When you hear "accounts payable automation," it's easy to think it just means paying bills a little faster. But that’s selling it short. The real benefits run much deeper, completely changing how your business handles its money, making it more efficient, secure, and financially intelligent.

It’s about turning your AP process from a manual, error-prone cost center into a strategic part of your company. One that actually saves you money, gives you a crystal-clear view of your finances, and frees up your team to do work that matters.

Why AP Automation Is More Than Just Paying Bills Faster

Picture your current accounts payable department. Is it like a manual library? Every invoice is a book that someone has to find on a shelf, get stamped by an approver, and then carefully file away. Sure, it works. But it’s painfully slow, shockingly expensive, and one misplaced "book" can create massive headaches. For too many businesses, this isn't an analogy—it's their daily reality.

AP automation is the digital upgrade your financial "library" has been waiting for. It turns that dusty, disorganized room into a powerful, searchable engine for your company's finances. This isn't just about speed; it's about reinventing the entire lifecycle of an invoice from start to finish.

By automating, you aren't just digitizing the old, clunky steps. You're building a completely new, more resilient financial workflow. It's a system designed to actively prevent errors, slash risks, and unlock valuable data that was previously buried in stacks of paper.

A New Foundation for Financial Operations

Automation touches every single part of the AP journey, from the moment an invoice lands in your inbox to the final payment and analysis. This creates a rock-solid foundation for smarter financial management across the board.

Think about the key points of transformation:

- Invoice Receipt and Capture: Instead of someone manually keying in data, the system automatically pulls invoices from emails or scans paper copies. The drudgery of data entry is gone.

- Approval Workflows: The system digitally routes invoices to the right people based on rules you set. No more chasing down managers for a signature.

- Payment Processing: Payments are scheduled and executed securely, often linking directly with your accounting software like QuickBooks or Xero.

- Data and Analytics: You get a real-time dashboard showing spending, liabilities, and cash flow. Your AP data suddenly becomes a strategic asset, not a historical record.

