Project Code"—is automatically sent over to the accounting software, creating a new draft bill, ready for one-click approval. Zero manual typing.

Before you flip the switch and go live, run a small batch of 10-20 real documents through the entire system. Check that the data lands correctly in your accounting platform. This testing phase is your chance to catch any mapping errors or configuration quirks before they become real problems, ensuring your launch is smooth and successful.

Best Practices for a Smooth Implementation

Great tech is only half the battle. A successful rollout is what actually gets you the results you’re after.

If you just jump headfirst into a company-wide implementation, you’re setting yourself up for headaches and resistance. The smartest path I've seen? Start small and prove the concept.

Pick a single, high-pain area for a pilot project. Is your accounts payable team drowning in invoices from one particular group of vendors? That’s your perfect starting point. Automating one specific workflow creates a controlled environment where you can learn, test, and show everyone what the new system can really do.

A successful pilot becomes your best internal case study. It gives you hard numbers on time saved and errors eliminated, which is the kind of undeniable proof you need to win over skeptics and build momentum for a bigger rollout.

Lead With People, Not Just Technology

Honestly, the biggest hurdle for any new automation project isn't the software—it's the people. Your team is going to have questions and, frankly, some very valid concerns. "Is this tool going to make my job obsolete?" "Is this just another complicated system I have to learn?" You have to tackle these fears head-on.

Don't just send out an email announcing the change. Explain the why.

Frame the shift to automated data capture as a way to free them from mind-numbing, repetitive work. The whole point is to elevate their roles so they can focus on more strategic tasks—things like analyzing data, managing vendor relationships, and solving real problems.

For example, show your AP clerk how they'll go from typing in invoice details to analyzing spending patterns to find real cost-saving opportunities. This simple reframing turns what feels like a threat into a chance for professional growth. For a guided experience that helps put your team at ease, a structured onboarding process from Invowl can make a world of difference.

Establish Data Validation From Day One

You can't trust a system if you can't trust its output. That's why setting up strong data validation rules right from the beginning is completely non-negotiable. This step ensures the information flowing into your business systems is accurate and reliable, which builds confidence from the very first day.

You don't need to be a data scientist to get this right. Start with simple, common-sense rules that catch the most frequent errors. This foundational step is what transforms a cool piece of tech into a trusted business tool.

Here are a few essential checks you should implement immediately:

- Format Checks: Make sure dates are always in the right format (e.g., MM/DD/YYYY) and that monetary values are always treated as numbers.

- Range Checks: Flag any invoice totals that seem way too high or low. This is a simple way to catch typos or even potentially fraudulent bills.

- Cross-Referencing: If you can, have the system automatically check if a purchase order number on an invoice matches an existing PO in your records.

This focus on data integrity is part of a much bigger trend. Electronic data capture (EDC) systems—which are the heart of this kind of automation—are seeing explosive growth. The global EDC market, valued at $1.93 billion, is on track to hit $5.88 billion by 2034. As this market growth research shows, it’s a clear signal that industries everywhere are moving away from manual paper-pushing.

By starting small, putting your people first, and obsessing over data quality, you build a rock-solid foundation. This approach doesn't just make your first project a success; it paves the way for optimizing your entire operation and securing major wins for years to come.

The Future of Automated Data Capture

Automating data capture has already changed the game for countless businesses, but what’s coming next is where things get really interesting. The technology is quickly evolving past simply reading text off a page. We're moving toward truly intelligent, autonomous systems that can understand context, collaborate with people, and secure data in ways we're just starting to scratch the surface of.

Looking just over the horizon, hyperautomation is poised to become the new normal. This isn't just about automating a single task here and there. It's about combining advanced AI, machine learning, and other technologies to automate entire, complex business workflows from start to finish.

Think about a system that can digest a 50-page legal contract full of dense clauses, tables, and even handwritten notes, then pull out every key obligation and deadline with near-perfect accuracy—all with minimal human oversight. That's where we're headed. Automation is stepping up from handling simple, repetitive work to tackling the kind of complex, judgment-based tasks that used to be exclusively human territory.

Rise of the Collaborative Robots

Another huge shift is unfolding on factory floors and in warehouses with the arrival of collaborative robots, or "cobots." Forget the giant, caged-off industrial robots of the past. Cobots are designed to work safely right next to people, and they’re often equipped with sophisticated sensors that make them perfect for capturing data in physical environments.

For example, a cobot with a 3D camera can scan pallets of incoming inventory, instantly reading serial numbers, checking for damage, and updating your inventory system in real-time. This blend of physical action and digital data capture is a critical new frontier. Projections show that cobot shipments in North America are on track to hit 64,000 units a year by 2030. Even more telling, 59% of them are expected to feature advanced tech like 3D cameras. You can dive deeper into these manufacturing trends and their impact on industrial automation.

