At its most basic, accounts payable management is just the process of handling and paying the bills your company owes to suppliers and vendors. But really, it’s about efficiently tracking and paying those bills to keep your business financially healthy and your suppliers happy.

Why Accounts Payable Management Is Your Financial Command Center

Think of your business's finances as a busy airport. Invoices are like incoming flights, each with a specific destination (your bank account), a due date, and a cargo of costs. In this picture, accounts payable management is the air traffic control tower.

Its job is to make sure every single payment "flight" is documented, approved, and lands safely—on time and for the right amount.

Without that control tower, you've got chaos. Payments get lost, paid twice, or miss their deadlines entirely. This leads to late fees, angry phone calls, and damaged relationships with the very suppliers you depend on. But a well-run AP department does more than just stop disasters; it becomes a strategic hub for financial intelligence.

The Strategic Value Beyond Paying Bills

Let's be clear: effective accounts payable management is not just some back-office administrative task. It has a direct impact on your company’s financial stability and how efficiently you operate.

Mastering your AP process delivers some very real, tangible benefits:

- Improved Cash Flow Visibility: When you track every single outgoing payment, you get a crystal-clear picture of your financial obligations. This lets you forecast and manage your cash flow instead of just reacting to it.

- Stronger Supplier Relationships: Paying people accurately and on time builds trust. That goodwill can lead to better payment terms, priority service when you're in a jam, and even better pricing down the line.

- Enhanced Fraud Prevention: A solid, structured process with checks and balances—like matching every invoice to a purchase order—slams the door on most fraudulent or duplicate payment schemes.

- Increased Operational Efficiency: Getting rid of the manual bottlenecks frees up your team from chasing down paperwork. They can finally focus on more valuable, strategic work.

At its heart, a strong accounts payable process transforms a simple cost center into a source of strategic insight, protecting your company's bottom line while fostering growth.

Understanding the Core Components

The whole AP journey, from the moment you decide to buy something to the moment you pay for it, is often called the procure-to-pay (or P2P) cycle. It's made up of a few distinct stages, and each one is critical for keeping things accurate and under control.

To make sense of it all, let’s look at the key stages involved in the accounts payable lifecycle.

Core Components of the Accounts Payable Lifecycle

This table breaks down the end-to-end process, from the initial invoice landing on your desk to the final payment leaving your account.

| Stage | Description | Key Objective |

|---|---|---|

| Invoice Capture | Receiving and entering vendor invoices, whether they're paper, emailed PDFs, or from an online portal. | To get all incoming bills into one system so nothing gets lost. |

| Invoice Verification | Matching the invoice details against purchase orders and delivery receipts (this is called the three-way match). | To confirm the bill is legitimate, accurate, and actually approved for payment. |

| Payment Processing | Scheduling and sending the payment to the vendor via methods like ACH, wire transfer, or check. | To pay the right vendor the right amount on the best possible date. |

| Reconciliation & Reporting | Recording the payment in your general ledger and analyzing AP data to track performance. | To keep financial records accurate and find opportunities to improve. |

As you can see, there are a lot of moving parts. This growing need for efficiency and accuracy is exactly why so many businesses are turning to digital solutions.

The accounts payable software market is expected to jump from $1.53 billion in 2024 to $2.36 billion by 2029. That's not just a random statistic; it shows a massive shift toward automating manual work to get a better handle on finances. For a deeper dive, you can find more stats on the AP software market from The Business Research Company.

Understanding these core components is the first step. Once you grasp them, you can start optimizing your AP function and unlock its true strategic power.

Mapping Your Accounts Payable Workflow From Invoice To Payment

Let's break down the accounts payable process. Forget the dry textbook definitions—think of it as a journey. Every single invoice, from the moment it lands in your business to the second it gets paid, follows a specific path. Nailing this workflow is the key to keeping your finances organized, transparent, and under control.

The journey starts the instant a vendor invoice shows up. It could be a paper bill in the mail, a PDF in an email, or a submission through a supplier portal. The first, most critical step is to get all these documents into one central place. If you don't, you risk them getting lost in a messy inbox or buried under a pile of mail on someone's desk.