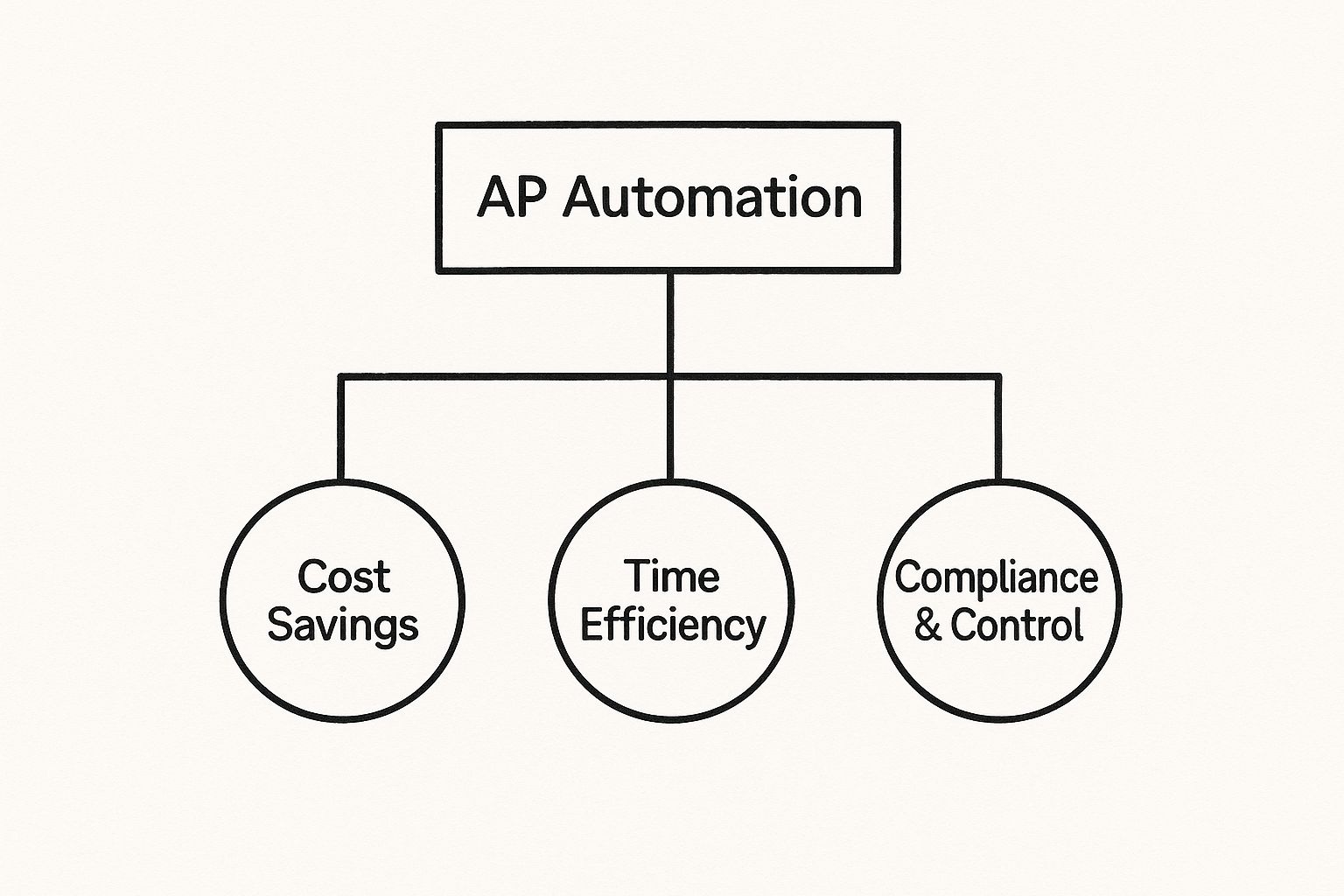

This diagram breaks down how the single goal of AP automation delivers a powerful trifecta of benefits.

As you can see, the value here goes way beyond just making things move faster. It’s a complete overhaul that delivers savings, speed, and security all at once.

To make this crystal clear, let's look at a side-by-side comparison.

Manual AP vs. Automated AP: A Quick Comparison

This table offers a quick snapshot of just how different the day-to-day reality is when you move from a traditional AP process to an automated one. The contrasts in efficiency, cost, and accuracy are stark.

| Process Area | Manual AP Process | Automated AP Process |

|---|---|---|

| Invoice Entry | Manual data entry from PDFs or paper. High risk of typos and errors. | OCR technology captures data automatically. 99%+ accuracy. |

| Approval Routing | Physically walking invoices to desks or sending easily lost emails. | Digital workflows route invoices instantly based on preset rules. |

| Cycle Time | Weeks. Often 20-30 days to process a single invoice. | Hours or days. Typically 3-5 days from receipt to payment. |

| Cost Per Invoice | High. Can be $15-$40+ depending on complexity and labor costs. | Low. Often drops to $2-$5 per invoice. |

| Visibility | None. Financial status is a mystery until month-end closing. | Real-time dashboards showing all outstanding liabilities and cash flow. |

| Fraud Risk | High. Susceptible to duplicate payments and fake invoice scams. | Low. System flags duplicates and suspicious activity automatically. |

| Archiving | Physical file cabinets. Difficult to search, vulnerable to damage. | Secure, searchable cloud archive. Find any invoice in seconds. |

| Team Focus | Low-value tasks: data entry, paper shuffling, chasing approvals. | High-value tasks: data analysis, vendor relations, strategic financial planning. |

Seeing it laid out like this, the choice becomes obvious. A manual system is a constant drain on resources, while an automated one becomes a source of strength and strategic insight.

How Automation Dramatically Reduces Invoice Costs

Let's cut to the chase. When people talk about accounts payable automation, the first thing on everyone's mind is a simple one: saving a ton of money. Manual invoice processing is a notorious black hole for company resources, but the real cost isn't just the hours your team spends shuffling paper. It’s a toxic mix of labor costs, missed savings, and late payment penalties.

Picture a typical mid-sized business buried under a mountain of invoices. Each one needs someone to manually punch in data, physically walk it around for approvals, and then carefully file it away. This isn't just slow—it's incredibly expensive. Every single minute an employee spends typing line items or hunting down a manager for a signature is a direct cost that automation makes disappear.

The Hidden Costs of Doing Things Manually

The most obvious expense is the time your team sinks into repetitive, mind-numbing tasks. But the financial bleeding often comes from places you might not even be looking.

When your system is a mess of papers and emails, it’s ridiculously easy to miss payment deadlines. Those late fees start to add up, slowly eating away at your profits. Even worse, many of your suppliers probably offer discounts for paying early—a huge savings opportunity that’s nearly impossible to grab when your approval process takes weeks instead of days. Automation completely flips this script.

