Building Your AP Foundation the Right Way

Setting up a solid accounts payable process isn't about ticking boxes on a generic checklist. It's about building a strong foundation that can handle your business's growth and stop problems before they even start. A well-designed AP structure is more than just an administrative chore; it’s a strategic advantage that saves you from major headaches when the number of invoices starts to climb.

From Vendor Onboarding to Approval Hierarchies

Many businesses treat vendor onboarding as a quick data entry task, but this is often where things first go wrong. A rushed or sloppy onboarding process creates a domino effect of incorrect payment details, missed tax compliance, and painful back-and-forth communication down the line. Instead, create a standard vendor packet that gathers everything you need upfront: contact info, payment preferences (ACH, check, etc.), W-9 forms, and service agreements. This simple change turns a potential bottleneck into a smooth, one-and-done setup.

Just as critical is setting up clear approval hierarchies. Who needs to sign off on a $500 invoice versus a $50,000 one? Documenting this prevents delays and makes sure the right people have oversight without getting bogged down in every small payment. A sensible, tiered hierarchy might look something like this:

- Under $1,000: Requires approval from the department manager.

- $1,001 - $10,000: Needs a sign-off from both the department head and the finance manager.

- Over $10,000: Must be approved by a VP or C-level executive.

This approach keeps everyday payments flowing while ensuring proper financial control on larger expenses.

Policies and Exception Handling That Actually Work

Your AP policies should be a practical guide your team actually uses, not a document collecting dust in a forgotten server folder. Concentrate on creating simple, direct rules for invoice submission deadlines, expense coding, and payment schedules. A clear policy helps your team make decisions with confidence. But since no process is flawless, you need a plan for when things don't go as expected.

This is where a clear exception handling procedure comes in. Define what an "exception" is—like an invoice with a missing PO number or a price that doesn't match the quote—and map out the exact steps to resolve it. This proactive planning is more important than ever. Managing working capital is now a key job for AP teams, who use payment timing and vendor terms as strategic tools.

Think about this: over 40% of CEOs say delayed payments are a major problem, hurting both their cash flow and supplier relationships. At the same time, more than 60% of businesses are seeing a rise in fraud risks within their AP processes. You can read more about how AP trends are shaping business strategy and see why nailing these fundamentals is so crucial. By building your AP foundation the right way, you’re not just making things run smoother—you're strengthening your company’s financial stability and security.

Conquering Invoice Processing Once and For All

If your desk looks like a graveyard for paper invoices and your team's days are eaten up by manual data entry, it’s time for a serious change. Moving away from the paper-based chaos is one of the most effective accounts payable best practices you can implement. The goal isn't just to scramble through month-end; it's to build a smooth, predictable workflow from the moment an invoice arrives until the final payment is sent.

