So, what does it actually mean to automate invoice processing?So, what does it actually mean to automate invoice processing? It’s simply using smart software to take over the repetitive, soul-crushing tasks of finance—think data entry, chasing approvals, and scheduling payments. By bringing in technologies like AI and Optical Character Recognition (OCR), you're essentially getting a digital assistant who never makes a typo or takes a coffee break.

This isn’t about some far-off future. It's about getting rid of tedious work now so you can focus on what actually matters.

Why Manual Invoice Processing Is Costing You More Than You Think

Let's get real for a moment. If your accounts payable "process" involves printing PDFs, hunting down managers for email approvals, and manually punching numbers into a spreadsheet, you’re not just being inefficient. You're actively putting a drag on your business's growth. Every minute your team spends on these mind-numbing tasks is a minute they aren't spending on strategic financial planning.

The truth is, manual processes are incredibly fragile and surprisingly expensive. A single misplaced decimal point can cause an overpayment that flies under the radar for months. A missed email can mean a late payment fee and, worse, a damaged relationship with a critical supplier. These aren't just one-off problems; they're the everyday cracks in the foundation that create financial blind spots and kill momentum.

The Hidden Costs Bleeding Your Bottom Line

The most obvious cost is time. We all feel that. Picture a small agency that gets about 50 invoices a month. If each one takes a conservative 15 minutes to handle—from opening the email to reconciling the final payment—that's over 12 hours of pure administrative slog every single month. That's a day and a half of work gone.

But the real damage goes far beyond lost hours. Human error is a huge financial risk. Think about how easily these scenarios can happen:

- Duplicate Payments: The same invoice gets paid twice because the first payment wasn't tracked properly. It happens more than you'd think.

- Incorrect Amounts: A simple typo during data entry means you overpay a vendor by a few hundred (or thousand) dollars.

- Missed Discounts: You fail to process an invoice within the 10-day window and lose out on a 2% early payment discount. Do that a few times, and the losses add up fast.

These little fires create a constant state of financial guesswork, making it nearly impossible to get a clear, accurate picture of your cash flow.

This isn't just a small-business problem. The entire market is shifting for a reason. The global accounts payable automation market hit $3.08 billion in 2023 and is climbing fast. That’s because businesses are realizing the cost of inaction—especially when studies show that almost half of all employees spend over five days each month on manual invoice chores. You can find more eye-opening AP automation stats here.

There's a Much Smarter Way to Work

Luckily, the fix is straightforward. When you automate invoice processing, you replace these error-prone manual steps with a system that's built for reliability and speed. Modern OCR tech can read and pull data from any invoice format in seconds. From there, AI-powered software can check the information for accuracy, flag anything that looks off, and route it for approval without anyone lifting a finger.

This isn't about replacing your team; it's about upgrading their roles. By taking the administrative burden off their shoulders, you free them up to do the high-value work they were hired for—analyzing spending trends, negotiating better terms with vendors, and finding real opportunities to save money. The choice is pretty clear: keep drowning in paper and spreadsheets, or step into the efficiency that modern tools offer.

Choosing the Right Invoice Automation Software

Picking the right software is probably the single most important decision you'll make when you decide to automate invoice processing. The market is crowded, and every tool promises the moon. Honestly, you have to ignore the marketing hype and focus on what your business actually needs.

Before you even look at a single website, you need to look inward. How many invoices are you really dealing with each month? If you're a freelancer handling 15 invoices, your needs are worlds apart from a small agency juggling 100+. That volume is the first filter—it dictates whether you need a simple tool or a more serious platform.

Next up, what's your current tech stack? The software absolutely must play nice with your accounting system, whether that's QuickBooks, Xero, or something else. If the integration is clunky, you'll just be creating more manual work for yourself, which completely defeats the point.

Must-Have Features to Look For

When you start comparing options, it's easy to get distracted by flashy dashboards. You need to look past that and scrutinize the core features that actually do the work. These are the non-negotiables.

Here's what you should be demanding:

- High-Accuracy OCR: This is the foundation. The software's ability to read and correctly pull data from PDFs and scanned invoices is everything. Don't be afraid to ask for accuracy rates—the best tools out there are consistently hitting over 95%.

- AI-Driven Data Extraction: Forget manual templates. Modern systems use AI to learn the layout of different vendor invoices. This means the software gets smarter with every invoice it sees, so you're not stuck creating rules for every new supplier.

