In today's competitive business environment, manual accounts payable processes are a significant bottleneck, fraught with errors, delays, and hidden costs. The constant chase for approvals, tedious data entry, and the risk of fraudulent invoices can drain resources and divert focus from strategic growth. While accounts payable automation offers a powerful solution, simply adopting new technology isn't enough. To truly unlock its potential, you need a strategic approach grounded in proven methods.

This article provides a comprehensive roundup of the top accounts payable automation best practices. We will move beyond generic advice to offer actionable strategies in process design, tool selection, data management, and performance measurement. You will gain a clear understanding of how to implement critical functions like three-way matching, AI-powered invoice processing, and automated approval workflows. We will also explore advanced tactics such as integrating supplier portals, managing exceptions with analytics, and optimizing early payment discount capture.

Whether you're a small business owner drowning in invoices or a finance leader aiming to optimize departmental efficiency, this guide provides a clear roadmap. These seven practices will help you transform your AP function from a reactive cost center into a strategic asset that enhances cash flow, strengthens supplier relationships, and improves financial control. By applying these detailed insights, you can build a more resilient and efficient financial operation prepared for future challenges and growth.

1. Implement Three-Way Matching Automation

At the heart of robust accounts payable automation best practices lies the principle of automated three-way matching. This process is a fundamental control mechanism that automatically cross-references three critical documents before approving an invoice for payment: the purchase order (PO), the goods receipt note (GRN), and the supplier’s invoice. By automating this verification, you ensure that your company only pays for the exact goods and services it ordered and received, at the agreed-upon price.

The core benefit of automated three-way matching is its power to significantly reduce payment errors, prevent duplicate payments, and mitigate the risk of invoice fraud. It transforms the accounts payable function from a manual, error-prone data entry task into a strategic, exception-based management role. Instead of reviewing every single invoice, your AP team can focus their valuable time on investigating the discrepancies that the system flags. This shift boosts efficiency, enhances financial controls, and provides a clear, auditable trail for every transaction.