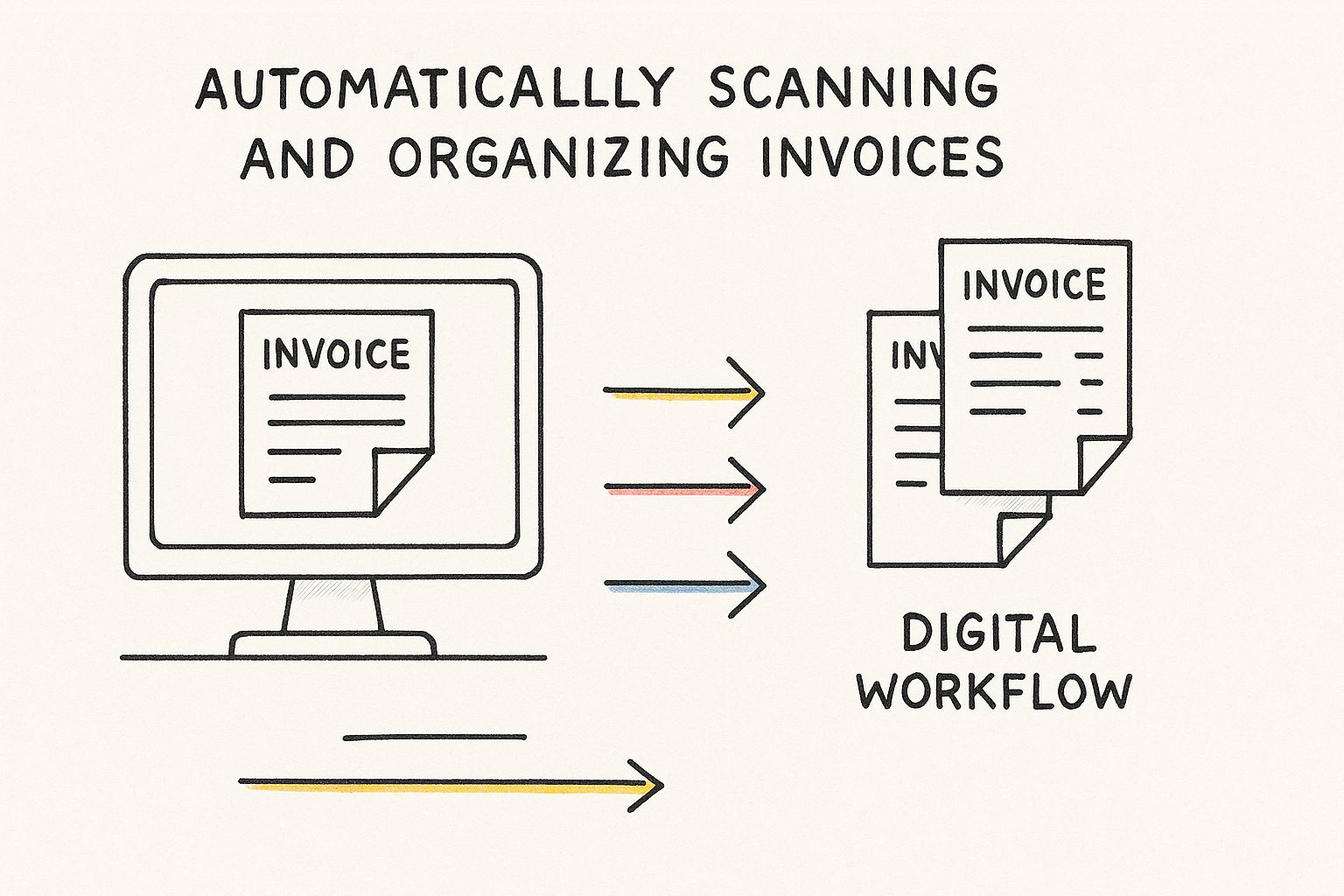

This visualization shows how a digital workflow can automatically scan and organize invoices, replacing chaotic paper piles with a streamlined process.

The main takeaway here is the shift from error-prone, manual tasks to an efficient, automated system. This brings order and much-needed clarity to your AP operations, letting your team focus on what matters.

The main takeaway here is the shift from error-prone, manual tasks to an efficient, automated system. This brings order and much-needed clarity to your AP operations, letting your team focus on what matters.

Moving Beyond Manual Entry

The attachment to paper is a surprisingly tough habit to break. Recent data reveals that 37% of businesses still handle paper invoice receipts. This dependence on physical documents isn't just slow; it piles on mailing costs and increases the risk of invoices getting lost in transit. The problem deepens when you learn that 57% of the data from those paper invoices is manually keyed into an accounting system, a process notorious for human error and causing major delays. You can explore more about where AP is headed in these 2025 AP trends to see just how expensive outdated methods are.

Let’s look at the real-world differences between sticking with paper and going digital.

Paper vs Digital Invoice Processing Comparison

A detailed comparison showing processing times, error rates, and costs between traditional paper-based and digital invoice processing methods

| Processing Method | Average Processing Time | Error Rate | Cost Per Invoice | Manual Data Entry Required |

|---|---|---|---|---|

| Paper-Based | 10-25 days | 3-5% | $12-$15 | 100% |

| Digital/Automated | 2-5 days | < 1% | $2-$5 | Minimal to None |

The numbers don't lie. By going digital, you not only speed up the entire cycle but also drastically cut down on costly mistakes and operational expenses. The elimination of manual data entry is a game-changer for team productivity and accuracy.

Three-Way Matching Without the Headaches

One of the most time-consuming parts of processing an invoice is the three-way match. This is where your team meticulously compares the purchase order (PO), the goods receipt note, and the vendor's invoice to ensure everything lines up. Done manually, it’s a tedious task of shuffling papers and double-checking line items.