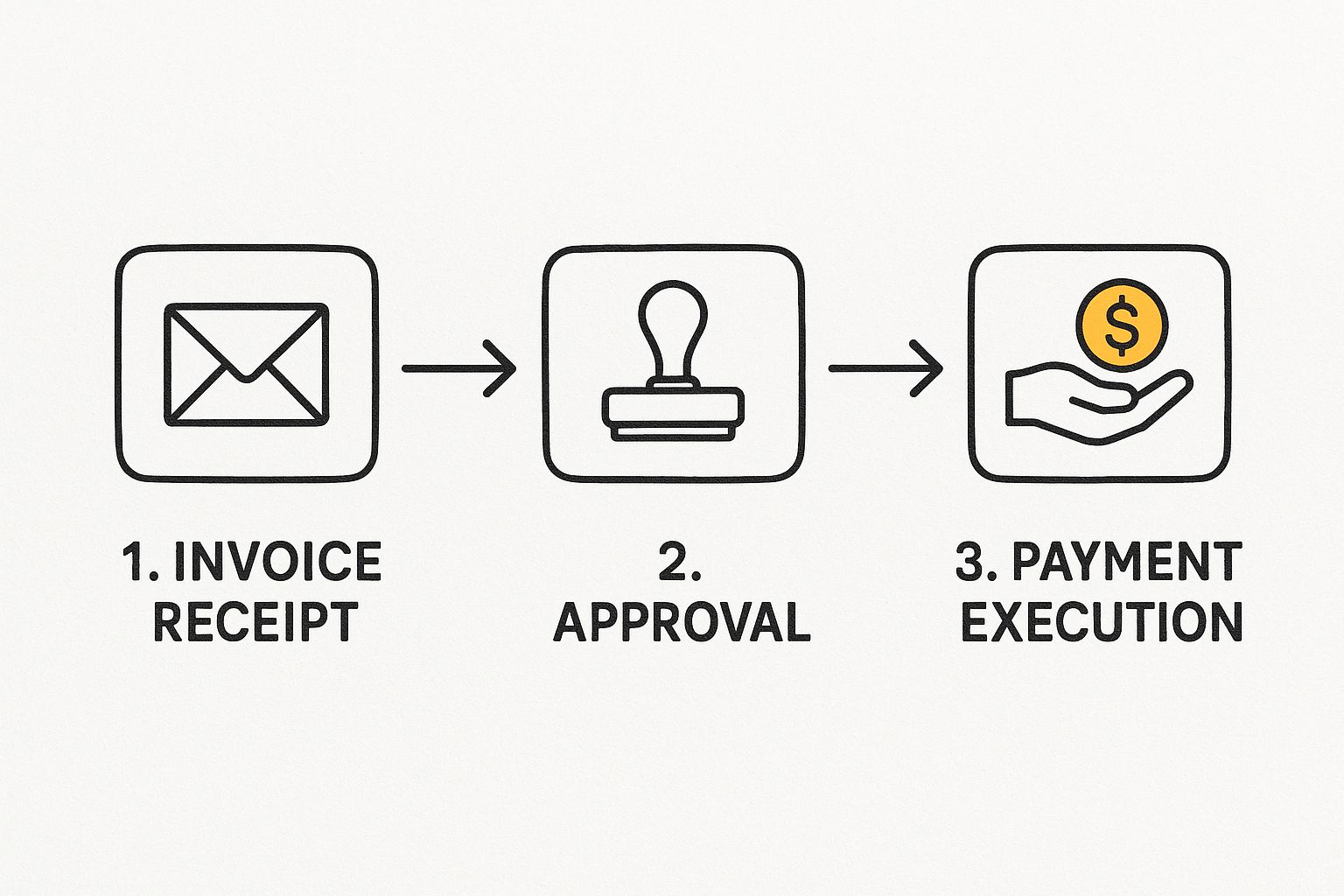

From there, the invoice moves through three main checkpoints: capture, approval, and finally, payment.