Shifting from a Cost Center to a Savings Engine

Automating your AP department does more than just chip away at your cost-per-invoice; it turns a necessary evil into a genuine source of savings.

Let's look at the hard numbers. The cost to manually process a single invoice hovers around $15, mostly due to all that painstaking data entry and fixing the inevitable mistakes. It's shocking, but market analysis shows that a staggering 68% of companies are still manually keying in their invoice data, while only 32% have made the switch to automation.

By systematically catching early payment discounts and dodging late fees, your AP team transforms from a reactive, fire-fighting unit into a proactive, strategic one. This is a fundamental shift. You can dig deeper into how to automate your invoice management and save significant time in our detailed guide.

An automated system doesn’t just pay bills faster; it pays them smarter. By giving you a crystal-clear, real-time view of all outstanding invoices and their payment terms, it empowers you to manage cash flow strategically. You can finally take advantage of every single opportunity to cut costs.

This isn't just about making small tweaks. For many businesses, this transition marks a major financial turnaround. The cash you unlock can be funneled back into growing the business, innovating, or other critical projects. The system doesn't just pay for itself in time saved—it pays for itself in actual dollars added back to your budget, turning the AP department into an engine for financial health.

Give Your Team Their Time Back and Boost Productivity

Your finance team is your company’s brain trust, but manual accounts payable work often traps them in tasks that don't require much thinking at all.

Picture a day in the life of a skilled AP professional without automation. It’s filled with hours of mind-numbing work: keying in invoice data, hunting down managers for approvals, and manually matching stacks of purchase orders to invoices. This isn't just inefficient; it's a colossal waste of talent that leads straight to burnout.

AP automation flips the script by taking over the grunt work. Instead of being data entry operators, your AP pros get to be the financial strategists you hired them to be. Their day shifts from repetition to high-impact analysis.

This isn't about replacing people. It's about letting them do the work that actually drives your business forward.

From Task-Driven to Strategy-Focused

When you let software handle the tedious bits, your team can finally focus on what people do best—critical thinking, problem-solving, and building relationships. Their daily routine starts to look completely different.

The data paints a clear picture. A recent report from Concur.com shows the massive divide in their 2025 AP automation trends. Among teams with automation, 52% spend less than 10 hours a week just processing invoices. Meanwhile, 63% of teams stuck doing things manually spend more than 10 hours a week on that same task. Worse, 66% are still hand-typing data into their ERPs.

Think about what your team could do with all that time back. They could be adding real, measurable value by:

- Managing by Exception: Instead of reviewing every single invoice, they only step in when the system flags a problem. Their expertise is applied where it's truly needed.

- Analyzing Spending Patterns: With organized, accessible data, they can spot cost-saving opportunities, flag unusual supplier price hikes, and provide insights that lead to smarter budgets.

- Strengthening Supplier Relationships: They have the bandwidth to communicate proactively with vendors, solve issues before they escalate, and even negotiate better payment terms. A transactional relationship becomes a strategic one.

This shift elevates your AP department from a back-office cost center to a hub of financial intelligence. Your team becomes more engaged, their work feels more meaningful, and their contributions become far more visible.

The result is a more productive and motivated finance team. As they begin working together on bigger-picture initiatives, having the right tools becomes essential. To learn how to get the most out of their newfound collaborative power, you can explore tips to streamline accountant collaboration with modern solutions. This strategic refocus is one of the most powerful benefits any business can get from AP automation.

Achieving Real-Time Financial Control and Accuracy

In finance, accuracy isn't just a nice-to-have; it's the entire game. But let's be honest, manual accounts payable is a minefield of human error. A simple "fat-finger" mistake, a misplaced decimal point—these tiny slip-ups can snowball into costly overpayments, missed deadlines, or serious compliance headaches.

Even the most meticulous AP team is only human. When you're buried under a mountain of paperwork, mistakes are bound to happen. This is where automation steps in, acting as a digital safeguard for your company's financials. It's not just about speed; it’s about getting it right, every single time.

From Manual Errors to Machine Precision

The magic behind this shift is technology that makes manual data entry a thing of the past. Tools like Optical Character Recognition (OCR) and AI work in tandem to read and understand invoices with surgical precision.