A digital system turns this headache into a simple background check. A centralized platform can automatically flag discrepancies for you. Imagine your PO approved 10 laptops at $1,200 each, but the invoice arrives listing 11 laptops. An automated system instantly flags this mismatch for review, preventing an overpayment. This lets you resolve vendor issues right away instead of finding the error weeks later during an account reconciliation.

This approach allows your team to manage by exception, focusing their valuable time only on the invoices that actually require human attention. If you're looking to reclaim countless hours, check out our guide on how to automate invoice management for practical tips.

Making AP Automation Work for Your Business

Let's be honest: the idea of "automation" can feel overwhelming. Many business owners picture a massive, costly overhaul that disrupts everything. But effective automation isn't about replacing your entire system overnight. One of the most important accounts payable best practices is to start small and scale smart, focusing on tools that deliver tangible results without causing chaos.

The push for AP automation is driven by simple math. The average cost to process an invoice manually is around $15, a figure that reflects hours of tedious data entry, chasing approvals, and fixing errors. It’s no surprise that while only 20% of AP teams have fully automated their processes, another 41% are actively planning to do so in the coming year. These figures highlight a clear shift away from inefficient manual work. You can discover more insights about AP automation trends and see why so many businesses are making the change.

How to Choose the Right Tools

The key is finding software that plays nicely with what you already use, like your accounting platform. Look for solutions that tackle your biggest pain points first. For many small businesses, this is simply invoice capture and data extraction. A tool like Invowl, for example, connects to your inbox and automatically pulls key details from invoices, eliminating manual entry and sending the data straight to your accounting software.

Here’s what to prioritize when evaluating solutions:

- Integration Capabilities: Does it connect easily with your existing accounting software (like QuickBooks or Xero)? A tool that doesn’t sync is just another data silo.

- Ease of Use: Can your team learn it quickly without extensive training? A complicated tool will just gather digital dust.

- Scalability: Will it grow with you? Start with invoice capture, and you might later want features for approval workflows or payment processing.

A Realistic Implementation Plan

A successful rollout doesn't have to be disruptive. Start by automating one part of the process—like invoice data entry—and measure the impact. This allows you to show quick wins and get team buy-in. Once everyone is comfortable, you can explore automating approvals or payment scheduling.

To give you a clearer picture, here’s a typical timeline for implementing AP automation, broken down by business size.

| Implementation Phase | Small Business (Timeline) | Mid-Size Business (Timeline) | Enterprise (Timeline) | Typical Costs |

|---|---|---|---|---|

| Phase 1: Research & Selection | 1-2 weeks | 2-4 weeks | 4-8 weeks | Staff time; potential consultant fees ($2k-$10k) |

| Phase 2: Initial Setup & Integration | 1-3 days | 1-2 weeks | 2-4 weeks | Software subscription ($20-$100/mo); setup fees ($0-$1k) |

| Phase 3: Pilot Program (Single Process) | 2-4 weeks | 4-6 weeks | 6-10 weeks | Primarily internal staff time for testing and feedback |

| Phase 4: Team Training & Full Rollout | 1 week | 2-3 weeks | 4-8 weeks | Training costs (internal); potential vendor training fees |

| Phase 5: Optimization & Scaling | Ongoing | Ongoing | Ongoing | Ongoing subscription costs; potential for module add-ons |

As the table shows, a small business can get a basic system running in under a month. This gradual approach ensures a smooth transition and builds a more efficient AP department one step at a time. It also encourages better teamwork, a topic we explore in our guide to streamlining accountant collaboration.

Turning Vendor Relationships Into Strategic Advantages

It’s easy to think of accounts payable as a purely transactional part of the business, but this mindset misses a huge opportunity. Seeing your vendors as strategic allies instead of just companies that send you bills is a cornerstone of modern accounts payable best practices. The relationships you cultivate with suppliers can be a lifeline for your cash flow and unlock better pricing and terms down the road. Real partnerships are built on mutual respect and open communication, not just on-time payments.

The Art of Proactive Communication and Negotiation

Things don’t always go as planned. Let's say a major client payment is late, and suddenly your cash reserves are tighter than expected. Instead of ghosting your vendor and letting an invoice go past due, picking up the phone can make all the difference. A straightforward conversation explaining the delay and proposing a new payment date shows you value the relationship. This approach is worlds better than making them chase you down, which is the fastest way to burn a bridge.