- Three-Way Matching: If your business uses purchase orders (POs), this isn't optional; it's essential. The system needs to automatically match the invoice against the PO and the goods receipt note, instantly flagging any mismatches for you to review.

- A Solid API and Integrations: Look beyond just your accounting software. Does it connect to your project management tools? Your payment gateways? A flexible API means the tool can grow with you.

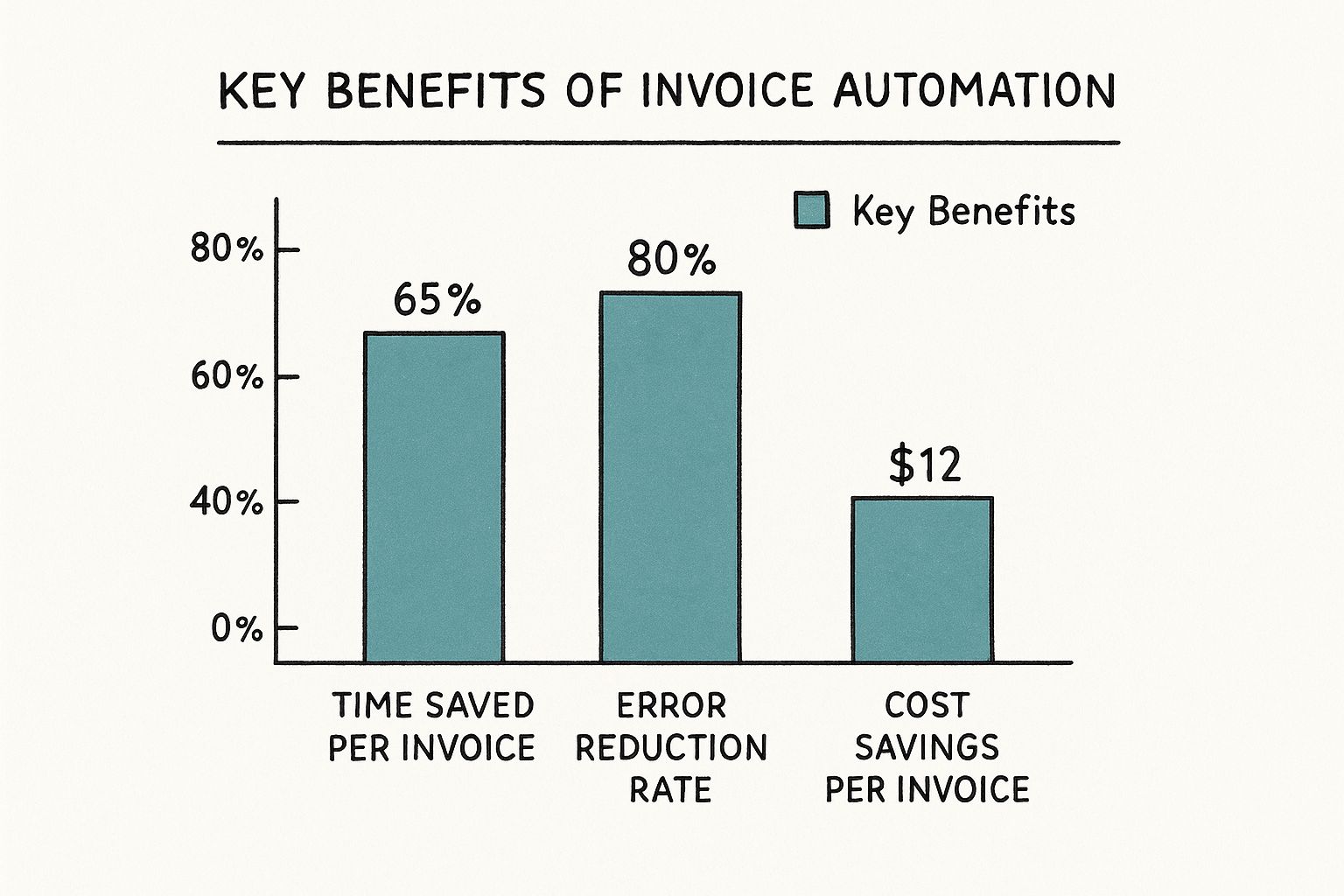

The benefits aren't just theoretical. The right tool with these features delivers tangible results you'll feel almost immediately.