Think about an AI-powered system like Invowl hooked up to your inbox. It doesn't just see a PDF attachment. It reads the supplier's name, finds the invoice number, grabs the due date, and pulls out every line item, automatically populating the data into your system. This single step wipes out the vast majority of errors that plague manual workflows.

By automating data capture, you create a "single source of truth." All invoice information is consistent, accurate, and centralized. This puts an end to the chaos of dueling spreadsheets and gives everyone a single, reliable view of financial liabilities.

This newfound accuracy sends ripples across the entire business. Your financial reports become rock-solid. Audits are no longer a source of dread. And your team can finally stop chasing down typos and start analyzing what the numbers actually mean.

With a trusted dataset, you can see all your liabilities clearly from one place, like a unified financial dashboard. That's a game-changer for managing cash flow effectively.

Gaining Real-Time Visibility and Control

Maybe the biggest win here is the move from rearview-mirror accounting to real-time financial command. With manual AP, you're often flying blind, only discovering your true financial position weeks later during a frantic month-end close.

Automation flips this dynamic on its head.

With a centralized system, you have an up-to-the-minute view of every single invoice in the pipeline. You know what's been received, what’s waiting for approval, and what's scheduled for payment—right now. This level of insight unlocks:

- Accurate Cash Flow Forecasting: You can predict future cash needs with confidence because you know exactly what payments are coming due and when.

- Strategic Payment Timing: You get to decide precisely when to pay suppliers. Want to grab that early payment discount? You can. Need to hold onto your cash a little longer? You can do that, too.

- Smarter Decision-Making: When your CEO asks about current liabilities, you can give them an exact number in seconds, not spend days digging for an answer.

This control transforms AP from a reactive, back-office chore into a strategic financial lever. It provides the solid data foundation you need to make smarter, more agile business decisions.

Bolster Security and Shut Down Fraud

A manual accounts payable process is a fraudster's playground. Think about it: paper invoices, scattered email approvals, and people manually typing in bank details. The opportunities for bad actors—both inside and outside your company—are frighteningly wide open.

It’s way too easy for a fake invoice or a slightly altered bank account number to slip through the cracks, especially when your team is overworked and buried in paperwork. This is where automation builds a digital fortress around your payment operations, systematically closing the security gaps that manual processes create by default. It’s about moving from a system based on trust to one based on verification.

Thwarting Common Fraud Schemes

Automation brings in a series of checks and balances that are nearly impossible for a human team to replicate consistently. It's designed to spot suspicious activity before a fraudulent payment ever has a chance to go out the door.

Imagine a digital security guard who never gets tired, never takes a coffee break, and never misses a single detail. This guard is specifically trained to stop the most common AP fraud schemes dead in their tracks:

- Duplicate Invoices: An automated system instantly flags any invoice number it has seen before. This prevents both accidental double payments and intentional scams where the same bill is submitted twice.

- Fake Vendor Scams: Automation enforces a strict, multi-step process for adding or changing vendor information. This stops fraudsters from submitting invoices from shell companies or redirecting a legitimate payment to their own bank account. Every change requires verification and leaves a crystal-clear digital footprint.

- Invoice Manipulation: Once an invoice is scanned and entered into the system, it's digitally locked. No one can secretly alter amounts or line items after it’s been approved without leaving a permanent, time-stamped record of the change.

The proof is in the numbers. Recent data shows that companies with fully automated AP are 63% more likely to feel very confident in their fraud prevention capabilities compared to those still shuffling paper. You simply can't match that level of control with manual oversight.

Creating an Unbreakable Digital Audit Trail

Perhaps the most powerful security feature of all is the automatic creation of a detailed, unchangeable audit trail for every single invoice.

From the moment an invoice is received to the second it’s paid, every single action is logged and time-stamped. You can see who touched it, who approved it, precisely when they approved it, and when the payment was sent. This level of transparency is a massive deterrent to anyone thinking about trying something funny.

If a questionable payment ever does come up, you can retrace every step in seconds. No more digging through filing cabinets for a week or scrolling through endless email chains. This digital paper trail is gold for internal audits, financial reporting, and compliance, giving you undeniable proof of your company's financial integrity. It replaces guesswork with absolute certainty.

Unlocking Strategic Insights with AI Analytics

Paying bills faster is great, but that’s just scratching the surface. The real power of modern accounts payable automation comes from using AI to transform your invoice data from a dusty digital filing cabinet into a genuine strategic asset. This is where the AP team stops being a back-office cost center and becomes a proactive, forward-thinking partner for the entire business.