This goodwill becomes your biggest asset when it's time to negotiate. With a track record of clear communication and dependable payments, you’re in a great spot to ask for more flexible terms. For example, you could ask to move from Net 30 to Net 45 during your slow season or see if they offer discounts for paying early.

Resolving Disputes and Tracking Performance

Disagreements are bound to happen, but they don't need to be damaging. A classic issue is a mismatch between the purchase order and the final invoice. Rather than starting a confrontation, treat it like a puzzle you need to solve together.

Try framing it this way: "Hey, I'm looking at the PO, which lists this at $500, but the invoice has it at $550. Can you help me figure out the difference so we can get this paid for you?" This cooperative tone avoids putting them on the defensive and gets you to a solution much faster.

To have these kinds of productive talks, you need to track how your vendors are doing. Here are a few key things to watch:

- On-Time Delivery Rate: Are they consistently hitting their promised delivery dates?

- Order Accuracy: How often do shipments arrive complete and correct?

- Invoice Accuracy: What percentage of their invoices are error-free?

The goal of collecting this data isn't to hold mistakes over their heads. It’s about having informed, constructive conversations. When you manage vendor relationships like true partnerships, you transform a simple cost center into a source of strategic flexibility and operational strength.

Fraud-Proofing Your AP Without Creating Bureaucracy

When you hear "accounts payable fraud," you might picture elaborate heists, but the truth is often much simpler. The real goal of fraud prevention isn't to wrap your AP process in so much red tape that it slows to a crawl. It’s about building in smart, practical controls that work behind the scenes without getting in your way. This is one of the most important accounts payable best practices for protecting your company’s cash.

With fraud attempts becoming more common—over 60% of businesses have reported an increase—just hoping for the best isn't a viable strategy anymore. You need to put active, yet efficient, measures in place.

Practical Controls That Actually Work

The most effective ways to prevent fraud are often the most direct. They introduce checks and balances that make it tough for sketchy activities to go unnoticed.

Segregation of Duties: This is the bedrock of AP security. The person who adds a new vendor to your system should never be the same person who approves their invoices or cuts the check. If you're on a small team and thinking, "That's impossible for us," even a simple split in duties can make a world of difference. For example, have one person enter invoices and a different person execute the payment run. This simple "two-touch" process adds an immediate layer of verification.

Positive Pay Systems: This is a fantastic service to set up with your bank. A positive pay system works like a security checkpoint for your checks. Before cashing any check, your bank compares it against a list you provide of all officially issued checks. If a check isn't on your list—or if the amount or payee name doesn't match—it gets flagged for your review. It’s a powerful defense against counterfeit checks and tampering.

Vendor Verification: Create a non-negotiable process for onboarding new vendors or changing payment details. A common scam involves an email that looks like it's from a trusted vendor asking you to update their bank account info. Always verify these requests by calling a known contact at the vendor's company using a phone number you already have on file—not one provided in the suspicious email.

Training Your Team as the First Line of Defense

Your people are your best asset in spotting trouble. Train them to recognize common red flags and, more importantly, create a culture where they feel comfortable raising them.

Encourage your team to be on the lookout for:

- Invoices that don't have a corresponding purchase order.

- A series of sequentially numbered invoices from the same vendor in a short time frame.

- Anyone applying pressure for an urgent payment that bypasses the normal process.

When you empower your team to question things that feel "off," you turn them into an active line of defense. Fraud-proofing your AP is all about building a system of smart, overlapping controls that protect the business while still allowing your team to get their work done efficiently.

Strategic Payment Timing for Cash Flow Mastery

Mastering the art of when to pay your bills is one of the most powerful moves you can make in accounts payable. This isn't about stringing your suppliers along and damaging relationships. Instead, it's a strategic dance to boost your working capital while keeping those crucial vendors happy. By paying invoices at the most opportune moment—not too early, not too late—you keep more cash in your business to fund growth, cover surprises, or simply sleep better at night.