The numbers speak for themselves. You're not just saving a few minutes here and there; you're dramatically cutting down on manual work, preventing costly mistakes, and lowering the real cost of processing every single invoice.

Understanding the Tiers of Automation Tools

It's important to realize that not all "automation" software is the same. The options out there generally fall into a few different buckets, each suited for different needs and budgets. Thinking about where you fit will save you a lot of time during your search.

To help you see the differences clearly, here's a quick comparison of the common types of solutions you'll encounter.

Comparing Invoice Automation Tool Features

| Feature | Standalone OCR Tool | Mid-Tier Automation Platform | Enterprise AP Solution |

|---|---|---|---|

| Primary Function | Extracts text from documents | Manages invoice workflow from capture to approval | Full-suite procurement and payment management |

| Data Extraction | Basic OCR, often needs templates | AI-driven, learns layouts | Advanced AI with validation & enrichment |

| Integrations | Limited, often just CSV/Excel export | Core accounting (QuickBooks, Xero) | Deep ERP integration (SAP, Oracle) & custom APIs |

| Workflow | None | Approval routing, status tracking | Complex, multi-step approvals, compliance checks |

| 3-Way Matching | Not included | Included in higher plans | Core feature, highly customizable |

| Best For | Solopreneurs, basic data entry tasks | Small to medium businesses (SMBs) | Large corporations with complex AP departments |

| Example Use Case | Pulling invoice data into a spreadsheet | Automatically capturing invoices from email, getting manager approval, and syncing to Xero | Managing thousands of invoices with multi-level PO matching and global payment processing |

As you can see, the capabilities vary wildly. A simple OCR reader is fine if all you want to do is rip data from a PDF into a spreadsheet. It’s cheap and solves one specific problem.

However, a true accounts payable platform like Invowl goes much, much further. It handles the entire journey—from automatically grabbing an invoice out of your email, to routing it for approval, and finally teeing it up for payment in your accounting system.

Key Takeaway: Your goal shouldn't be just to extract data. It should be to automate the entire process. A simple OCR tool digitizes a document, but a real AP automation platform digitizes your workflow. That’s where the massive time savings and error reduction really come from.

If you’re serious about making a dent in your administrative workload, a platform that manages the complete invoice lifecycle is the smarter investment for the long run.

Putting Your Invoice Automation Plan into Action

You’ve picked your software. Now it’s time for the fun part: making it work. This is where you actually build the automated engine that will handle your invoices, moving from a concept on paper to a real, working system.

But the first step doesn’t happen inside the software. It happens with a hard, honest look at how you handle invoices right now.

Get out a whiteboard or a fresh document and trace the entire lifecycle of an invoice at your company. Seriously, every single step. From the moment it lands in someone’s inbox to when it’s finally paid and archived. Who sees it first? Where does it go for approval? Be ruthless in identifying where things get stuck. This map is your key to unlocking the biggest automation wins.

Setting Up Your New System for Success

With a clear picture of your bottlenecks, you can start telling your new platform exactly how to fix them. This setup phase is more than just installing an app; you’re teaching it to think like your finance team—only much faster and with fewer mistakes.

Here's what that typically involves:

- Building Your Vendor List: Get your key suppliers into the system. Most platforms can slurp this data right out of your existing accounting software, which is a huge time-saver. You can then set up default rules for each vendor, like specific payment terms or GL codes, so you never have to enter them again.

- Designing Approval Workflows: This is where the magic really happens. You need to define who approves what. Modern tools are smart about this. For example, you can set a rule that any invoice under $500 gets approved automatically, while anything over $5,000 gets sent straight to a department head. No more chasing signatures.

- Creating Business Rules: Think of these as your system's "if-then" logic for catching problems. You can build rules that automatically flag invoices that are missing a PO number, look like a duplicate, or come from a vendor you don't recognize.

It might feel a bit tedious at first, but this initial investment of time is what allows the system to run on autopilot later. Getting your team aligned is just as important, and our guide on creating a smooth onboarding process has some great tips for that.

Connecting to Your Accounting Core

An invoice tool on its own is useful. But one that talks to your accounting software? That's a true game-changer. The main goal here is to create a seamless, two-way street for data between your new automation tool and your ERP or accounting platform, like QuickBooks or Xero.