This simple flow chart shows exactly how an invoice moves through your AP system.

Each step is a quality check, ensuring everything is accurate before a single dollar leaves your bank account.

The Crucial Three-Way Match

Before an invoice gets anywhere near being paid, it needs to be verified. The gold standard for this is the three-way match. It’s a simple but powerful technique that dramatically cuts down on overpayments, mistakes, and even fraud. Think of it as a three-point security check for your company’s cash.

It works by comparing three essential documents:

- The Purchase Order (PO): This is the official document your team created when you decided to buy something. It clearly states what you ordered, how much of it, and the price you agreed to pay.

- The Goods Receipt Note (GRN): This document is proof of delivery. It confirms what you actually received from the supplier.

- The Vendor Invoice: This is the bill from your supplier, requesting payment for what they delivered.

If the details across all three—the items, the quantities, and the prices—are a perfect match, the invoice is good to go. Any mismatch is a red flag, signaling that your team needs to investigate before any money changes hands.

Navigating Approval Workflows

Once an invoice passes the three-way match, it’s not time to pay just yet. It moves into the approval stage. This isn't just a rubber-stamp exercise; it's a structured process to make sure the right people see the bill before it’s paid. How complex this is really depends on your business size and the amount on the invoice.

An effective approval workflow ensures that invoices are reviewed by the appropriate department heads or budget owners, providing an essential layer of accountability and cost control.

Imagine an invoice for a new marketing campaign. It would first need approval from the marketing manager who ordered the work. But if that invoice is over a certain amount, say $5,000, it might also need a second signature from the CFO.

This is where things often get stuck. Invoices can sit for days waiting for an approver who’s out of the office or swamped with other tasks. This is exactly where modern AP tools make a huge difference, by automatically routing invoices and sending nudges to keep things moving.

Executing and Reconciling the Payment

With all the checks and approvals complete, the invoice is finally cleared for payment. This last phase involves scheduling and sending the money to the vendor based on the agreed-upon payment terms. You’ve got a few options for how to pay, each with its own pros and cons:

- ACH (Automated Clearing House): A secure, low-cost way to send electronic payments. It’s perfect for most of your regular, domestic bills.

- Wire Transfer: A much faster option, but it usually costs more. Best for large, urgent, or international payments.

- Check: The old-school method. It's slower and more open to fraud, but some businesses still rely on it.

- Virtual Cards: These are single-use digital card numbers that add a great layer of security for online or one-off purchases.

After the payment goes out, the final step is reconciliation. Your team records the payment in your company’s general ledger, which officially closes out the payable. This keeps your books clean and creates a perfect audit trail, showing exactly where every dollar went.

Tracking The Metrics That Actually Matter In AP

You can’t improve what you don’t measure. In accounts payable, this isn't just a business cliché—it's the absolute truth. To figure out if your AP department is genuinely efficient or just busy, you need to track the right key performance indicators (KPIs). These metrics go way beyond simply counting paid invoices; they offer a real look into your company's financial health.

You can’t improve what you don’t measure. In accounts payable, this isn't just a business cliché—it's the absolute truth. To figure out if your AP department is genuinely efficient or just busy, you need to track the right key performance indicators (KPIs). These metrics go way beyond simply counting paid invoices; they offer a real look into your company's financial health.

Think of these KPIs as the dashboard in your car. It doesn’t just tell you the engine is running. It gives you critical data on speed, fuel efficiency, and engine temperature, helping you drive better. In the same way, AP metrics help you spot bottlenecks, justify investing in new tech, and prove your department's value to the rest of the company.

So, let's dive into the core metrics that separate the high-performing AP teams from everyone else.

To get a complete picture of your accounts payable health, you need to look at a handful of critical numbers. These KPIs give you a snapshot of your efficiency, cash flow management, and overall operational performance.

Here's a breakdown of the most important metrics every AP leader should be watching.