How Automated Three-Way Matching Works

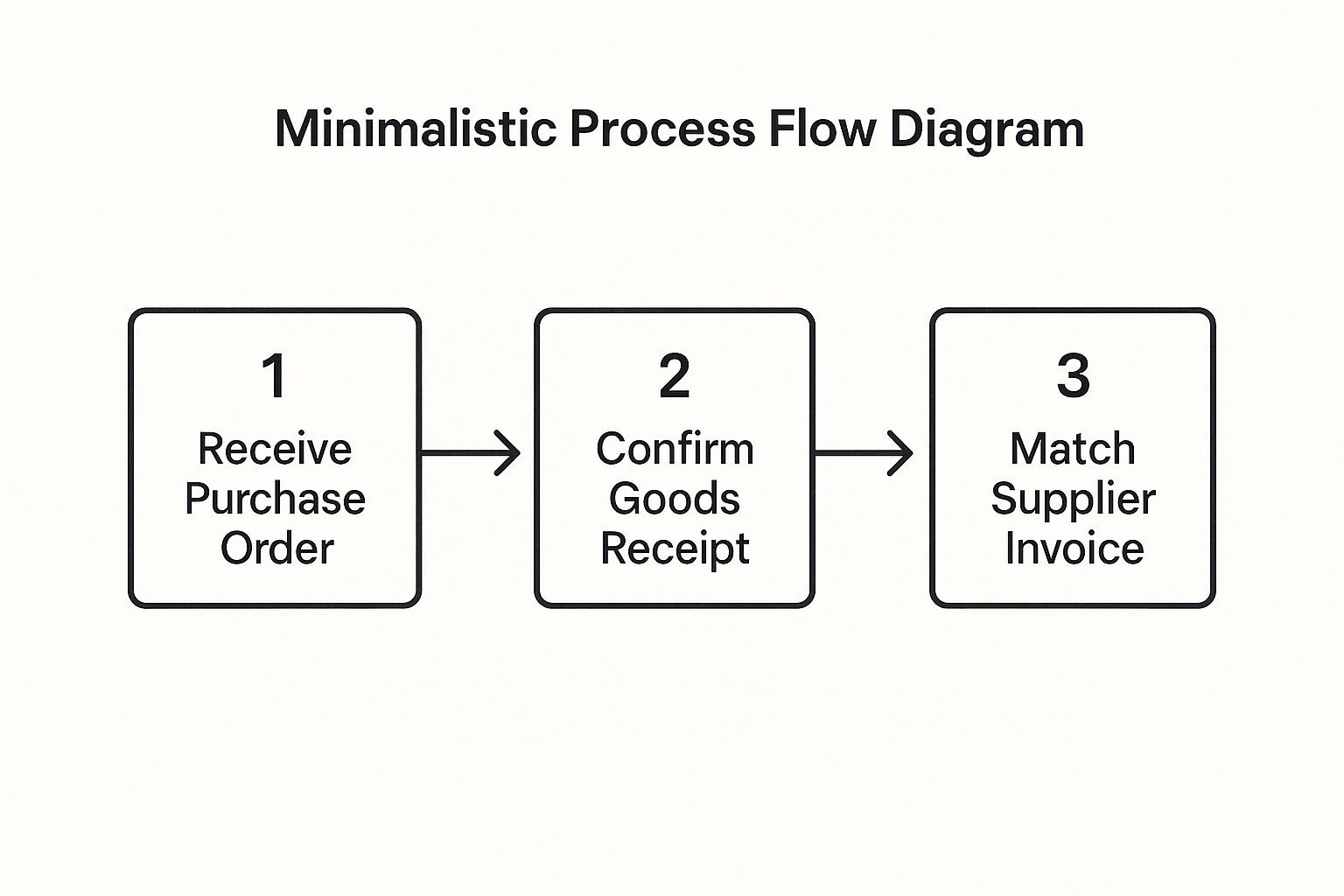

The process is a sequential verification workflow, typically managed within an AP automation or ERP system. The system first confirms that a PO exists for the incoming invoice. It then checks the GRN to verify that the specified quantities of goods or services were delivered. Finally, it matches the price and quantity details on the invoice against both the PO and the GRN. If all three documents align within pre-defined tolerance levels, the invoice is automatically approved for payment without any human intervention.

This diagram illustrates the streamlined, sequential flow of the automated three-way matching process.

As visualized, the successful completion of each step is a prerequisite for the next, creating a strong, logical verification chain that eliminates guesswork.

Actionable Implementation Tips

Successfully deploying automated three-way matching requires careful planning and a strategic approach.

- Start with a Pilot Program: Begin your implementation with a select group of high-volume, low-complexity suppliers. This allows you to refine your matching rules and internal processes in a controlled environment before a full-scale rollout.

- Establish Smart Tolerance Levels: Set reasonable tolerance thresholds for minor discrepancies in price or quantity. For example, a 1-2% variance might be acceptable. This prevents the system from flagging minor, immaterial differences and creating unnecessary exceptions for your team to handle.

- Prioritize Master Data Hygiene: The success of automation hinges on clean data. Before going live, ensure your supplier master data and item catalogs are accurate, complete, and standardized. Inaccurate data is the leading cause of matching failures.

- Develop Clear Exception Workflows: Not every invoice will match perfectly. Document and train your staff on the specific procedures for handling exceptions, such as contacting the purchasing department or the supplier to resolve a discrepancy.

2. Deploy Optical Character Recognition (OCR) and AI-Powered Invoice Processing

A cornerstone of modern accounts payable automation best practices is the adoption of Optical Character Recognition (OCR) enhanced with artificial intelligence. This technology fundamentally eliminates the tedious, error-prone task of manual data entry by automatically reading and extracting key information from invoices, regardless of their format or layout. By leveraging AI and machine learning, these systems move beyond simple text recognition to intelligently understand context, identify data fields like invoice number, PO number, line items, and totals, and continuously improve their accuracy over time.

This powerful combination transforms unstructured invoice data from PDFs, emails, or scanned paper documents into structured, usable information that can be fed directly into your accounting or ERP system. The primary benefit is a dramatic increase in processing speed and accuracy. Instead of manual keying, the AP team's role shifts to one of verification and exception handling, allowing them to process a much higher volume of invoices. For instance, global leaders like Siemens have used AI-powered OCR to slash invoice processing times from weeks to just a few days, demonstrating the technology's transformative impact.