This integration is what kills manual reconciliation for good. When an invoice gets the green light in your automation platform, it should instantly pop up as a bill in your accounting system, ready to be paid. This keeps your general ledger perfectly in sync, all the time.

We're seeing a massive industry shift away from this kind of grunt work. In just one year, the manual entry of invoices plummeted from 85% down to 60%. What’s more, a recent global survey found that 68% of finance pros are now actively looking for AI-driven tools to take over approvals. This isn't a fad; it's the new standard. You can dig into these key automation statistics for more on the trend.

Launching with a Pilot Program

Don’t try to boil the ocean. Instead of unleashing the new system on everyone at once, start with a small, controlled group. Pick a handful of your most predictable, high-volume vendors and run them through the new process first.

Think of a pilot program as your secret weapon for a stress-free launch.

This test run lets you:

- Catch and fix any weird workflow kinks you didn't anticipate.

- Double-check that your integration is syncing data correctly.

- Get real feedback from a small, manageable group of users.

- Build momentum and turn those first users into champions for the new system.

By ironing out the wrinkles with a few trusted partners, you set yourself up for a smooth and successful rollout when it's time to open the floodgates to all your vendors. This is how a good idea becomes a well-executed reality.

Moving Beyond Basic Invoice Automation

Getting a system to automatically grab and route your invoices is a massive win. But the real magic happens when you stop thinking about it as just replacing tasks and start seeing it as a source of financial intelligence.

This isn't a "set it and forget it" tool. It’s the groundwork for making your accounts payable function a strategic asset instead of just a cost center. With all the data your new system is collecting, you can finally spot trends, dodge risks, and make smarter decisions with your money. The goal shifts from processing invoices faster to processing them smarter.

Refining Workflows and Adding Smart Alerts

Your initial setup got you off the ground, but now it’s time to fine-tune the engine. Take a hard look at your approval workflow analytics. Where are the bottlenecks?

If invoices for marketing expenses always get stuck waiting on the same manager, you can change the rules. A simple tweak, like automatically escalating an invoice if it sits unapproved for more than 48 hours, can work wonders.

Next, you can supercharge your system with smart alerts that act like a financial watchdog, catching issues before they become problems.

Imagine setting up alerts for things like:

- Price Creep: Get a ping if a vendor's recurring invoice is 10% higher than last month's. This is your cue to investigate before you accidentally overpay.

- Potential Duplicates: The system can flag invoices from the same vendor with similar amounts in a short period, even if the invoice numbers are slightly different.

- Unusual Activity: An alert for an invoice submitted after hours or from a new bank account can be your first line of defense against fraud.

This proactive approach stops fires before they start. It also makes managing your team's workload much smoother, a topic we cover in depth in our guide to streamlining accountant collaboration.

Unlocking Strategic Insights with Analytics

Here’s where advanced automation really shines: the analytics. Your system is now a goldmine of spending data, just waiting for you to dig in. Instead of just seeing what you paid, you can finally understand how and why you're spending.

By 2025, over 60% of accounts payable teams are expected to reach full invoice automation. A major driver for this is the power of modern technology, which can reduce human error by up to 40% and deliver incredible data accuracy. You can discover more insights about the future of invoice automation on Softco.com.

Think about the high-level questions you can now answer with a few clicks:

- Which department is consistently blowing its budget?

- Are we actually using all our early payment discounts?

- Who are our most expensive vendors, and are we sure their terms are still competitive?

Trying to answer these with a manual, spreadsheet-based system is a nightmare. With an automated platform, you get clean, visual reports that point directly to cost savings and give you leverage for better vendor negotiations.

Your AP team is no longer just paying bills—they’re generating the intelligence that fuels business growth.

Common Automation Pitfalls And How To Sidestep Them

Learning from experience is great, but learning from someone else's mistakes is a whole lot cheaper. When you decide to automate invoice processing, a few common hurdles can easily derail an otherwise smooth project. Knowing what they are ahead of time is the key to a successful transition.

One of the biggest traps I see is people choosing software based on price alone. A cheap tool that can't integrate with your existing accounting system or chokes on your invoice volume isn't a bargain. It's a massive future headache. Your focus should always be on long-term value and scalability, not just the initial sticker price.