Key Accounts Payable Performance Indicators

| KPI (Key Performance Indicator) | What It Measures | Why It's Important |

|---|---|---|

| Cost Per Invoice | The total direct and indirect cost to process one invoice, from receipt to payment. | It’s a direct measure of your AP team's efficiency. A high cost signals manual work and process friction. |

| Invoice Cycle Time | The average time it takes for an invoice to get from your inbox to final approval. | This reveals bottlenecks in your workflow. Shorter times mean you can capture early payment discounts and keep vendors happy. |

| Days Payable Outstanding (DPO) | The average number of days your company takes to pay its suppliers after receiving an invoice. | This is a key cash flow management tool. A balanced DPO helps you hold onto cash without damaging vendor relationships. |

Monitoring these KPIs isn't just about generating reports. It's about turning data into action—pinpointing weaknesses, celebrating wins, and continuously refining your process to be faster, cheaper, and more accurate.

H3: Cost Per Invoice

This is arguably the most fundamental AP metric of all. It calculates the total cost—both direct and indirect—to process a single invoice from the moment it arrives until it’s paid. This includes everything from your team's salaries and printing costs to software subscriptions and bank fees.

Why is this so important? It puts a clear dollar amount on your operational efficiency. A high Cost Per Invoice is a huge red flag, often pointing to too much manual data entry, complicated approval chains, or outdated systems.

Top-performing companies using automation can get this cost down below $3.00. Meanwhile, businesses still stuck in manual processes often see costs explode to $15.00 or more for every single invoice.

A rising Cost Per Invoice is a clear signal that your current process can't scale. As your business grows and invoice volume increases, these inefficiencies will multiply, eating directly into your profits.

H3: Invoice Cycle Time

This KPI measures the average time it takes for an invoice to complete its journey through your entire workflow, from the moment it's received to the second it's approved for payment. A short cycle time is a direct sign of a well-oiled AP machine.

Think of it like a relay race. A long cycle time means the baton is getting dropped somewhere along the way. This could be happening for a few reasons:

- Manual Data Entry: Invoices are just sitting in a pile, waiting for someone to type them in.

- Approval Delays: Invoices get stuck in a manager's inbox, waiting for a review and sign-off.

- Dispute Resolution: Time is wasted going back and forth with vendors to fix mistakes or clarify details.

Cutting down this cycle time isn't just about moving faster. It opens up the opportunity to grab early payment discounts, which can add up to serious savings. It also strengthens vendor relationships—suppliers love a company that processes their invoices promptly, even before the payment is sent.

H3: Days Payable Outstanding (DPO)

Days Payable Outstanding (DPO) is a financial ratio that tells you the average number of days it takes your company to pay its suppliers. A higher DPO means you're holding onto your cash longer, which can be a smart move to improve your working capital.

But you have to be careful. A DPO that gets too high can be a red flag for your suppliers. It might signal that your company has cash flow problems, which could damage those crucial relationships and lead to them giving you stricter payment terms down the road.

The goal is to find the sweet spot. A great AP strategy optimizes DPO to hold onto cash for a reasonable time without making your vendors nervous. Tracking this number helps you manage your cash flow strategically, ensuring you can meet all your obligations while keeping as much capital as possible available for growth.

From Manual Drudgery To Automated Efficiency

When you think of a traditional accounts payable department, what comes to mind? For most, it’s a picture of overflowing in-trays, the frantic click-clack of manual data entry, and the endless chase for approvals. This old-school, paper-based approach isn’t just slow; it’s a huge drain on your team’s time and a breeding ground for expensive mistakes.

Imagine your AP specialist spending hours every day just keying in invoice details. It's tedious, mind-numbing work, and every keystroke is a chance for a typo. A single invoice might sit on a manager's desk for days, or a misplaced decimal point could lead to an overpayment that nobody catches for weeks. This isn't just inefficient—it’s a broken model that simply can’t scale with a growing business.

The Automation Shift in AP

Now, let's picture a different reality. An invoice lands in your inbox. Instead of being printed out, it’s automatically captured and processed. All the key details—vendor name, invoice number, due date, total amount—are extracted with near-perfect accuracy in a matter of seconds. This isn't science fiction; it's the power of accounts payable automation.