How AI-Powered OCR Works

The process begins when an invoice is received, typically via a dedicated email inbox or a scanner. The AI-powered OCR engine first digitizes the document and then uses sophisticated algorithms to identify and extract relevant data points. Unlike traditional OCR, which relies on fixed templates, AI-driven solutions use natural language processing (NLP) and machine learning to understand the document's structure, even if it has never seen that specific supplier's format before. The system learns from corrections made by users, meaning its accuracy improves with every invoice processed.

This diagram illustrates how AI-powered OCR acts as a smart data capture engine, turning varied invoice formats into structured data ready for system integration.

As you can see, the technology serves as a universal translator, standardizing chaotic incoming data into a clean, predictable format for your financial systems. Learn more about how to automate your invoice management to save valuable time and boost efficiency.

Actionable Implementation Tips

Implementing an intelligent data capture solution effectively requires more than just choosing a vendor. A strategic approach is crucial for maximizing ROI.

- Prioritize Machine Learning Capabilities: When evaluating solutions from providers like ABBYY, Rossum, or Kofax, choose one with strong, self-learning AI. The system should be able to learn from user corrections without requiring complex template re-configurations.

- Establish a Feedback Loop: Create a clear, simple process for your AP team to verify extracted data and correct any errors. This human-in-the-loop validation is the single most important factor in training the AI model and improving its straight-through processing rate over time.

- Start with High-Volume Suppliers: To see the quickest return on investment, begin your rollout by focusing on the suppliers who send you the most invoices. This will provide the system with a large dataset to learn from and will deliver the most significant time savings early on.

- Monitor Accuracy and Set KPIs: Track key performance indicators (KPIs) such as the straight-through processing rate (the percentage of invoices processed with no human touch) and field-level accuracy. Continuously monitor these metrics to identify areas for improvement and measure the system's effectiveness.

3. Establish Automated Approval Workflows

Beyond initial data capture and matching, one of the most impactful accounts payable automation best practices is establishing automated approval workflows. This involves creating digital, rule-based pathways that automatically route invoices to the correct approvers based on predefined business logic. Instead of manually emailing invoices or physically walking them from desk to desk, the system ensures they move seamlessly through the necessary chain of command, eliminating bottlenecks and dramatically accelerating the entire payment cycle.

The primary advantage of automated workflows is the enforcement of internal controls and segregation of duties with absolute consistency. By codifying your company's authorization policies into the system, you prevent unauthorized payments and ensure every invoice receives the proper level of scrutiny. This moves the AP team away from chasing approvals and into a governance role, overseeing the process and managing exceptions. The result is a faster, more compliant, and fully transparent approval process with a clear, digital audit trail for every single invoice. For example, a global giant like Unilever successfully streamlined approvals across 190 countries by implementing standardized automated workflows, demonstrating the scalability and power of this practice.

How Automated Approval Workflows Function

At its core, an automated workflow is a sequence of conditional logic. When an invoice enters the system, it's analyzed against a set of rules you define. These rules can be based on various criteria, such as the invoice amount, supplier name, department or cost center, project code, or GL code. Based on these attributes, the system automatically sends the invoice to the designated approver or sequence of approvers. For instance, an invoice under $1,000 for the marketing department might go directly to the Marketing Manager, while an invoice over $50,000 might require sequential approval from a Department Head, a Director, and finally the CFO.

This diagram illustrates how an invoice is routed based on different business rules.

As shown, the system intelligently directs each invoice, ensuring it follows the correct, compliant path without manual intervention, which significantly reduces the risk of human error or process deviation.

Actionable Implementation Tips

Implementing effective automated workflows requires a clear understanding of your current processes and a forward-looking strategy.

- Map Existing Approval Processes: Before building any automation, thoroughly document your current approval hierarchies and rules. Identify who approves what, under which conditions, and where the common delays occur. This map will be the blueprint for your automated system.