Aligning Payments with Your Business Rhythm

First things first, you need to get your payment schedule in sync with your company's own cash flow cycle. Think about your business's natural rhythm. If you run a retail store that sees a huge spike during the holidays, you might pay certain vendors faster during those high-cash months. Then, during the slower seasons, you can use the full payment terms to your advantage. This does require a bit of looking ahead.

A simple cash flow forecast can be your best friend here. By looking at past sales and customer payment patterns, you can get a good idea of when cash will be flowing in and when it will be tight. For example, knowing a large client payment is set to arrive on the 25th gives you the confidence to hold off on a supplier payment due on the 15th, using the full Net 30 terms. This simple shift changes your payables from a reactive chore into a proactive tool for managing your liquidity. You're making your cash work for you for the longest time possible.

To Discount or Not to Discount? That Is the Question

Early payment discounts, like the classic "2/10 Net 30," can look very appealing. This common term means you can slice 2% off the invoice total if you pay within 10 days; otherwise, the full amount is due in 30 days. But is grabbing that discount always the smart play?

The real answer hinges on your company's cost of capital. A 2% discount for paying 20 days early might not sound like much, but it's equivalent to earning an annualized return of over 36%. If your business is sitting on a healthy cash reserve, that's a fantastic, risk-free return you should absolutely jump on. Even if taking that discount means you have to tap into a business line of credit that costs you 15% annually, you’re still coming out way ahead.

The calculation completely flips when cash is tight. If paying early means you can’t make payroll without taking on high-interest debt, that "discount" suddenly becomes a very expensive choice. The key is to analyze each opportunity individually. A good rule of thumb is: if the annualized return from the discount is greater than your cost of capital, take it. By being selective, you squeeze maximum value from your payments without putting a strain on your cash flow.

Measuring What Matters in Your AP Operation

You can't improve what you don't measure, but let’s be honest, tracking the wrong things is just as useless. It’s easy to get lost in impressive-looking charts that don’t actually help you make better decisions. A core part of running a sharp accounts payable team is focusing on key performance indicators (KPIs) that offer real, actionable insights into how things are really going. These are the numbers that help you spot bottlenecks before they become full-blown crises and prove your team's value to the rest of the company.

Identifying Your Core AP Metrics

Forget about vanity metrics that look good on paper but don't mean much. A high-performing AP team zeroes in on KPIs that directly reflect efficiency, cost, and accuracy. By tracking the right data, you can build a compelling story about your department’s contribution to the company’s financial health.

Here are the KPIs that truly matter:

- Cost Per Invoice: This is the ultimate measure of your team's efficiency. It wraps up all your AP-related costs—salaries, software, office supplies—and divides them by the number of invoices you process. A stubbornly high number here is a clear sign that manual processes are eating into your budget.

- Invoice Cycle Time: How long does it take from the moment an invoice hits your inbox to the moment it’s paid? Tracking this KPI helps you pinpoint exactly where the delays are, whether it's a slow approval workflow or a data entry snag. Setting a goal to shorten this time is a great objective for the whole team.

- Early Payment Discount Capture Rate: This KPI shows how well you're managing cash flow strategically. A low rate means you're literally leaving money on the table. It’s often a symptom of an approval process that’s too slow to take advantage of these valuable savings opportunities.

- Payment Error Rate: This metric tracks the frequency of mistakes like duplicate payments, paying the wrong vendor, or entering an incorrect amount. A high error rate not only costs the company directly but can also damage the relationships you have with your vendors.

From Data to Actionable Insights

Once you start tracking these numbers, you can begin setting realistic goals for improvement. For instance, if you find your invoice cycle time is hovering around 25 days, you might set a quarterly goal to bring it down to 20. This creates a clear, measurable objective that your team can rally behind and work toward.

It’s also crucial to build a culture where this data is used for continuous improvement, not for pointing fingers. Share your team's performance on a simple dashboard, celebrate the wins when you hit a goal, and use the numbers to start constructive conversations about where you can do better. This data-driven approach turns your AP department from a necessary cost center into a strategic operation that actively finds ways to save money and boost efficiency. For more ideas on how data and processes can transform your finance functions, you can find a wealth of information on the Invowl blog.

Ready to stop chasing down invoices and start tracking what truly matters? Invowl automatically finds and extracts data from every invoice in your inbox, giving you the clear insights you need to optimize your AP process and save an average of $847 per month.