Technologies like Optical Character Recognition (OCR) and AI-powered workflows are completely changing the game. Think of them as a digital assistant for your finance team, taking over all the repetitive, low-value tasks that used to eat up their entire day. This frees up your team to stop being data-entry clerks and start focusing on what really matters: high-level financial strategy.

By swapping a manual, paper-chasing system for a smart, digital workflow, businesses can slash processing times, boost accuracy, and gain a crystal-clear view of their spending.

This shift is no longer a "nice-to-have" but a strategic must. The accounts payable world is changing fast, and by 2025, AI will be at the heart of it. In fact, over half of all companies globally are expected to bring AI into their AP processes, a change driven by rising costs and the urgent need to work smarter, not harder. You can get more insights on these global AP trends from research by Medius.

Accuracy, Speed, And Enhanced Security

Automation does more than just speed things up. It brings a level of precision that human processes can't hope to match. By taking manual data entry out of the equation, you virtually eliminate the risk of human error, making sure your payments are right, every single time.

The ripple effects are felt across the entire AP function:

- Lightning-Fast Approvals: Automated systems are smart. They can instantly route an invoice to the right person for approval based on rules you’ve already set. A manager gets a notification on their phone and can approve with a single click, turning a process that took days into one that takes minutes.

- Powerful Fraud Detection: AI algorithms are brilliant at spotting things that look out of place. They can flag duplicate invoices, catch unusual payment amounts, or identify a vendor invoice that deviates from historical patterns, acting as a powerful guard against fraud.

- Real-Time Visibility: Forget guessing games. With an automated system, you get a live dashboard view of your entire AP world. You can see exactly where every invoice is, track spending against your budgets in real time, and pull financial reports in an instant.

From Cost Center to Strategic Partner

Perhaps the biggest win from automation is how it transforms the role of your AP team. When your finance pros are no longer drowning in paperwork, they can finally put their expertise to work on strategic initiatives. For business owners, learning how to automate invoice management can save significant time and reveal efficiencies you never knew you had.

Instead of just pushing payments through, your team can start analyzing spending trends, finding new opportunities for cost savings, and working with suppliers to negotiate better payment terms. They evolve from a back-office cost center into a proactive, strategic partner who directly contributes to the company's financial strength and competitive advantage. Embracing automation is the single most important step toward building a finance function that's modern, resilient, and ready for growth.

Adopting Best Practices For Elite AP Operations

Moving your accounts payable team from simply putting out fires to proactively managing cash flow isn't just about buying new software. It's about building a solid foundation of proven best practices. Think of these as the playbook for turning your AP department from a cost center into a strategic financial hub.

Moving your accounts payable team from simply putting out fires to proactively managing cash flow isn't just about buying new software. It's about building a solid foundation of proven best practices. Think of these as the playbook for turning your AP department from a cost center into a strategic financial hub.

When you adopt these habits, you’re giving your team a clear, standardized approach that cuts down on confusion, plugs security holes, and empowers them to perform at a much higher level. Let's break down the core disciplines that separate world-class AP teams from the rest.

Establish Robust Internal Controls

Internal controls are your business's first and best line of defense against fraud, costly errors, and accidental duplicate payments. Without them, you’re essentially leaving your company’s bank account wide open. These controls are all about creating checks and balances in your AP workflow so that every single transaction is verified and accurate.

A cornerstone of this is the segregation of duties. In simple terms, the person who approves an invoice should never be the same person who schedules the payment. This one change makes it exponentially harder for fraud to slip through the cracks, as it would require two people to conspire.

Another must-have control is the three-way match for any significant purchase. This process confirms that the purchase order, the goods receipt, and the vendor invoice are all in perfect agreement. No mismatches, no payment.