- Implement Mobile-Friendly Interfaces: Approvers are often busy and on the go. Choose an AP automation solution that offers a user-friendly mobile app or responsive web interface. This allows stakeholders to review and approve invoices from anywhere, at any time, preventing delays.

- Set Up Escalation Rules: To combat bottlenecks, configure automated escalation rules. If an approver doesn't act on an invoice within a specified timeframe (e.g., 48 hours), the system can automatically send them a reminder or escalate the invoice to their manager or an alternate approver.

- Regularly Review and Update Thresholds: Business needs change. Schedule periodic reviews (e.g., quarterly or annually) of your approval thresholds and workflow rules to ensure they still align with your company's operational structure, financial policies, and personnel changes.

4. Integrate Supplier Portals and Electronic Data Interchange (EDI)

A pivotal best practice in accounts payable automation is to bridge the communication gap with your vendors through dedicated supplier portals and Electronic Data Interchange (EDI). These technologies move beyond internal process optimization to create a collaborative, digital ecosystem. A supplier portal provides a secure, self-service web interface where vendors can submit invoices, track payment statuses in real-time, and manage their own information, drastically reducing inbound inquiries to your AP team.

Integrating portals and EDI fundamentally shifts the AP process from a reactive, paper-chasing function to a proactive, strategic partnership. By empowering suppliers with direct access and enabling standardized machine-to-machine communication, you eliminate the delays and errors inherent in manual submission methods like mail and email. This direct line of digital communication accelerates the entire procure-to-pay lifecycle, improves supplier relationships, and provides unparalleled visibility for both parties. For example, Ford Motor Company processes over 80% of its invoices via EDI, enabling impressive two-day processing cycles.

How Supplier Portals and EDI Work

Supplier portals and EDI serve a similar goal-digitizing communication-but through different mechanisms. A supplier portal acts as a centralized hub. Vendors log in to upload invoices directly, often using pre-set templates that ensure data accuracy from the start. They can also view purchase orders and check the status of their payments without needing to contact your AP staff. This self-service model is a cornerstone of modern accounts payable automation best practices.

EDI, on the other hand, facilitates the direct, automated exchange of business documents between your ERP or accounting system and your supplier’s system. It uses a standardized format (like ANSI X12 or EDIFACT) to transmit documents such as invoices, purchase orders, and advance ship notices. This eliminates the need for any manual data entry on either side, ensuring maximum speed and accuracy. Major networks like the Ariba Network and Tungsten Network facilitate these connections for thousands of businesses.

Actionable Implementation Tips

Effectively deploying these powerful tools requires a focus on supplier adoption and clear communication.

- Prioritize High-Volume Suppliers: Begin your rollout by onboarding suppliers with whom you transact most frequently. This approach delivers the biggest impact on efficiency and cost savings early in the process.

- Provide Comprehensive Training and Support: Don’t just launch the portal and expect immediate adoption. Develop clear user guides, offer training webinars, and provide a dedicated support channel to help suppliers navigate the new system and understand its benefits.

- Offer Incentives for Electronic Submission: Encourage adoption by offering tangible benefits to suppliers who use the portal or EDI. This could include faster payment terms or prioritized invoice processing for electronic submissions.

- Establish Clear Data Standards: Mandate specific data fields and validation rules for electronic submissions to prevent incomplete or inaccurate invoices from entering your workflow. This ensures the data is clean before it even reaches your AP system.

5. Implement Exception Management and Analytics

A crucial element of mature accounts payable automation best practices is a robust system for exception management, powered by insightful analytics. This dual approach ensures that any invoice failing to meet predefined criteria, such as a mismatch in three-way matching, is automatically flagged and routed for manual review. Concurrently, analytics provide deep visibility into why these exceptions occur, identifying patterns, bottlenecks, and opportunities to refine the process further.

The primary benefit of this strategy is that it maintains the velocity of straight-through processing for standard invoices while creating a controlled, efficient workflow for non-standard ones. Instead of treating every invoice as a potential problem, you isolate the actual issues. This allows your AP team to transition from clerical work to strategic problem-solving, focusing their expertise on resolving discrepancies and improving supplier relationships. Analytics, in turn, transform raw data into actionable intelligence, guiding continuous improvement and preventing future exceptions.