Think of all your AP data as raw, unrefined ore. When handled manually, it just sits there in messy spreadsheets or forgotten folders. But when you run it through an AI-powered system, it gets refined into pure intelligence, revealing patterns and opportunities you never could have spotted before. This is easily one of the most powerful benefits of AP automation today.

From Data Points to Data-Driven Decisions

An AI-powered system doesn't just store your invoice information; it's constantly sifting through it, looking for connections. This ongoing analysis is a massive competitive advantage, pointing out hidden savings and giving you a much stronger hand to play in negotiations.

For instance, the system can:

- Spot Cost-Saving Opportunities: It automatically tracks what you spend with every supplier. It can instantly flag a strange price hike or show you where you could consolidate vendors to get a better deal on volume.

- Strengthen Supplier Negotiations: Imagine walking into a contract renegotiation armed with a perfect, detailed history of your spending and payment timelines. That kind of data gives you incredible leverage to secure better terms.

- Forecast Cash Flow with Frightening Accuracy: By learning your payment cycles and invoice trends, the AI can predict your future cash needs with remarkable precision. This makes managing your working capital far less of a guessing game.

This changes the game entirely. Your AP team is no longer just pushing paper. They become a source of financial intelligence, providing real insights that help shape budgets, guide procurement, and inform the company's overall strategy.

Using AI for financial management is quickly becoming the new standard. Projections show that by 2025, 80% of organizations will be using in-house AI platforms to get a better handle on their finances. Experts even predict that by 2028, AI will autonomously handle at least 15% of daily work decisions.

This isn’t some far-off future. It’s happening right now. If you want to dive deeper, you can learn more about these key automation statistics and what they signal for the future of finance teams.

Of course. Here is the rewritten section, crafted to sound like an experienced human expert, following all your specified requirements.

Common Questions About AP Automation

Switching to a new system always brings up a few good questions. It's only natural. You need to know how new tech will actually fit into your daily operations and what the real-world impact will be on your team and your bottom line.

Let's dig into the most common concerns we hear from businesses exploring accounts payable automation. Getting clear, straightforward answers is the first step to making a smart decision for your company.

How Long Does Implementation Really Take?

There's a common fear that switching to a new system means months of disruption and technical headaches. That might have been true years ago, but modern cloud-based platforms are built for speed. For most businesses, we're talking about being fully up and running in weeks, not months.

The process isn't some massive, drawn-out project. It's usually a few simple steps:

- Connecting Your Inbox: Just link the software to your dedicated AP email, and it starts capturing invoices automatically.

- Setting Up Workflows: You'll map out your existing approval rules—who needs to see what, and in what order.

- Syncing Your Accounting Software: A quick integration connects it to tools like QuickBooks or Xero, so data flows seamlessly.

- Onboarding the Team: A short training session is usually all it takes to get everyone comfortable with the new, much simpler process.

Any good provider will have a team dedicated to walking you through this, making the transition feel smooth, not stressful.

Will Automation Replace Our AP Team?

This is probably the biggest myth out there. The goal of AP automation has never been to replace people; it's to make your team's work more valuable and, frankly, more interesting. Automation is designed to take over the mind-numbing, repetitive tasks that cause burnout.

Think of it this way: automation frees your skilled finance pros from the drudgery of manual data entry. Instead, they can focus on work that actually requires a human brain—like managing complex exceptions, optimizing cash flow, analyzing spending patterns, and building better relationships with suppliers.

It empowers your existing team, shifting their roles from transactional to strategic. They become a bigger asset to the company, not a line item to be cut.

Is AP Automation Only for Big Companies?

Absolutely not. This is an outdated idea. While large corporations were the early adopters, today’s solutions are built to be affordable and scalable for businesses of every size. The days of needing a six-figure budget and a massive IT team are long gone.

Modern platforms, including our own at Invowl, often use flexible subscription or per-invoice pricing. This opens the door for freelancers, small agencies, and growing businesses to get the same powerful benefits.

The reality is, the need for cost savings, better efficiency, and tight financial control is just as critical for a small business as it is for a Fortune 500 company. Automation simply levels the playing field.

Ready to stop wasting time on manual invoice entry and start uncovering real savings? Invowl connects to your inbox, extracts all your invoice data with AI, and gives you the insights to manage cash flow like a pro. Reclaim your time and take control of your finances today.