Centralize All Incoming Invoices

Invoices have a knack for showing up everywhere: buried in personal inboxes, sitting in a pile of snail mail, or scattered across different supplier portals. When bills land in a dozen different places, chaos is guaranteed. An invoice lost in a forgotten email thread can quickly lead to late fees and a damaged reputation with your suppliers.

Centralizing where and how you receive invoices is probably the single biggest step you can take to get a grip on your payables. It creates one predictable entry point for every bill, making sure nothing ever gets lost in the shuffle.

Set up a single, dedicated email address like invoices@yourcompany.com or use a software portal for all vendor submissions. The key is to communicate this policy clearly and firmly to all your suppliers. This simple shift banishes confusion and gives your AP team total visibility the second an invoice arrives.

Nurture Strong Vendor Relationships

Your suppliers aren't just line items on a spreadsheet; they are crucial partners in your success. The simple act of paying them accurately and on time is the bedrock of a healthy, productive business relationship. Good vendor relationships can pay dividends in the form of better payment terms, preferential treatment, and a little more understanding when you need it most.

Proactive communication is everything. If a payment is going to be late for some reason, tell the vendor ahead of time and explain why. It’s a small courtesy that builds a massive amount of goodwill. Also, give vendors a single point of contact for payment questions so they aren't forced to hunt down answers. For more on improving how you work with external partners, our guide to streamline accountant collaboration has great tips you can apply to vendor relationships.

Create A Definitive AP Policy Document

All these best practices need to live somewhere. A formal, comprehensive accounts payable policy document is the single source of truth for your entire team, outlining every procedure, rule, and responsibility in black and white.

Your AP policy should clearly lay out:

- Approval Hierarchies: Who can approve invoices and for how much.

- Payment Procedures: Your rules for different payment methods, payment run schedules, and how to capture early payment discounts.

- Dispute Resolution: The step-by-step process your team should follow when an invoice has a discrepancy or a vendor raises an issue.

This isn't a "set it and forget it" document. It should be reviewed and updated regularly to keep up with new tools and business needs. It ensures consistency, makes training new hires a breeze, and gives you a clear framework for auditing your own AP performance.

How To Choose The Right AP Automation Software

Picking the right software for your accounts payable can feel like a make-or-break decision. With so many platforms out there making huge promises, it’s easy to get lost in a sea of feature lists and slick marketing. But finding the right tool doesn't have to be a headache if you know what to focus on.

Your goal is to find a platform that feels less like another piece of software and more like a dependable new member of your team—one that actually simplifies your day, grows with your company, and gives you back your most valuable asset: time.

Evaluate Non-Negotiable Core Features

Before you even glance at a price tag, you need a firm checklist of your absolute must-haves. These are the core functions that will decide whether a tool solves your real-world problems or just creates a bunch of new ones. Without these, even the priciest platform will just gather digital dust.

Start your evaluation by zeroing in on these essentials:

- Seamless ERP or Accounting Software Integration: This is non-negotiable. Your AP software has to talk to your existing financial system—whether that's QuickBooks, Xero, or a bigger ERP—without a hitch. If you’re still manually shuttling data between systems, you’ve defeated the entire purpose of automation.

- High-Accuracy OCR Technology: A tool’s ability to use Optical Character Recognition (OCR) to read and pull data from invoices is where the magic happens. Don't just take their word for it. Ask for their accuracy rates and, more importantly, test it with a few of your own tricky invoices.

- Intuitive Mobile Approvals: Work doesn't just happen at a desk anymore. Approvals can't be chained to one either. A solid platform lets managers review, question, and approve invoices from their phone or tablet, wherever they are.

Think of these three features as the engine of any good AP automation system. Everything else is just bells and whistles.

Assess Scalability and Future Growth

The software that fits your business perfectly today could become a major bottleneck tomorrow. When you're looking at different options, don't just think about your current invoice volume. Think about where your company will be in two or even five years. The right solution has to grow with you.

Ask yourself these questions about scalability:

- Can the system handle a 10x increase in invoice volume without slowing down?

- Does the pricing model punish you for growing with outrageous per-invoice fees?

- Can you easily add new users, departments, or even entire business entities as you expand?