How Exception Management and Analytics Work

Within an AP automation platform, exception management operates on a rules-based engine. When an invoice is processed, the system checks it against a series of validation rules, such as matching a PO, correct tax calculations, or valid supplier details. If an invoice violates any of these rules, it is moved from the automated approval queue into a dedicated exception workflow. The system then automatically routes it to the appropriate person or department, like purchasing or the budget owner, along with all relevant documentation.

Analytics tools integrated into the system continuously collect data on these exceptions. Dashboards and reports visualize key metrics like exception rates by supplier, common reasons for failure, and the average time to resolution. This data empowers finance leaders to pinpoint the root causes of process friction. For instance, BMW famously analyzes payment patterns not just for efficiency but to strategically optimize cash flow and strengthen its supplier ecosystem.

Actionable Implementation Tips

To effectively deploy exception handling and analytics, a methodical approach is essential. This ensures you are not just managing problems but actively eliminating them.

- Define Clear Exception Categories: Classify exceptions based on their root cause (e.g., price variance, quantity mismatch, missing PO, invalid supplier data). Assign clear, documented resolution paths and ownership for each category.

- Establish Regular Reporting Cadences: Schedule weekly or monthly reviews of analytics dashboards with key stakeholders. Discuss trends, identify problem suppliers or internal process gaps, and assign action items for improvement.

- Use Analytics to Drive Automation: Your analytics will reveal repetitive, manual tasks involved in resolving certain exceptions. Use these insights to identify opportunities for further automation, such as creating new rules or improving master data. For more ideas on process optimization, you can explore advanced AP strategies on the Invowl blog.

- Monitor Exception Rates and Root Causes: Track your overall exception rate as a key performance indicator. A high rate (like the 40% Philips initially faced before reducing it to 15% through analytics) signals systemic issues that need immediate attention, such as poor master data hygiene or inadequate supplier communication.

6. Optimize Early Payment Discount Capture

A crucial yet often overlooked component of accounts payable automation best practices is the strategic capture of early payment discounts. Suppliers frequently offer small discounts, such as "2/10 net 30," as an incentive for prompt payment. While a 2% discount may seem minor on a single invoice, these savings accumulate into a significant financial benefit over thousands of transactions, turning the AP department into a profit center.

Automating this process transforms it from a manual, opportunistic effort into a systematic and reliable source of cost savings. An AP automation system can automatically identify invoices with available discounts, calculate the potential savings, and prioritize them for approval and payment. This proactive approach ensures your company never misses a discount opportunity due to processing delays or oversight, directly boosting your bottom line and strengthening supplier relationships through reliable, early payments.

How Automated Discount Capture Works

The system actively scans incoming invoices for payment terms that include a discount. Once an eligible invoice is identified, it's flagged and often accelerated through the approval workflow to meet the discount deadline. The system calculates the net payment amount and schedules it to be executed just in time to secure the savings, optimizing your cash flow while maximizing returns. This is far superior to manually tracking dates on spreadsheets, which is prone to human error and delays.

For instance, companies like General Electric have leveraged automation to increase their discount capture rate from 45% to an impressive 85%. Similarly, Caterpillar saves an estimated $8 million annually through its optimized early payment program, demonstrating the immense value locked within this practice. These examples showcase how a systematic, automated approach is essential to achieving such results.

Actionable Implementation Tips

To effectively integrate early payment discount capture into your AP processes, a strategic plan is necessary.

- Analyze Historical Opportunities: Before implementation, review a year's worth of invoices to quantify the total value of missed discounts. This data will build a strong business case for automation and set a clear ROI benchmark.

- Negotiate Favorable Terms: Proactively work with your high-volume suppliers to negotiate better discount terms. If you can promise consistent early payments, many vendors will be willing to offer more attractive rates.

- Integrate with Cash Flow Forecasting: Connect your AP automation system with your treasury or cash flow management tools. This ensures you only pursue discounts when it aligns with your company's liquidity strategy, preventing cash-on-hand shortages.