This tight integration of physical and digital data capture will create a hyper-efficient feedback loop where real-world actions are instantly logged and reflected in your business systems.

Securing Data with Blockchain

As automation takes on more sensitive information, making sure that data is secure and can't be tampered with becomes a top priority. This is where blockchain technology makes its entrance. The future of data capture will involve merging automation with blockchain to create ultra-secure, transparent, and permanent records.

A key advantage here is creating an immutable audit trail. When an automated system captures and processes an invoice, a corresponding entry can be created on a private blockchain, providing a permanent, unchangeable record of the transaction.

This has massive implications for industries like supply chain management, where verifying the authenticity of goods and payments is essential. It also brings a new level of trust to financial processes, which is a huge benefit for any business looking to streamline accountant collaboration and guarantee data integrity.

By getting ready for these advancements now—from hyperautomation and cobots to blockchain integration—you can build a forward-thinking strategy that puts you well ahead of the curve. The future isn’t just about being more efficient; it's about creating intelligent, collaborative, and fundamentally secure data ecosystems.

Your Top Questions About Data Capture Automation, Answered

Jumping into data capture automation is a big move, and it's totally normal to have a few questions. It’s a fundamental shift, so let's clear up some of the most common concerns we hear from businesses just like yours.

Is This Really More Secure Than Our Manual Process?

It's a fair question, but the answer is a resounding yes. When set up correctly, automated data capture is leagues ahead of manual methods in terms of security.

Think about the old way: sensitive documents printed out, sitting on desks, passed between colleagues, or even getting lost in interoffice mail. Every one of those steps is a security risk. Automation flips the script entirely.

It drastically reduces the number of people who ever need to physically see or touch sensitive information. Plus, modern platforms layer on protections that paper-based systems just can't match.

We're talking about essentials like:

- Rock-solid encryption for your data, both when it's being stored (at rest) and when it's moving between systems (in transit).

- Role-based access controls, ensuring that people can only see the specific information they need to do their job—nothing more.

- Detailed audit logs that create a permanent, tamper-proof record of every single action taken on a document, from viewing to approval.

This combination creates a secure, transparent, and auditable trail, which is non-negotiable when you're dealing with financial records or personal data.

What's the Real ROI on This Kind of Investment?

The return on investment for automating data capture hits you from multiple angles, and it often shows up faster than you’d expect. Most businesses see a direct, hard-dollar ROI within 6 to 18 months. This comes straight from slashing labor costs and wiping out those costly (and embarrassing) manual data entry errors.

But the financial savings are just the beginning. The real magic is the massive boost in productivity. When your team is finally freed from the soul-crushing task of keying in data, they can pivot to high-value work that actually pushes the business forward.

The true value isn't just in what you save, but in what you gain. Better data accuracy leads to smarter business decisions, and faster processing times dramatically improve relationships with both customers and vendors.

Can Automation Actually Handle Our Messy, Real-World Documents?

Absolutely. This is probably the biggest misconception out there, usually born from bad experiences with older, clunkier tech. The first-generation OCR tools were picky; they needed perfect, machine-printed text on a clean white background to have any chance of working.

Today’s technology is in a completely different universe.

Modern tools use Intelligent Character Recognition (ICR), which leverages AI to accurately read and make sense of a huge variety of handwriting styles. It’s no longer just about recognizing characters, but understanding them.

Even better, Intelligent Document Processing (IDP) platforms don’t need rigid templates. Instead of looking for an invoice number in one specific spot, they use AI to understand the context of the document. The system knows what an invoice number is, so it can find it whether it’s at the top, bottom, or somewhere in the middle. It learns what to look for, not just where.

How Much Technical Skill Do I Actually Need to Run This?

Here’s the best part: you need way less technical expertise than you think. The new generation of data capture platforms is built for the people who actually use them—the business users. They feature intuitive, low-code, and even completely no-code interfaces.

Sure, a massive, company-wide rollout might need some help from your IT crew. But most departments can get a powerful solution up and running on their own, often using simple drag-and-drop workflow builders and pre-built models for common documents like invoices or purchase orders.

The whole point of these platforms is to empower your team, not create another time-sink for IT.

Ready to stop the tedious manual work and see what automation can do for your business? With Invowl, you can connect your inbox and let our AI find, extract, and organize all your invoice data in seconds. Reclaim your time and discover real savings. Try Invowl today and turn hours of admin into a one-click task.