Choosing a scalable platform isn't just a purchase; it's an investment in your company's future. It ensures your AP process remains a well-oiled machine, not a roadblock to growth.

This forward-thinking approach is more important than ever. Despite all the talk about automation, recent research shows that 63% of AP teams still spend over 10 hours a week just processing invoices. A staggering 66% are still manually typing invoice data into their accounting systems.

The good news? The tide is turning fast. AI adoption in accounts payable has quadrupled in just the last few years, marking a massive shift in how finance teams operate. You can explore more accounts payable automation trends to see why getting this right is so critical.

Analyze Pricing Models and Support

Finally, a tool is only as good as its price tag and the support team standing behind it. Look for clear, predictable pricing that fits your budget. Be wary of platforms with hidden fees for things like implementation, ongoing support, or connecting to your existing software.

Just as important is the quality of their customer support. When you have an urgent payment issue on a Friday afternoon, you need a team that's responsive and actually knows what they're talking about. Before you sign anything, check reviews and ask direct questions about their support channels and average response times. A great product with terrible support will quickly become your biggest headache.

By carefully weighing these three practical factors—core features, scalability, and support—you can cut through the noise and confidently choose the right software to get your AP process under control.

Frequently Asked Firedrills (And How to Put Them Out)

Even with the best game plan, you're going to have questions.## Frequently Asked Firedrills (And How to Put Them Out)

Even with the best game plan, you're going to have questions. It's totally normal. Here are some of the most common ones we hear from business owners trying to get a handle on their accounts payable.

I'm a Small Business. Where Do I Even Start?

For any small business feeling overwhelmed, the very first step is simple: centralize everything. Stop the madness of invoices living in three different email inboxes, a pile on your desk, and maybe a few screenshots on your phone.

Create one single email address (something like invoices@yourcompany.com) and tell every single vendor to send their bills there. That’s it. This one change creates a single source of truth and instantly stops things from getting lost. Once you've done that, set up a basic approval flow—even if it's just you forwarding an invoice to a team lead for a quick "Yep, this is good to pay" email before you schedule the payment.

How Does This AP Stuff Actually Affect My Cash Flow?

Think of it this way: managing your accounts payable properly gives you a control panel for your cash flow. When you know exactly what you owe and when it’s due, you’re in the driver's seat.

This clarity lets you be strategic. You can see all your upcoming payments and decide when to pay them. Want to hold onto your cash as long as possible? Pay right before the due date. Have a vendor offering a 2% discount for paying 10 days early? You can see if you have the cash to take advantage of it. Without an organized AP process, you're just reacting to bills as they pop up, which is a recipe for surprise cash shortages.

A well-managed payables process is a powerful lever for optimizing working capital. It transforms a reactive payment function into a proactive tool for financial strategy and stability.

What are the Real-World Benefits of Automating This?

Moving from a manual process to an automated one is about so much more than just saving time. Yes, eliminating data entry is a huge win, but the real magic is in the accuracy and control you gain almost overnight.

It's the difference between flying blind and having a full dashboard. Here’s what you really get:

- Fewer Mistakes: Automation kills typos and human error. You pay the right amount to the right vendor, every single time.

- Lightning-Fast Approvals: Invoices get routed to the right person automatically. They can approve with a click on their phone, cutting down approval times from days to minutes.

- A Fraud Shield: Smart tools can instantly flag duplicate invoices or weird payment requests that a busy human might miss, adding a powerful layer of security.

- Total Visibility: You get a real-time dashboard showing exactly what you owe at any given moment. No more guesswork.

To see just how transformative these systems can be, check out the case studies and guides on the Invowl blog. Automation turns your AP department from a slow, clunky cost center into a lean, strategic part of your business.

Ready to stop chasing invoices and start optimizing your finances? Invowl is the AI-powered tool that automatically finds every invoice in your inbox, extracts the key details, and highlights savings opportunities. Reclaim hours of manual work and gain complete control over your payables. Try Invowl today and see how easy it can be.