- Monitor Your Capture Rate: Continuously track your discount capture rate as a key performance indicator (KPI). Regularly review a "missed opportunities" report to identify bottlenecks in your approval workflow that are preventing timely payments. Streamlining these processes enhances accountant collaboration and efficiency.

7. Establish Robust Security and Compliance Controls

A critical component of any accounts payable automation best practices framework is the implementation of robust security and compliance controls. As you centralize sensitive financial data and automate payment workflows, you must protect this information from both internal and external threats. This involves implementing a multi-layered security strategy that safeguards data integrity, prevents unauthorized access, and ensures adherence to regulations like the Sarbanes-Oxley Act (SOX) and GDPR.

The primary benefit of embedding strong security controls into your AP automation is the drastic reduction in financial risk. It mitigates the potential for payment fraud, data breaches, and non-compliance penalties, which can be reputationally and financially devastating. By moving from manual, paper-based processes to a secure digital environment, you create a system where every action is tracked, every permission is deliberate, and compliance is built into the workflow, not treated as an afterthought.

How Security and Compliance Controls Work

These controls are a combination of technological safeguards and procedural rules integrated directly into your AP automation or ERP system. The system enforces these rules automatically, creating a secure and transparent environment for all financial transactions. Key features include role-based access control (RBAC), which limits user actions to only what is necessary for their job function, and comprehensive audit trails, which log every view, change, and approval within the system.

This approach transforms security from a manual checklist into an automated, always-on function. For example, the system can automatically flag invoices from new or unverified suppliers for additional review or prevent an employee from both creating a vendor and approving an invoice from that same vendor.

Actionable Implementation Tips

Building a secure and compliant AP automation system requires a proactive and meticulous approach to security management.

- Implement Segregation of Duties (SoD): Configure your system to enforce a clear separation of critical tasks. For instance, ensure the person who enters an invoice cannot also be the one who approves it for payment. This is a foundational control for preventing internal fraud.

- Enforce Multi-Factor Authentication (MFA): Require MFA for all users accessing the AP automation system. This adds a crucial layer of security that protects against compromised credentials, a common attack vector.

- Regularly Review User Access Permissions: Conduct quarterly or semi-annual reviews of all user roles and permissions. Remove access for former employees immediately and adjust permissions for current employees whose roles have changed to maintain the principle of least privilege.

- Leverage Automated Fraud Detection: Utilize the AI-powered fraud detection capabilities of modern AP platforms. These tools can analyze transaction patterns, flag duplicate invoices, identify unusual payment amounts, and detect changes to vendor bank details, alerting your team to potential threats in real time.

7 Best Practices Comparison Guide

| Solution | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Implement Three-Way Matching Automation | Medium to High: Requires system integration and configuration | Moderate: ERP/procurement integration, maintenance | High: Reduces payment errors, accelerates processing, lowers fraud | Organizations with high invoice volumes needing verification accuracy | Accuracy improvement, fraud reduction, faster payments |

| Deploy OCR and AI-Powered Invoice Processing | High: Advanced AI/ML training and technology implementation | High: Investment in AI tech and continuous training | Very High: Up to 99% data accuracy, 24/7 processing, major cost reduction | Businesses processing varied invoice formats and high volume | Eliminates manual entry, scalable, improves accuracy |

| Establish Automated Approval Workflows | Medium: Define rules and setup approval chains | Moderate: IT setup and ongoing rule maintenance | High: Faster approvals, compliance, audit trails | Companies needing structured, rule-based invoice approvals | Accelerated approvals, compliance enforcement |

| Integrate Supplier Portals and EDI | Medium to High: Supplier onboarding and system integration | Moderate to High: Training suppliers, technical support | High: Paperless processes, fewer errors, better supplier visibility | Organizations managing many suppliers requiring self-service | Eliminates paper, improves supplier engagement |

| Implement Exception Management and Analytics | High: Analytics setup, skilled users needed | Moderate: Data analytics tools and analysts | High: Identifies bottlenecks, enables continuous improvement | Firms seeking to optimize processes and manage exceptions | Enhanced visibility, data-driven decision-making |

| Optimize Early Payment Discount Capture | Medium: Integration with treasury systems required | Moderate: Cash flow management and automation | Medium to High: Cost savings via discount capture | Companies with sufficient cash flow wanting to reduce costs | Immediate savings, improved supplier relations |

| Establish Robust Security and Compliance Controls | High: Complex controls and continuous updates | High: Security infrastructure and monitoring | Very High: Fraud prevention, regulatory compliance | Businesses requiring strong data protection and audit readiness | Fraud protection, compliance guarantee |