Standardizing Your Inbound Invoices

Another classic misstep is forgetting to standardize how you receive invoices in the first place. If your suppliers are sending a random mix of paper copies, blurry scanned PDFs, and emails in a dozen different formats, your shiny new automation tool is going to struggle. Chaos in always equals chaos out.

Take the time to work with your vendors and establish crystal-clear submission guidelines. A simple request—like asking for high-quality PDFs sent to a single, dedicated email address—can dramatically improve data extraction accuracy and make your entire workflow more reliable. It’s a small change with a huge impact.

Expert Insight: Don’t underestimate the people problem. The best technology on the planet will fail if your team resists it. You have to proactively communicate the 'why' behind the change. Show them how it frees them from mind-numbing data entry to focus on more valuable work, and then back it up with thorough, hands-on training.

Cleaning Up Your Data First

Seriously, don't pour new wine into old bottles. Trying to automate on top of messy, disorganized legacy data is a recipe for pure frustration. If your current vendor records are littered with duplicates, old information, or typos, your new system will just inherit those problems. This leads directly to payment exceptions and costly mistakes.

Before you even think about going live, commit to a data cleanup project. I know, it sounds like a chore, but the payoff is enormous.

Here’s a quick checklist for what to focus on:

- De-dupe Vendors: Hunt down and merge those duplicate supplier profiles in your accounting system.

- Verify Information: Get on the phone or email and confirm that key details like vendor names, addresses, and payment terms are actually correct.

- Archive Old Data: Get rid of inactive vendors you haven't worked with in years. A clean list is a happy list.

Starting with a clean data foundation ensures your automation can run with maximum accuracy from day one. This simple, proactive step prevents the most common frustrations and truly sets you up for long-term success as you automate invoice processing.

Got Questions About Invoice Automation? We've Got Answers.

When you first start looking into automating your invoices, it's natural to have a few questions. How much is this really going to cost? What about that stack of paper invoices from my old-school vendors? Will a robot take over my bookkeeper's job?

Let's cut through the noise and get straight to the practical answers you're looking for.

How Much Does Invoice Automation Really Cost?

The price tag for automating invoices can swing pretty widely. It all comes down to how many invoices you process each month and what features you actually need.

A simple tool that just performs Optical Character Recognition (OCR) might be a small monthly fee or even a per-invoice charge. This can be a great starting point for very small businesses.

On the other end, a full-blown accounts payable platform is a more serious investment, often tiered by user count or monthly invoice volume. But don't just look at the sticker price. The real story is in the return on your investment. When you factor in the hours saved on manual entry, the expensive errors you'll avoid, and the early payment discounts you can now grab, most businesses find these systems pay for themselves within 12 to 18 months.

Can Automation Handle Paper Invoices and PDFs?

Yep, absolutely. This is a common worry, but modern systems are built for the real world, where invoices come in all shapes and sizes.

The secret sauce is Optical Character Recognition (OCR) technology. It’s designed specifically to read and pull data from scanned paper documents and image-based PDFs. Think of it as a super-fast assistant who can read a document just like a human, but without ever needing a coffee break.

And for invoices that arrive as true digital files—like those from vendor portals or attached to emails—the system can often read the data directly, no OCR needed.

The best platforms don't just read the invoice once; they use AI to learn. They start to recognize the unique layouts from each of your vendors, getting smarter and more accurate over time. This adaptability is what makes today’s automation so incredibly powerful.

Will Automation Replace My Accounting Team?

Not at all. It empowers them. This is the biggest misconception out there. Automation isn't about replacing people; it's about getting rid of the soul-crushing, repetitive work that leads to burnout.

Think about it: who enjoys manually keying in data, filing stacks of paper, or chasing down managers for approvals? Nobody. By automating those tasks, you free up your finance pros to focus on work that actually moves the needle.

Instead of being data-entry clerks, your team can finally become financial strategists. They'll have time to:

- Dig into financial reports and spot real spending trends.

- Focus only on the exceptions—the invoices the system flags as problems.

- Work with vendors to negotiate better payment terms.

- Proactively hunt for potential fraud and find ways to improve cash flow.

Ultimately, you automate invoice processing to turn your finance team from a cost center into a strategic powerhouse for the business.

Ready to stop wasting time on manual data entry? Invowl connects to your inbox, finds every invoice automatically, and extracts all the key details in seconds. Reclaim your time and get the insights you need to grow your business. Discover how Invowl can transform your finances today.