From Manual Grind to Strategic Command: Your Next Steps

Transitioning your accounts payable function from a manual, paper-shuffling cost center into a strategic, automated asset is no longer a distant aspiration; it's an achievable reality. Throughout this guide, we've explored the essential pillars that support a world-class AP operation. These aren't just isolated tips; they are interconnected components of a cohesive strategy designed to unlock efficiency, visibility, and value across your entire financial ecosystem.

By embracing these accounts payable automation best practices, you move beyond simply paying bills faster. You begin to build a resilient financial framework that empowers your business to thrive. Let's revisit the core transformations you can ignite by putting these principles into action.

Recapping the Cornerstones of AP Excellence

The journey we've mapped out covers seven critical domains, each offering a distinct yet complementary benefit:

- Eliminating Manual Drudgery: Automated three-way matching and AI-powered invoice processing via OCR are your frontline soldiers against tedious data entry and verification. They eradicate the human error and slow cycle times that plague traditional AP departments, freeing your team for higher-value analysis.

- Accelerating Decision-Making: Implementing automated approval workflows and supplier portals removes the communication bottlenecks that leave invoices lingering and vendor relationships strained. Approvals happen in minutes, not days, and suppliers can self-serve, reducing the endless back-and-forth emails and phone calls.

- Transforming AP into a Profit Center: Strategic exception management and a focus on capturing early payment discounts turn your AP function from a cost-drain into a source of savings. Instead of just processing payments, you are actively managing cash flow and strengthening your bottom line with every invoice paid.

- Fortifying Your Financial Foundation: Finally, embedding robust security and compliance controls isn't just a best practice; it's a necessity. Automation provides a clear, unalterable audit trail, enforces separation of duties, and flags suspicious activity, protecting your business from both internal and external threats.

Your Action Plan: Moving from Insight to Implementation

Understanding these concepts is the first step, but action is what drives transformation. For small businesses, freelancers, and growing teams, the prospect of implementing all seven practices at once can feel daunting. The key is to start with the highest-impact, lowest-friction area.

Begin by identifying your biggest AP bottleneck. Is it the sheer volume of manual data entry from PDF invoices? Is it the chaotic process of chasing down approvals via email? Your answer will point you to your starting line.

Key Insight: The most successful AP automation initiatives don't try to boil the ocean. They start with a single, painful problem, solve it elegantly, and then use that momentum to tackle the next challenge. For many, that initial pain point is the manual extraction of data from invoices.

By focusing on that first step, such as automating invoice data capture, you create immediate breathing room. You reclaim valuable hours, reduce costly errors, and generate the initial ROI that builds the business case for further investment in more advanced accounts payable automation best practices. This initial win proves the concept and fuels the appetite for deeper transformation, making it easier to champion subsequent projects like automated workflows or supplier portal integration.

The True Value of Mastering AP Automation

Ultimately, mastering these principles is about more than just technology; it's about fundamentally changing the role of your finance team. When you automate the repetitive, you elevate the human. Your team members are no longer data entry clerks. They become financial strategists, data analysts, and vendor relationship managers. They can focus on analyzing spending patterns, negotiating better terms, and providing the forward-looking insights that guide critical business decisions. This strategic shift is the true promise of AP automation-turning a back-office necessity into a competitive advantage that fuels growth, enhances profitability, and builds a more scalable, intelligent business.

Ready to take the first, most impactful step in your AP automation journey? Invowl is designed specifically for freelancers, agencies, and small businesses to eliminate the #1 bottleneck: manual invoice data entry. It automatically extracts data from invoices directly from your email, organizes it, and gives you the clean data you need to pay bills faster and gain financial clarity. Start reclaiming your time and building a smarter financial workflow today with Invowl.